Alternative E1 E2 $65,000 Capital investment Annual expenses Useful life (years) Market value (at end of useful life) $14,000 $14,000 $9,000 5 20 $8,000 $13,000

Alternative E1 E2 $65,000 Capital investment Annual expenses Useful life (years) Market value (at end of useful life) $14,000 $14,000 $9,000 5 20 $8,000 $13,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

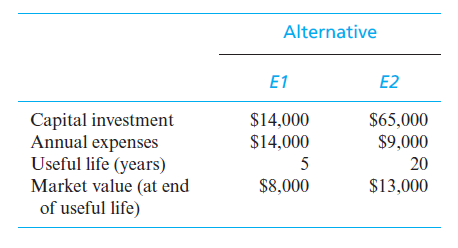

A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for each are shown in the accompanying table. The MARR is 15% per year. Solve, a. Which alternative is preferred, based on the repeatability assumption? b. Show, for the coterminated assumption with a five-year study period and an imputed market value for Alternative B, that the AW of B remains the same as it was in Part (a). [And obviously, the selection is the same as in Part (a).] Explain why that occurs in this problem.

Transcribed Image Text:Alternative

E1

E2

$65,000

Capital investment

Annual expenses

Useful life (years)

Market value (at end

of useful life)

$14,000

$14,000

$9,000

5

20

$8,000

$13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College