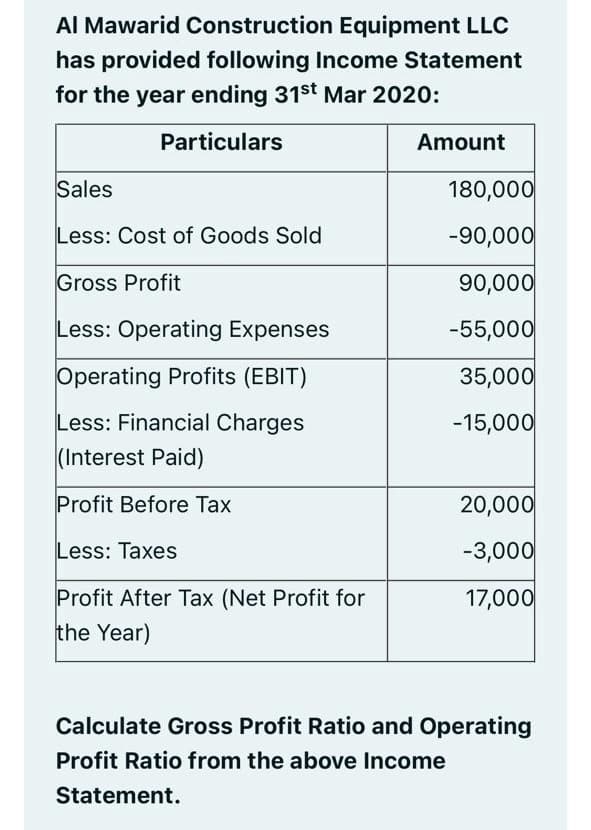

Al Mawarid Construction Equipment LLC has provided following Income Statement for the year ending 31st Mar 2020: Particulars Amount Sales 180,000 Less: Cost of Goods Sold -90,000 Gross Profit 90,000 Less: Operating Expenses -55,000 Operating Profits (EBIT) 35,000 Less: Financial Charges -15,000 (Interest Paid) Profit Before Tax 20,000 Less: Taxes -3,000 Profit After Tax (Net Profit for the Year) 17,000 Calculate Gross Profit Ratio and Operating Profit Ratio from the above Income Statement.

Al Mawarid Construction Equipment LLC has provided following Income Statement for the year ending 31st Mar 2020: Particulars Amount Sales 180,000 Less: Cost of Goods Sold -90,000 Gross Profit 90,000 Less: Operating Expenses -55,000 Operating Profits (EBIT) 35,000 Less: Financial Charges -15,000 (Interest Paid) Profit Before Tax 20,000 Less: Taxes -3,000 Profit After Tax (Net Profit for the Year) 17,000 Calculate Gross Profit Ratio and Operating Profit Ratio from the above Income Statement.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 15P: Use the following income statement of Elliott Game Theory Consulting to determine its net operating...

Related questions

Question

Transcribed Image Text:Al Mawarid Construction Equipment LLC

has provided following Income Statement

for the year ending 31st Mar 2020:

Particulars

Amount

Sales

180,000

Less: Cost of Goods Sold

-90,000

Gross Profit

90,000

Less: Operating Expenses

-55,000

Operating Profits (EBIT)

35,000

Less: Financial Charges

-15,000

(Interest Paid)

Profit Before Tax

20,000

Less: Taxes

-3,000

Profit After Tax (Net Profit for

the Year)

17,000

Calculate Gross Profit Ratio and Operating

Profit Ratio from the above Income

Statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning