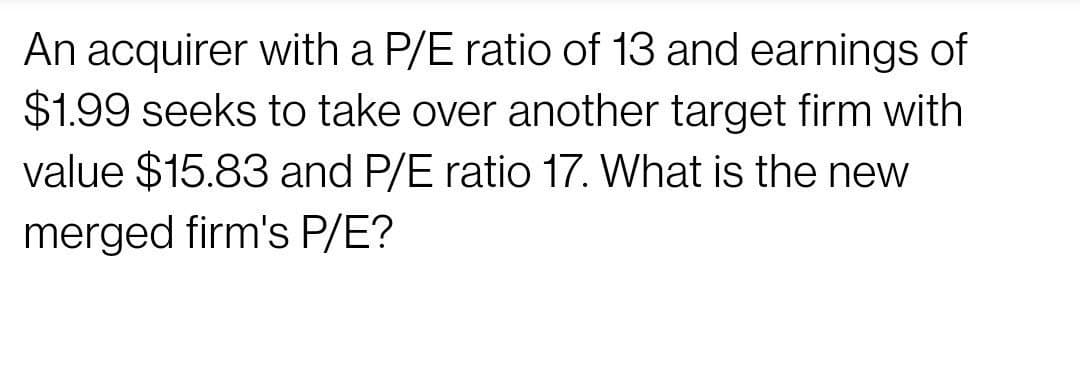

An acquirer with a P/E ratio of 13 and earnings of $1.99 seeks to take over another target firm with value $15.83 and P/E ratio 17. What is the new merged firm's P/E?

Q: Amekom Plc is a public company that would like to acquire (100% of) a suitable private company. It…

A: Part (a) Equivalent ratios from the financial statements of Apim Plc workings in GHS’000) Return on…

Q: erging with Target Corporation. Equity values were gathered as follows: ABC, separate equity value =…

A: Intrinsic value of merged entity depends on net income of the merged entity and required rate of…

Q: What is the goodwill arising from the consolidation, if the 100,000, P50 par value shares of the…

A: According to IFRS 3, the differences among the net identifiable acquisition value and the fair value…

Q: Jupiter, the bidding firm and Venus, the target firm. Assume that both firms have no debt…

A: NPV of merger is the net benefits due to merger of the firm and the difference between the value…

Q: Companies X, Y and Z, parties to a consolidation, have the following data:…

A: Issue of shares or stock is one of the important source of finance being used by the business. These…

Q: Tangy is attempting to acquire Target. Selected financial data is presented for both companies in…

A: Earning per share depicts the earnings of equity shareholders against the amount of capital invested…

Q: Kunla Ltd and Cunta Ltd intend to merge. The following were observed just before the merger…

A: The question is related to the Merger ans Acquisition. The details of two companies are given.…

Q: World Enterprises is determined to report earnings per share of $2.17. It therefore acquires the…

A: Merger is that term under which two firm are one after merger under merger which firm acquire (…

Q: 1)A Bhd is planning to take over B Bhd. The growth rate of B Bhd is 5% in earnings and dividends. A…

A: i.) First calculate the required rate of return on B Bhd. r = D1P0+gr = D×(1+g)P0+gr =…

Q: Both of Firm A and Firm B are 100 equity firms. You estimate that the incremental value of the…

A: Incremental Value of Acquistion = $100,000 Firm B agrees = $150,000 Exchange Ratio =…

Q: Holmes, Inc., has offered $351,887 cash for all of the common stock in Watson Corporation. Based on…

A: In the given question we need to compute the minimum estimated value of the synergistic benefits…

Q: A and B are partners in the ratio of 2:3.Thier balance sheet shows machienery at 400000,stock at…

A: Partnership is an agreement between two or more than two persons in which they invest capital, run…

Q: Investor company owns 35% of the shares in Investee company and has significant influence over the…

A: Investments in Equity Securities When the investor acquires common stock, the appropriate method…

Q: Consider the following data in relation to a proposed acquisition, where Firm B will take over Firm…

A: Pre-merger Value A=$600m Pre-merger Value B=$475m Post-merger Value A + B=$1,200m Cash Offer=$630m…

Q: Firm A is being acquired by Firm B for $62,000 worth of Firm B stock. The incremental value of the…

A: given 2,700 shares of stock outstanding of stock A 10,400 shares of stock outstanding of stock B

Q: Calculate the group earnings per share that could be expected for the year ending 31 March 2019 in…

A:

Q: Consider the following data in relation to a proposed acquisition, where Firm B will take over Firm…

A: given information Pre-merger Value A $550m Pre-merger Value B $420m Post-merger…

Q: A. On 1 July 2020, Alba Bbd. acquired 30 per cent of the ordinary shares that carry voting rights at…

A: Investment in Equity Method Investment in equity method which are calculated on cost basis and not…

Q: Question: The total amount reported in 2019 profit or loss is? On January 1, 2019, an entity…

A: INVESTMENT IN SHARES OF ANOTHER COMPANY IS RECORDED AS AN ASSET IN SEPERATE FINANCIAL STATEMENT OF…

Q: what amount of stockholders' equity will be reported? a. P355,000 b. P397,000 c. P419,500 d.…

A: Power Corporation Acquired 70% of Silk Corporation Dec31,20x2.

Q: Procta Ltd is determined to report earnings per share of R9.5. It therefore acquires JJ&J Company.…

A: Earning Per Share- Earnings per share is a financial metric that measures a company's ability to…

Q: Identify the type of merger in the following case: ABC manufactures furniture. It acquired a…

A: Merger means acquistion of one business by another. There are two parties involved in merger…

Q: You're given the following details of an acquisition of Target Co. by Acquirer Ltd.. What is the…

A: An acquisition is when one company purchases most or all of another company's shares to gain control…

Q: Use the follouing information for the next two questions: On January 1, 20x1, Entity A acquires…

A: It is pertinent to note that as per PFRS 3 in a business combination all the identifiable net assets…

Q: Firm A is acquiring Firm B. Firm A's share price is $6 and Firm B's share price is $3. Firm A has 3…

A:

Q: What balance in Retained earnings will the combined entity report immediately following the…

A: Consolidated financial statements: When an investor company holds above 50% in the outstanding stock…

Q: Firm B is willing to be acquired by firm A at a price of $14 a share in either cash or proposed…

A: Given information : Acquisition price per share $14 Incremental value $280,000 Firm B shares…

Q: There are 7 firms in an industry. Firms 1 and 2 each have a 20% share and the other 6 firms each…

A: HHI stands for Herfindahl-Hirschman Index which is evaluated through squaring the every firm market…

Q: Firm A has a total market value of RM 200 million. It is planning to acquire Firm B, which has a…

A: Firm Value of B = RM 630 million Premium paid = RM 24 Million Merger charges = RM 42 Million

Q: Type 2D: ABC Inc. is considering the acquisition of Togo Company. respectively. ABC's financial…

A: Given, Value of ABC is $ 40 million Togo is $15 million

Q: Assume that the entity is a medium-size and the company policy is to account this type of investment…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Firm A is acquiring Firm B. Firm A's share price is $20 and Firm B's share price is $15. Firm A has…

A: Acquisition are done to increase the value and merger will increase the the value of acquiring…

Q: ds, year-end rate

A: A merger occurs when two separate entities combine hands to create a new, united entity.The…

Q: ssume that Company A acquires 70 per cent of Company B for a cash price of $14 million when the…

A: Solution: Calculation of goodwill when NCI is measured at Fair Value: Fair value of Consideration…

Q: Need help with the following questions please. One company that the analysis indicated as…

A: Note: There is no information provided about the synergies from the merger. Hence Q3 cannot be…

Q: ABC will be merging with Target Corporation. Equity values were gathered as follows: ABC, separate…

A: Where the present value of combined enterprise is grater than the sum of present value of individual…

Q: Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm…

A: Note : As per our guidelines, we can only answer up to 3 subparts , since you already have answers…

Q: Consider Firm X and Y. The firm had total earnings of $500,000 and Shares outstanding of 2,250,000.…

A: Total assets of company XY can be calculated using shareholder’s equity and combining the debt…

Q: 3. Before the acquisition of AFB, the market value of MBSB and AFB were RM250 million and RM15…

A: A merger is the voluntary combination of two businesses on roughly equal terms into one new legal…

Q: Company A is considering acquiring company B. Calculate the combined PV of Companies A and B, the…

A: As per the given information: Present value of Company A - 30 mn Present value of Company B - 75 mn…

Q: Ebony Corporation has negotiated the acquisition of Ivory Company in an exchange of shares. Under…

A: The question requires us to calculate the post-merger earnings per share and the percentage…

Q: Grow Company declared and distributed a 15% share dividend with fair value of P2,500,000 and par…

A: Share premium on share dividend is recognized at the amount of fair value over the par value of the…

Step by step

Solved in 4 steps

- Good Investments Company forecasts a $2.44 dividend for 2017, $2.62 dividend for 2018 and a $2.77 dividend for 2019 for Mountain Vacations Corporation. For all years after 2019, Good Investments Company forecasts that Mountain Vacations will pay a $2.94 dividend.Using the dividend discount valuation model determine the intrinsic value of Mountain Vacations Corporation, assuming the company's cost of equity capital is 7%.For each situation described below, find the following items ignoring any costs other than thepurchase price.a) the total purchase priceb) the total dividend amountif applicable c) the capital gain or lossd) the total returne) the percentage return 1. Mila bought 50 shares of American EagleOutfitters stock on May 23, 2018, paying$22.01 per share. On May 22, 2020, shereceived dividends of $1.10 per share, and thestock price had fallen to $8.95 per share.When analysing a company, the equity sales person has noticed that the company has incurred a large development cost relating to a new product and has stated that the costs meet the necessary criterion to be capitalised. The analyst feels a more reasonable treatment of this item would be to expense it, in the year incurred. The company has a tax rate of 30%. The company acquires 100% of shares in another company called Horizon for cash of £4.8 million. Net assets Horizon are £3.3m.There is an upward fair value adjustment of £0.4 m required to the acquirees’ net assets. The acquired company has a 0.2, in process development costs that have not been previously recognised but now meet the necessary capitalisation criteria. Explain how a company could acquire intangible assets. With regard to the development costs, what will be the implication for the financial statements of the two different approaches? Include any relevant ratios.

- Good Investments Company forecasts a $1.57 dividend for 2017, $1.68 dividend for 2018 and a $1.78 dividend for 2019 for Mountain Vacations Corporation. For all years after 2019, Good Investments Company forecasts that Mountain Vacations will pay a $1.89 dividend.Using the dividend discount valuation model determine the intrinsic value of Mountain Vacations Corporation, assuming the company’s cost of equity capital is 7%. Select one: a. $26.43 b. $22.02 c. $17.66 d. $24.99Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%. Required: 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio. 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.On January 1, 2020, Alice Company purchased 40,000 shares of Jasper at P100 per share. The investment is measured at fair value through other comprehensive income. Brokerage fees amounted to P120,000. A P5 dividend per share of Jasper had been declared on December 15, 2019, to be paid on March 31, 2020 to shareholders of record on January 31, 2020. No other transactions occurred in 2020 affecting the investment in Jasper's share. What is the initial measurement of the investment?

- he Net Profit of ABC company for the year 2019 was OMR 11,400. The company issued 40,000 6% preference shares of OMR 1 each. What will be the Net Profit after distributing preference dividend? a. OMR 0 b. OMR 9,000 c. OMR 10,000 d. OMR 13,800\Choose the correct. Perez, Inc., applies the equity method for its 25 percent investment in Senior, Inc. During 2018, Perez sold goods with a 40 percent gross profit to Senior, which sold all of these goods in 2018. How should Perez report the effect of the intra-entity sale on its 2018 income statement?a. Sales and cost of goods sold should be reduced by the amount of intra-entity sales.b. Sales and cost of goods sold should be reduced by 25 percent of the amount of intra-entity sales.c. Investment income should be reduced by 25 percent of the gross profit on the amount of intra-entity sales.d. No adjustment is necessary.The following information relates to the acquisition of M plc by D plc: Recent dividend of M plc: 20p per share Expected dividend growth of M plc: 3% per year Cost of equity of D plc: 10% Number of shares of D plc: 20 million Cost of equity of M plc: 8% Number of shares of M plc: 15 million What is the market value suggested by the dividend valuation model? Answers: £82.4 million £63.6 million £61.8 million £58.9 million £44.1 million

- Wonda Inc aims to acquire Ovaltime Ltd in the near future. As an analyst, you have compiled the data as follows:As per the table is shown above, calculate the following:a) of shares to be issued by the acquirerb) Post-merger EPSc) Post-merger P/E if market is efficientd) Post-merger P/E if market is not efficiente) One-day after the M&A process, the new company stock price becomes Rm 10, with 3-month T-bills 5%, bursa Malaysia return was 12% with risk premia of 0.8. Is there any abnormal return from the M&A Process? Prove it.A company has a reported net income of RM12 million and 60million shares outstanding.a) Estimate the stock’s market price if the price earning (P/E)ratio is 14.0b) What is the company’s value by market capitalization?The following investment-related transactions were completed by LackyCorp. during 2020 - Purchased 30,000 shares of Y Company ordinary shares at P125 per share plus brokerage fees of P28,500. Lackyclassified this stock as non-trading security (FVTOCI) -Sold 4,500 shares of Y Company at P132 per share. a.At what amount should the Y Company shares be measured on initial recognition? b.How much is the realized gain or loss on the sale of Y Company shares?