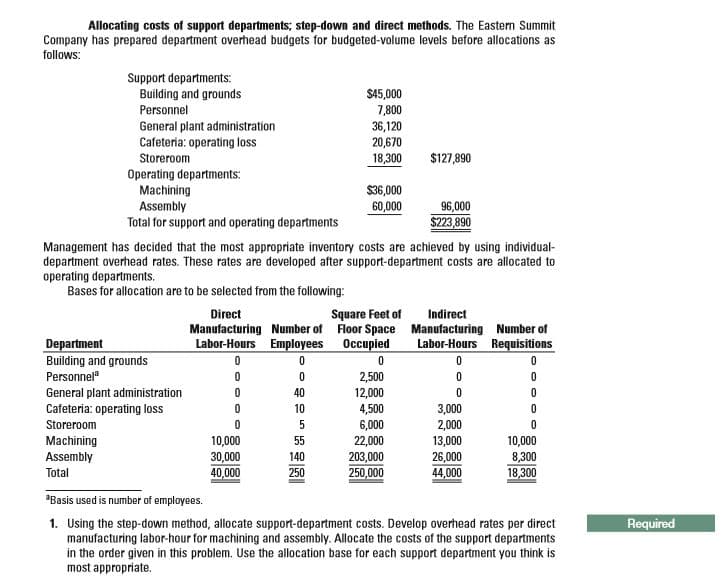

Allocating costs of support departments; step-down and direct methods. The Eastern Summit Company has prepared department overhead budgets for budgeted-volume levels before allocations as follows: Support departments: $45,000 7,800 36,120 20,670 18,300 Building and grounds Personnel General plant administration Cafeteria: operating loss Storeroom $127,890 Operating departments: Machining Assembly Total for support and operating departments $36,000 60,000 96,000 $223,890 Management has decided that the most appropriate inventory costs are achieved by using individual- department overhead rates. These rates are developed after support-department costs are allocated to operating departments. Bases for allocation are to be selected from the following: Direct Manufacturing Number of Floor Space Manufacturing Number of Labor-Hours Employees Occupied Square Feet of Indirect Labor-Hours Requisitions Department Building and grounds Personnel" 2,500 12,000 4,500 6,000 22,000 General plant administration Cafeteria: operating loss 40 10 3,000 2,000 13,000 26,000 44,000 Storeroom Machining Assembly 10,000 55 30,000 40,000 10,000 8,300 18,300 140 203,000 250,000 Total 250 *Basis used is number of employees. 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate. Required

Allocating costs of support departments; step-down and direct methods. The Eastern Summit Company has prepared department overhead budgets for budgeted-volume levels before allocations as follows: Support departments: $45,000 7,800 36,120 20,670 18,300 Building and grounds Personnel General plant administration Cafeteria: operating loss Storeroom $127,890 Operating departments: Machining Assembly Total for support and operating departments $36,000 60,000 96,000 $223,890 Management has decided that the most appropriate inventory costs are achieved by using individual- department overhead rates. These rates are developed after support-department costs are allocated to operating departments. Bases for allocation are to be selected from the following: Direct Manufacturing Number of Floor Space Manufacturing Number of Labor-Hours Employees Occupied Square Feet of Indirect Labor-Hours Requisitions Department Building and grounds Personnel" 2,500 12,000 4,500 6,000 22,000 General plant administration Cafeteria: operating loss 40 10 3,000 2,000 13,000 26,000 44,000 Storeroom Machining Assembly 10,000 55 30,000 40,000 10,000 8,300 18,300 140 203,000 250,000 Total 250 *Basis used is number of employees. 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate. Required

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 28E: Minor Co. has a job order cost system and applies overhead based on departmental rates. Service...

Related questions

Question

100%

Transcribed Image Text:Allocating costs of support departments; step-down and direct methods. The Eastern Summit

Company has prepared department overhead budgets for budgeted-volume levels before allocations as

follows:

Support departments:

$45,000

7,800

36,120

20,670

18,300

Building and grounds

Personnel

General plant administration

Cafeteria: operating loss

Storeroom

$127,890

Operating departments:

Machining

Assembly

Total for support and operating departments

$36,000

60,000

96,000

$223,890

Management has decided that the most appropriate inventory costs are achieved by using individual-

department overhead rates. These rates are developed after support-department costs are allocated to

operating departments.

Bases for allocation are to be selected from the following:

Direct

Manufacturing Number of Floor Space Manufacturing Number of

Labor-Hours Employees Occupied

Square Feet of

Indirect

Labor-Hours Requisitions

Department

Building and grounds

Personnel"

2,500

12,000

4,500

6,000

22,000

General plant administration

Cafeteria: operating loss

40

10

3,000

2,000

13,000

26,000

44,000

Storeroom

Machining

Assembly

10,000

55

30,000

40,000

10,000

8,300

18,300

140

203,000

250,000

Total

250

*Basis used is number of employees.

1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct

manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments

in the order given in this problem. Use the allocation base for each support department you think is

most appropriate.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning