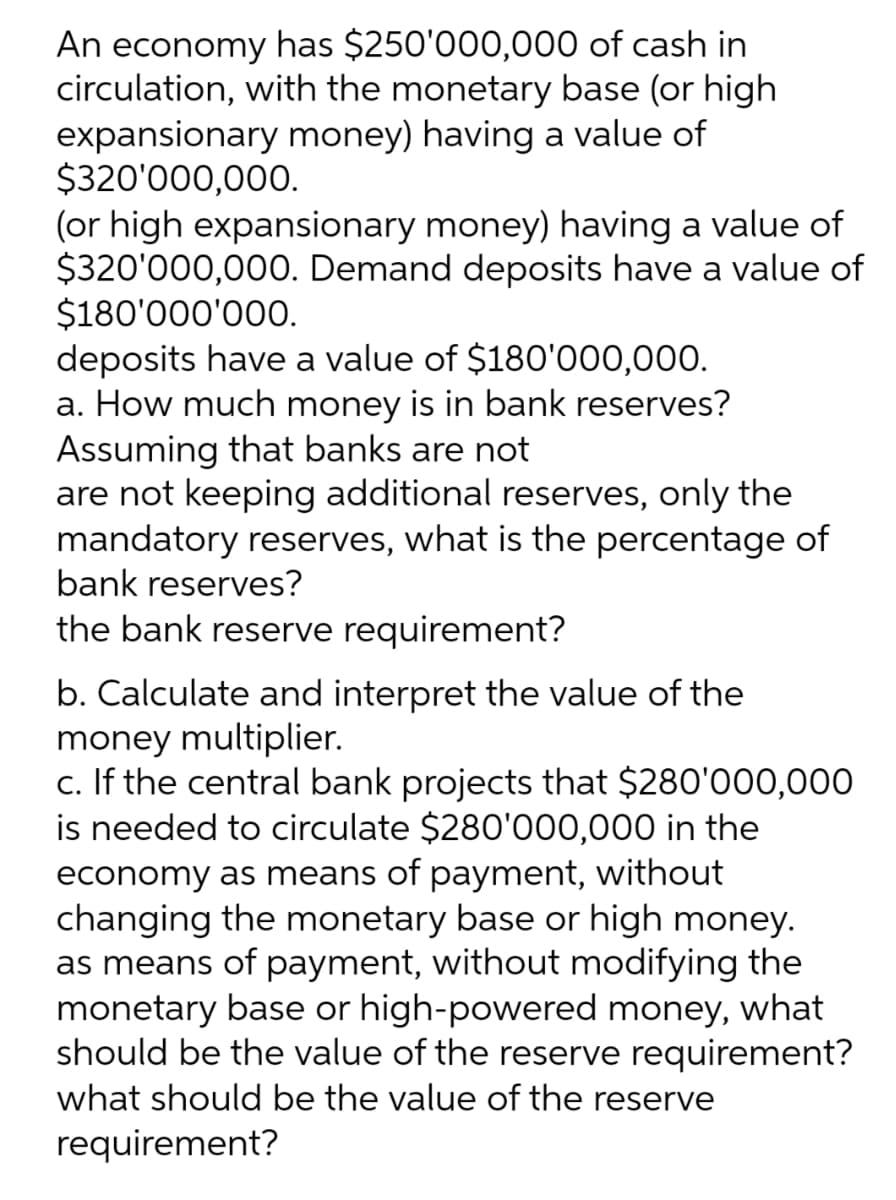

An economy has $250'000,000 of cash in circulation, with the monetary base (or high expansionary money) having a value of $320'000,000. (or high expansionary money) having a value of $320'000,000. Demand deposits have a value of $180'000'000. deposits have a value of $180'000,000. a. How much money is in bank reserves? Assuming that banks are not are not keeping additional reserves, only the mandatory reserves, what is the percentage of bank reserves? the bank reserve requirement? b. Calculate and interpret the value of the money multiplier. c. If the central bank projects that $280'000,000 is needed to circulate $280'000,000 in the economy as means of payment, without changing the monetary base or high money. as means of payment, without modifying the

An economy has $250'000,000 of cash in circulation, with the monetary base (or high expansionary money) having a value of $320'000,000. (or high expansionary money) having a value of $320'000,000. Demand deposits have a value of $180'000'000. deposits have a value of $180'000,000. a. How much money is in bank reserves? Assuming that banks are not are not keeping additional reserves, only the mandatory reserves, what is the percentage of bank reserves? the bank reserve requirement? b. Calculate and interpret the value of the money multiplier. c. If the central bank projects that $280'000,000 is needed to circulate $280'000,000 in the economy as means of payment, without changing the monetary base or high money. as means of payment, without modifying the

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

1

Transcribed Image Text:An economy has $250'000,000 of cash in

circulation, with the monetary base (or high

expansionary money) having a value of

$320'000,000.

(or high expansionary money) having a value of

$320'000,000. Demand deposits have a value of

$180'000'000.

deposits have a value of $180'000,000.

a. How much money is in bank reserves?

Assuming that banks are not

are not keeping additional reserves, only the

mandatory reserves, what is the percentage of

bank reserves?

the bank reserve requirement?

b. Calculate and interpret the value of the

money multiplier.

c. If the central bank projects that $280'000,000

is needed to circulate $280'000,000 in the

economy as means of payment, without

changing the monetary base or high money.

as means of payment, without modifying the

monetary base or high-powered money, what

should be the value of the reserve requirement?

what should be the value of the reserve

requirement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning