Allowable Monthly Housing Expenditure otal Non-Mortgage Housing Expenses Affordable Monthly Mortgage Payment Monthly Installment Debt otal Affordable Monthly Debt Payments affordable Monthly Mortgage Monthly Payment per $1000 mortgage Maximum that can be borrowed Down Payment What one can afford to spend on a house $300.00 $400.00 $7.25 10% Max Percentage 0.28 Max Percentage 0.36

Allowable Monthly Housing Expenditure otal Non-Mortgage Housing Expenses Affordable Monthly Mortgage Payment Monthly Installment Debt otal Affordable Monthly Debt Payments affordable Monthly Mortgage Monthly Payment per $1000 mortgage Maximum that can be borrowed Down Payment What one can afford to spend on a house $300.00 $400.00 $7.25 10% Max Percentage 0.28 Max Percentage 0.36

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 1E: The forecasting staff for the Prizer Corporation has developed a model to predict sales of its...

Related questions

Question

Sub : Economics

Pls answer very fast.I ll upvote correct answer. Thank You

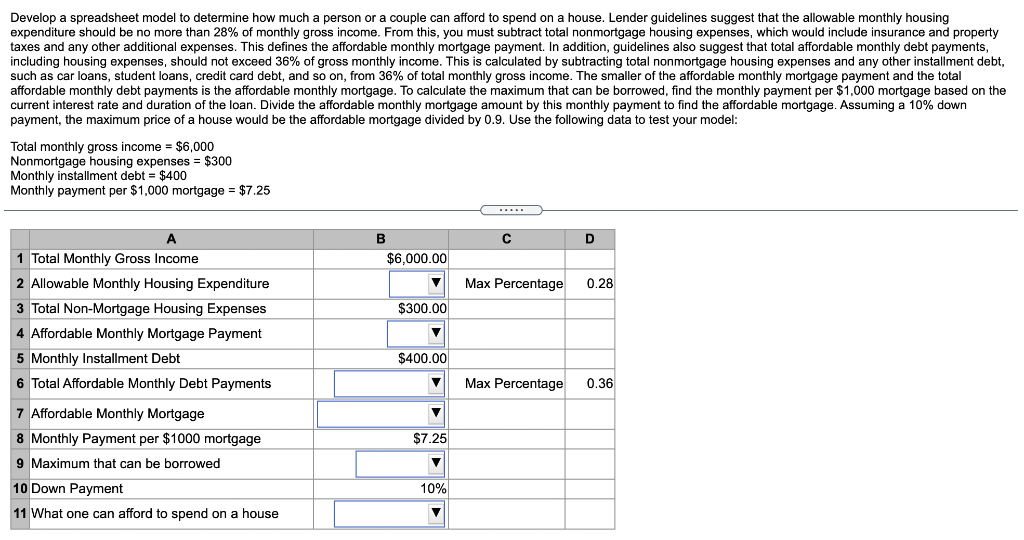

Transcribed Image Text:Develop a spreadsheet model to determine how much a person or a couple can afford to spend on a house. Lender guidelines suggest that the allowable monthly housing

expenditure should be no more than 28% of monthly gross income. From this, you must subtract total nonmortgage housing expenses, which would include insurance and property

taxes and any other additional expenses. This defines the affordable monthly mortgage payment. In addition, guidelines also suggest that total affordable monthly debt payments,

including housing expenses, should not exceed 36% of gross monthly income. This is calculated by subtracting total nonmortgage housing expenses and any other installment debt,

such as car loans, student loans, credit card debt, and so on, from 36% of total monthly gross income. The smaller of the affordable monthly mortgage payment and the total

affordable monthly debt payments is the affordable monthly mortgage. To calculate the maximum that can be borrowed, find the monthly payment per $1,000 mortgage based on the

current interest rate and duration of the loan. Divide the affordable monthly mortgage amount by this monthly payment to find the affordable mortgage. Assuming a 10% down

payment, the maximum price of a house would be the affordable mortgage divided by 0.9. Use the following data to test your model:

Total monthly gross income = $6,000

Nonmortgage housing expenses $300

Monthly installment debt = $400

Monthly payment per $1,000 mortgage = $7.25

A

1 Total Monthly Gross Income

2 Allowable Monthly Housing Expenditure

3 Total Non-Mortgage Housing Expenses

4 Affordable Monthly Mortgage Payment

5 Monthly Installment Debt

6 Total Affordable Monthly Debt Payments

7 Affordable Monthly Mortgage

8 Monthly Payment per $1000 mortgage

9 Maximum that can be borrowed

10 Down Payment

11 What one can afford to spend on a house

B

$6,000.00

▼

$300.00

▼

$400.00

▼

▼

$7.25

10%

C

Max Percentage

Max Percentage

D

0.28

0.36

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning