Amid the Covid-19 pandemic, health consciousness has fuelled the welliness industry. The wellness industry has pivoted fast to meet consumers' growing demands for wellness products and services that people can use from home. Due to this arisen opportunity. Mualim Fitness and Wellness is considering acquiring one of two businesses in order to diversity its operations. Muallim Fitness and Wellness is a state- atbe-art fitness and wellness centre, offering regular fitness assessments and personal training sessions customized to each individual's needs. In order to assist the management in making decision, the management accountant is preparing the following information: Option 1: Digital Fitness Products Estimated cost acquisition Annual production Sales of RM5,500.000.00 250,000 units A contract already exists covering the next four years under which the entire product will be sold at a price of RM80.00 per unit for Years 1 and 2, and RM00.00 per unit in Years 3 and 4. Operating costs (including depreciation) are estimated at RM350,000.00 in Year 1, RM380,000.00 in Year 2 and RM400.000.00 in each Years 3 and 4. Depreciation is estimated at RM150,000.00 per annum. Option 2: Home Gym Equipment Estimated acquisition Annual production cost of RMB,000,000.00 400,000 units 75% of production is to be sold under an existing foced price contract which has a further four years to run at RM820.00 per unit. The remaining 25% will be sold at the following prices: Year Seling price unit (RM) | 800.00 |OT00 50.00 00.00 Sales Operating costs (including depreciation) are estimated at RM4 million in each of Years 1 and 2 and RM4.4 million in each Years 3 and 4. Depreciation is estimated at RM500,000.00 per annum. Whichever option is chosen, the estimated cost of acquisition would be payable immediately. All other receipts and payments take place at the end of each year. The cost of capital for Fitness and Wellness Sdo. Bhd. is 10%. REQUIRED: a Determine the net present value of each of the two options. b. Evaluate each option and recommend which, if either, Muallim Fitness and Wellness

Amid the Covid-19 pandemic, health consciousness has fuelled the welliness industry. The wellness industry has pivoted fast to meet consumers' growing demands for wellness products and services that people can use from home. Due to this arisen opportunity. Mualim Fitness and Wellness is considering acquiring one of two businesses in order to diversity its operations. Muallim Fitness and Wellness is a state- atbe-art fitness and wellness centre, offering regular fitness assessments and personal training sessions customized to each individual's needs. In order to assist the management in making decision, the management accountant is preparing the following information: Option 1: Digital Fitness Products Estimated cost acquisition Annual production Sales of RM5,500.000.00 250,000 units A contract already exists covering the next four years under which the entire product will be sold at a price of RM80.00 per unit for Years 1 and 2, and RM00.00 per unit in Years 3 and 4. Operating costs (including depreciation) are estimated at RM350,000.00 in Year 1, RM380,000.00 in Year 2 and RM400.000.00 in each Years 3 and 4. Depreciation is estimated at RM150,000.00 per annum. Option 2: Home Gym Equipment Estimated acquisition Annual production cost of RMB,000,000.00 400,000 units 75% of production is to be sold under an existing foced price contract which has a further four years to run at RM820.00 per unit. The remaining 25% will be sold at the following prices: Year Seling price unit (RM) | 800.00 |OT00 50.00 00.00 Sales Operating costs (including depreciation) are estimated at RM4 million in each of Years 1 and 2 and RM4.4 million in each Years 3 and 4. Depreciation is estimated at RM500,000.00 per annum. Whichever option is chosen, the estimated cost of acquisition would be payable immediately. All other receipts and payments take place at the end of each year. The cost of capital for Fitness and Wellness Sdo. Bhd. is 10%. REQUIRED: a Determine the net present value of each of the two options. b. Evaluate each option and recommend which, if either, Muallim Fitness and Wellness

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter13: Emerging Topics In Managerial Accounting

Section: Chapter Questions

Problem 53P: Dorsey Scott MU Company manufactures and bottles a collection of health-oriented fruity beverages....

Related questions

Question

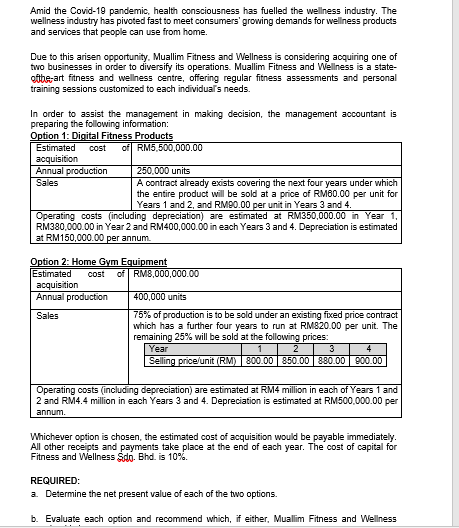

Transcribed Image Text:Amid the Covid-19 pandemic, health consciousness has fuelled the wellness industry. The

wellness industry has pivoted fast to meet consumers' growing demands for wellness products

and services that people can use from home.

Due to this arisen opportunity. Muallim Fitness and Wellness is considering acquiring one of

two businesses in order to diversify its operations. Muallim Fitness and Wellness is a state-

gibe art fitness and wellness centre, offering regular fitness assessments and personal

training sessions customized to each individual's needs.

In order to assist the management in making decision, the management accountant is

preparing the following information:

Option 1: Digital Fitness Products

Estimated

acquisition

Annual production

cost

of RM5,500,000.00

250,000 units

A contract already exists covering the next four years under which

the entire product will be sold at a price of RM60.00 per unit for

Years 1 and 2, and RM90.00 per unit in Years 3 and 4.

Sales

Operating costs (including depreciation) are estimated at RM350,000.00 in Year 1,

RM380,000.00 in Year 2 and RM400,000.00 in each Years 3 and 4. Depreciation is estimated

at RM150.000.00 per annum.

Option 2: Home Gym Equipment

Estimated

acquisition

Annual production

cost

of RM8,000,000.00

400,000 units

75% of production is to be sold under an existing fixed price contract

which has a further four years to run at RM820.00 per unit. The

remaining 25% will be sold at the following prices:

Year

Sales

2

3

4

Selling price/unit (RM) 800.00 850.00 880.00 900.00

Operating costs (including depreciation) are estimated at RM4 million in each of Years 1 and

2 and RM4.4 million in each Years 3 and 4. Depreciation is estimated at RM500,000.00 per

annum.

Whichever option

All other receipts and payments take place at the end of each year. The cost of capital for

Fitness and Wellness Sdo. Bhd. is 10%.

chosen, the estimated cost of acquisition would be paya

immediatel

REQUIRED:

a Determine the net present value of each of the two options.

b. Evaluate each option and recommend which, if either, Muallim Fitness and Wellness

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub