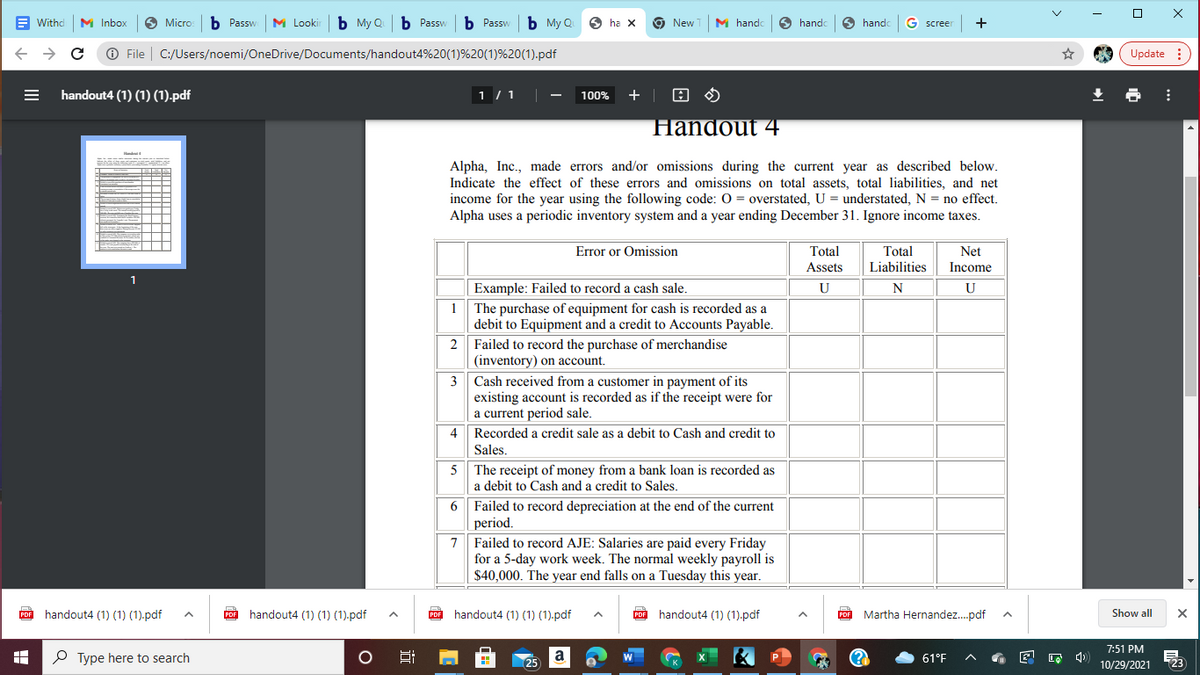

Alpha, Inc., made errors and/or omissions during the current year as described below. Indicate the effect of these errors and omissions on total assets, total liabilities, and net income for the year using the following code: O = overstated, U = understated, N = no effect. Alpha uses a periodic inventory system and a year ending December 31. Ignore income taxes. Error or Omission Total Net Income Total Assets Liabilities Example: Failed to record a cash sale. U N U 1 The purchase of equipment for cash is recorded as a

Alpha, Inc., made errors and/or omissions during the current year as described below. Indicate the effect of these errors and omissions on total assets, total liabilities, and net income for the year using the following code: O = overstated, U = understated, N = no effect. Alpha uses a periodic inventory system and a year ending December 31. Ignore income taxes. Error or Omission Total Net Income Total Assets Liabilities Example: Failed to record a cash sale. U N U 1 The purchase of equipment for cash is recorded as a

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

The receipt of money from a bank loan is recorded as a debit to Cash and a credit to Sales.

Transcribed Image Text:E Withc

M Inbox

O Micro

Ь Рassw

M Looki

b My Q

Ъ Рassw

Ъ Рassw

b My Q

S ha X

9 New

M handc

6 hando

O hande

G screen

+

O File

C:/Users/noemi/OneDrive/Documents/handout4%20(1)%20(1)%20(1).pdf

Update :

handout4 (1) (1) (1).pdf

1 / 1

100%

+ | 8 O

Handout 4

Alpha, Inc., made errors and/or omissions during the current year as described below.

Indicate the effect of these errors and omissions on total assets, total liabilities, and net

income for the year using the following code: O = overstated, U = understated, N = no effect.

Alpha uses a periodic inventory system and a year ending December 31. Ignore income taxes.

Error or Omission

Total

Assets

Total

Net

Liabilities

Income

Example: Failed to record a cash sale.

U

N

U

The purchase of equipment for cash is recorded as a

debit to Equipment and a credit to Accounts Payable.

2 Failed to record the purchase of merchandise

(inventory) on account.

1

3 Cash received from a customer in payment of its

existing account is recorded as if the receipt were for

a current period sale.

4

Recorded a credit sale as a debit to Cash and credit to

Sales.

The receipt of money from a bank loan is recorded as

a debit to Cash and a credit to Sales.

6 Failed to record depreciation at the end of the current

period.

Failed to record AJE: Salaries are paid every Friday

for a 5-day work week. The normal weekly payroll is

$40,000. The year end falls on a Tuesday this year.

7

PDF

handout4 (1) (1) (1).pdf

PDF

handout4 (1) (1) (1).pdf

PO handout4 (1) (1) (1).pdf

handout4 (1) (1).pdf

Martha Hernandez.pdf

PDF

Show all

7:51 PM

P Type here to search

61°F

10/29/2021

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you