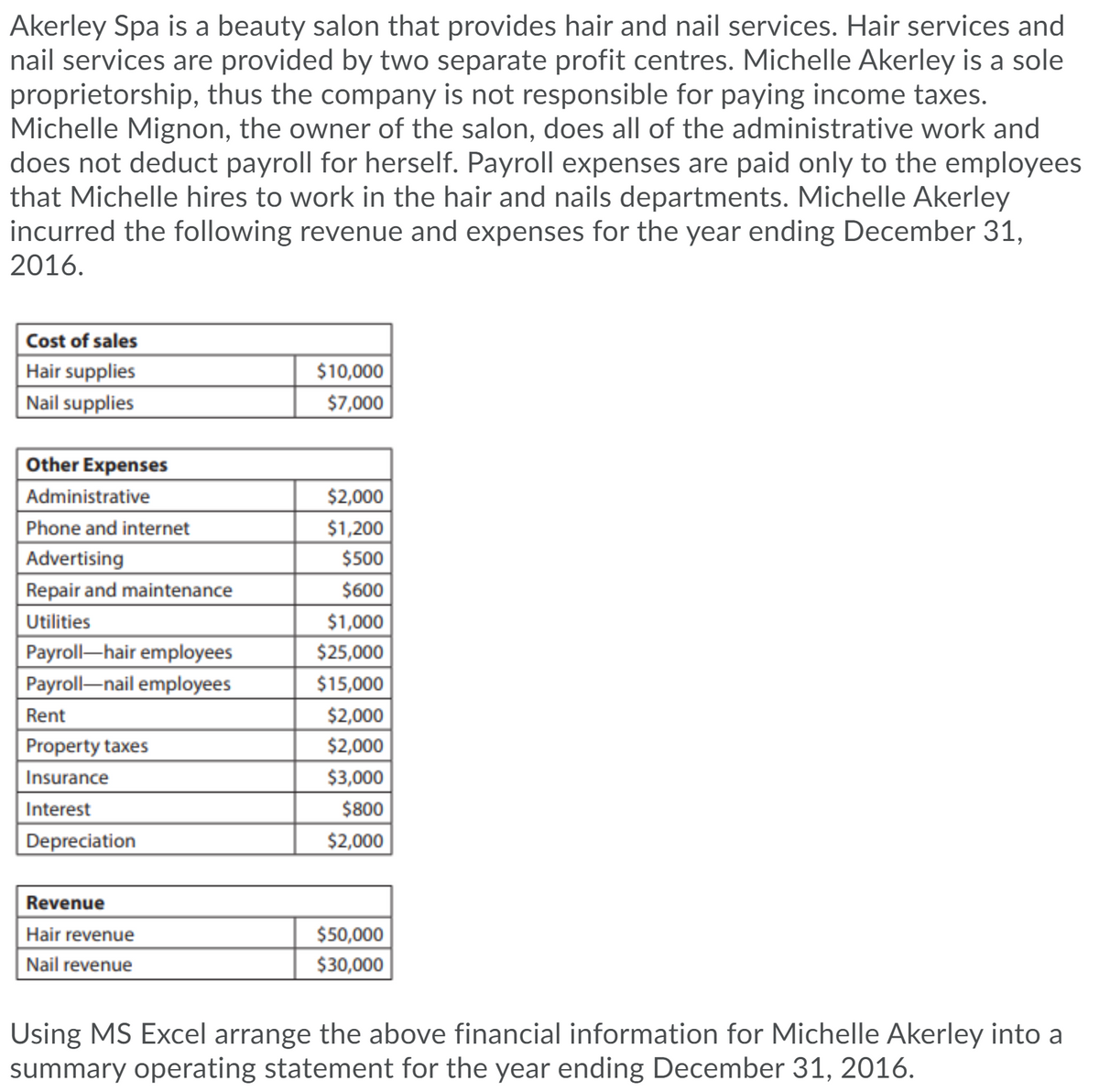

Akerley Spa is a beauty salon that provides hair and nail services. Hair services and nail services are provided by two separate profit centres. Michelle Akerley is a sole proprietorship, thus the company is not responsible for paying income taxes. Michelle Mignon, the owner of the salon, does all of the administrative work and does not deduct payroll for herself. Payroll expenses are paid only to the employees that Michelle hires to work in the hair and nails departments. Michelle Akerley incurred the following revenue and expenses for the year ending December 31, 2016. Cost of sales Hair supplies |Nail supplies $10,000 $7,000 Other Expenses Administrative $2,000 Phone and internet $1,200 Advertising $500 Repair and maintenance $600 Utilities $1,000 Payroll–hair employees Payroll-nail employees $25,000 $15,000 Rent $2,000 Property taxes $2,000 Insurance $3,000 Interest $800 Depreciation $2,000 Revenue Hair revenue $50,000 Nail revenue $30,000 Using MS Excel arrange the above financial information for Michelle Akerley into a summary operating statement for the year ending December 31, 2016.

Akerley Spa is a beauty salon that provides hair and nail services. Hair services and nail services are provided by two separate profit centres. Michelle Akerley is a sole proprietorship, thus the company is not responsible for paying income taxes. Michelle Mignon, the owner of the salon, does all of the administrative work and does not deduct payroll for herself. Payroll expenses are paid only to the employees that Michelle hires to work in the hair and nails departments. Michelle Akerley incurred the following revenue and expenses for the year ending December 31, 2016. Cost of sales Hair supplies |Nail supplies $10,000 $7,000 Other Expenses Administrative $2,000 Phone and internet $1,200 Advertising $500 Repair and maintenance $600 Utilities $1,000 Payroll–hair employees Payroll-nail employees $25,000 $15,000 Rent $2,000 Property taxes $2,000 Insurance $3,000 Interest $800 Depreciation $2,000 Revenue Hair revenue $50,000 Nail revenue $30,000 Using MS Excel arrange the above financial information for Michelle Akerley into a summary operating statement for the year ending December 31, 2016.

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 4MCQ

Related questions

Question

Transcribed Image Text:Akerley Spa is a beauty salon that provides hair and nail services. Hair services and

nail services are provided by two separate profit centres. Michelle Akerley is a sole

proprietorship, thus the company is not responsible for paying income taxes.

Michelle Mignon, the owner of the salon, does all of the administrative work and

does not deduct payroll for herself. Payroll expenses are paid only to the employees

that Michelle hires to work in the hair and nails departments. Michelle Akerley

incurred the following revenue and expenses for the year ending December 31,

2016.

Cost of sales

Hair supplies

Nail supplies

$10,000

$7,000

Other Expenses

Administrative

$2,000

Phone and internet

Advertising

$1,200

$500

Repair and maintenance

$600

Utilities

$1,000

Payroll-hair employees

Payroll-nail employees

$25,000

$15,000

Rent

$2,000

Property taxes

$2,000

Insurance

$3,000

Interest

$800

Depreciation

$2,000

Revenue

Hair revenue

Nail revenue

$50,000

$30,000

Using MS Excel arrange the above financial information for Michelle Akerley into a

summary operating statement for the year ending December 31, 2016.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you