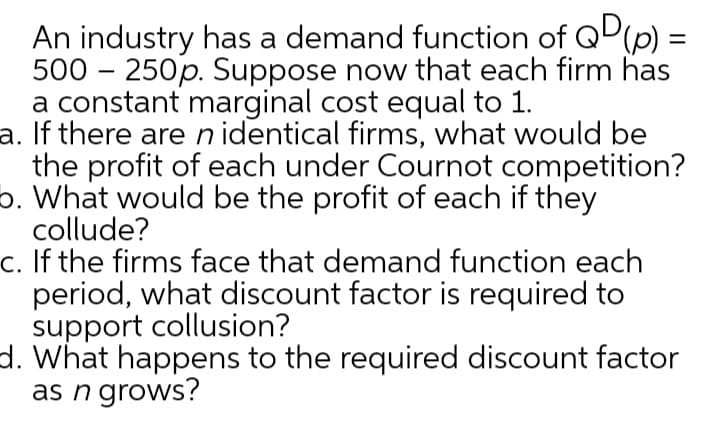

An industry has a demand function of QD(p) = 500 – 250p. Suppose now that each firm has a constant marginal cost equal to 1. a. If there are n identical firms, what would be the profit of each under Cournot competition? p. What would be the profit of each if they collude? c. If the firms face that demand function each period, what discount factor is required to support collusion? d. What happens to the required discount factor as n grows? |

Q: Consider an industry with only two firms: firm A and firm B. The industry’s inverse demand is P(Q) =…

A: P(Q) = 400 − 110Q since the two firm engage in quantity competition P becomes 400 −110(q1+q2)…

Q: There are two soda firms Apple and Dell in Cournot completion . The market inverse demand is P = 32…

A: Cournot competition is an microeconomic model that explains the behavior of firms operating in an…

Q: Consider a homogeneous good industry (such as an agricultural product) with just two firms and a…

A: This game represents Bertrand competition of duopoly market structure where two firms select optimum…

Q: Consider a homogeneous good duopoly with linear demand P(Q) = 12-Q, where Q is the total industry…

A: Given information Two firms are producing identical goods in duopoly market. P=12-Q Firms having…

Q: Suppose that a manufacturer produces two brands of a product, brand 1 and brand 2. Suppose the…

A: We are going to find the profit maximizing P1 and P2 to answer this question.

Q: Consider a setting of two competing firms F1 and F2. Both firms maximize their profits and provide a…

A:

Q: Suppose two Cournot firms selling identical products attempt to collude, calculate the profit to be…

A: Let's assume there are two firms, i.e., Firm A and firm B Qa -> quantity of firm A Qb ->…

Q: Consider an industry composed of only two firms, each producing an identical product. The two firms…

A: We have stackleberg competition between two firms where they both have the same cost structure.

Q: (a) Suppose (hypothetically) that the second firm produces 0 units, and the first firm anticipates…

A: Since you have posted a question with multiple sub-parts, we will solve the first 3 sub-parts for…

Q: The inverse demand function in an industry with two firms is given as p = 50 – 2y, where y is the…

A: "Since you have posted multiple sub-parts question, we can solve first three parts, rest you need to…

Q: Suppose an industry consists of two firms that compete in prices. Each firm produces one product.…

A: The products are homogeneous since they have identical cost structure and have identical demand…

Q: Two firms compete in a market to sell a homogeneous product with inverse demand function P = 960-6Q.…

A: Given: Inverse demand function P = 960-6Q. Constant marginal cost of $60

Q: The market demand in a homogeneous-product Cournot duopoly is P = 113 - 2.2Q, where Q = Q1 + Q2…

A: For the level of output and profits when Firm 2 cheats and Firm 1 colludes , firstly we find the…

Q: The inverse demand for a homogeneous-product Stackelberg duopoly is P = 16,000 − 4Q. The cost…

A:

Q: A homogeneous products duopoly faces a market demand function given byP = 300 − 3Q, where Q = Q1 +…

A: The market demand function. P=300-3QWhere, Q=Q1+Q2MC=100

Q: A homogenous product is produced by two rival firms. They have the same costs. The market demand is:…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: The market demand in a homogeneous-product Cournot duopoly is P = 100 - 2Q, where Q=Q1+Q2 (Firm 1…

A: If they engage in collusion and behave as a monopoly then the profit-maximizing equilibrium is…

Q: There are only two firms in a particular industry. The firms realize that by colluding, they can…

A: Under oligopoly form of market, there are a few firms and a large number of buyers. The firms…

Q: Consider an industry with only two firms: firm A and firm B. The industry’s inverse demand is P(Q) =…

A: Demand : P(Q) = 400 − 1/10Q P = 400 − 0.1Q Q=Q1+Q2 P = 400 − 0.1(Q1+Q2) P = 400 − 0.1Q1-0.1Q2 MC=10…

Q: Consider a duopoly where firms compete for market share by setting prices. The firms produce…

A: 1. According to the question Q1 = 100 – 2P1 + 2P2 Q2 = 120 – 4P2 + P1 MC1 = 30, MC2 = 20 Here Q1 –…

Q: Consider a market that is a Bertrand oligopoly with 5 firms in the market. Each of these firms…

A: All the firms in the market operate with the objective of profit-maximization and at the…

Q: Two firms compete in a market to sell a homogeneous product with inverse demand function P = 600 −…

A: Given, inverse demand function P = 600 – 3Q MC = 300…

Q: Store A and Store B compete for the business of the same customer base. Store A has 55% of the…

A: In a simultaneous game, both players choose their best strategy, given the strategy of the other…

Q: Suppose the inverse demand function for two Cournot duopolists is given by P = 10 – (Q1 + Q2) and…

A: a. According to the question, Cournot duopolist have demand for P = 10 –(Q1 + Q2)With MC1=MC2 =…

Q: An industry has four firms, each with a market share of 25 percent. There is no foreign competition,…

A: Given market share of 4 firms = 25 % The Herfindahl Index(HHI) is calculated by squaring the market…

Q: The four-firm concentration ratios for industries X and Y are 81 percent and 74 percent,…

A: Given, Four-firm concentration ratio of X = 81% Four-firm concentration ratio of Y = 74%…

Q: A homogenous product is produced by two rival firms. They have the same costs. The market demand is:…

A: a. P= 80-Q1-Q2 C1= 50Q1 C2=50Q2 MC1= MC2=50 TR1= PQ1 = (80 -Q1 - Q2)Q1 = 80Q1 - Q12 -…

Q: Consider an industry with two firms, each having marginal costs and total costs equal to zero. The…

A: Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: The inverse market demand curve for a Covid-19 mask is given by P(y) = 120 – 2y, and the total cost…

A: (i) Inverse market demand p(y) = 120 - 2y Total revenue (TR) = 120y - 2y2 Marginal revenue (MR)=…

Q: Perfect Picture Cameras: Perfect Picture Cameras is a national camera company. It competes with 2-3…

A: The oligopoly is the market structure with few sellers and they produce either homogenous or…

Q: You are given the market demand function Q=2200-1000p, and that each duopoly firm's marginal cost is…

A: Cournot competition is an financial version used to explain an enterprise shape wherein agencies…

Q: A homogeneous products duopoly faces a market demand function given by P = 300 − 3Q, where Q = Q1…

A: Demand function, P = 300 - 3Q Marginal cost, MC = 100 The output of firm2 = 50 units

Q: Consider a Cournot duopoly with the following inverse demand function: P = 4,000 – 4Q1 - 4Q2. The…

A: The type of market structure in which an exactly same product is produced and sold by two producers…

Q: Suppose that the market for computers is dominated by a single firm, like IBM, that is able to exert…

A: The measure that depicts the ways in which firms are classified and differentiated on the basis of…

Q: There are two firms, Firm 1 and Firm 2. The two firms’ products are viewed as identical by most…

A: There are two firms : Firm 1 & Firm 2 Cost function of firm 1 : C(Q1) = 10 + 4Q1 Average Cost…

Q: You are given the market demand function Q = 3400 – 1000p, and that each duopoly firm's marginal…

A:

Q: Consider an industry composed of only two firms, each producing an identical product. The two firms…

A: We have stackleberg competition between two firms and they both have identical costs.

Q: Select the correct statements. Note: Multiple correct, multiple selections. Topics covered:…

A: The Stackelberg leadership model is an economics strategic game in which the leader firm moves…

Q: Both oligopoly and monopoly market structures tend to form if or when: the product, service or…

A: In Oligopoly there are few sellers selling differentiated product. There is strict barriers to…

Q: An industry has two firms. Firm 1's cost function is c(y) = 3y + 200 and firm 2's cost function is…

A: In the Cournot model, firms compete in terms of quantities and each firm tries to produce such…

Q: An industry has two firms. Firm 1's cost function is c(y) = 3y + 200 and firm 2's cost function is…

A: Profit maximizing quantity is such quantity where marginal revenue equals marginal cost.

Q: A homogeneous product duopoly faces a market demand function given by p = 300 - 3Q,where Q = q1 +…

A: The equilibrium price is the only price where the plans of consumers and the plans of producers…

Q: 1. In a duopoly market, two firms produce the identical products, the cost function of firm 1 is: C,…

A:

Q: The market demand in a homogeneous-product Cournot duopoly is P = 113 - 2.2Q, where Q = Q1 + Q2…

A: For the level of output and profits when Firm 2 cheats and Firm 1 colludes , firstly we find the…

Q: The inverse demand for a homogeneous-product Stackelberg duopoly is P= 16,000-4Q. The cost…

A: Dear student, you have asked multiple sub-part questions in a single post.In such a case, as per the…

Step by step

Solved in 5 steps

- Two firms facing a demand curve are P = 50 -5Qwhere Q = Q1 + Q2. The cost functions of the two firms are:C1(Q1) = 20 + 10Q1C2(C2) = 10 + 12Q2Based on this information:a. Suppose both companies have entered the industry, then what is the price?and the profit-maximizing amount for the two firms under conditionsperfectly competitive market?b. What is the quantity, price and profit of the two firms ifcompanies collude in pricing?c. What are the quantities, prices, and profits of the two firms if theydo the Cournot strategy, and draw the reaction curves of the twothe company?d. What are the quantity, price, and profit of the two firms if theycarry out the stakeberg strategy.A homogeneous products duopoly faces a market demand function given byP = 300 − 3Q, where Q = Q1 +Q2. Both firms have constant marginal cost MC =100.a) What is Firm 1’s profit-maximizing quantity, given that Firm 2 produces an output of 50 unitsper year?If there are two firms Atlas and Bowden in this market with the total cost function TC = 500 + 10Q^2 and they engage in Cournot competition, what is each firm's equilibrium quantity, price, and profit? [NB: round quantities to nearest integer to find equilibrium quantity, price, and profit]

- only typed answer The inverse demand for a homogeneous-product Stackelberg duopoly is P = 26,000 −4Q. The cost structures for the leader and the follower, respectively, are CL(QL) = 2,000QL and CF (QF) = 4,000QF. a. What is the follower’s reaction function? QF = − QL b. Determine the equilibrium output level for both the leader and the follower. Leader output: Follower output: c. Determine the equilibrium market price. $ d. Determine the profits of the leader and the follower. Leader profits: $ Follower profits: $A10 Consider an industry with 2 firms, each firm with marginal costs equal to 0. Market demand curve is given by Q=60- P. With 2 firms, we can write Q=Q1+ Q2 . Suppose that each firm behaves as a “Cournot” competitor, that is, choose the optimal quantity maximizing the profits in a strategic way.(a) What would be the values of Q1, and Q2 in equilibrium? (b) Suppose firm 1 can “commit” its level of output in advance. In other words, if firm 1 announces to produce Q1, firm 2 needs to decide how much to produce assuming that firm 1 would indeed produce Q1. What’s the level of Q1 firm 1 would choose to maximize its profit?Two firms engage in Cournot competition in the Everlasting Gobstopper industry. The price elasticity of demand is-2. Firm 1 has aconstant marginal cost of $110.00 per unit, and firm 2 has a constant marginal cost of $181.50 per unit. If the two firms are currently inequilibrium, what is firm 2's share of the market? Enter your answer as a decimal, rounded to two places if necessary.______ Please show all steps

- Two firms, A and B, face an inverse market demand function of P = 1200 - 4Q. Each firm has the same cost function Ci = 20qi. Assume the A and B are Stackelberg competitors, and that A is the leader. Derive from profit functions the equilibrium prices, quantities, and profits for A and B. How does the methodology for solving the Stackelberg problem differ from the method for solving the Cournot problem? Why?Please solve all the parts and only typed answer The inverse demand for a homogeneous-product Stackelberg duopoly is P = 16,000 – 4Q. The cost structures for the leader and the follower, respectively, are CL(QL) = 4,000QL and CF (QF) = 6,000QF. What is the follower’s reaction function? Determine the equilibrium output level for both the leader and the follower. Leader output: Follower output: Determine the equilibrium market price. Determine the profits of the leader and the follower. Leader profits: Follower profits:Suppose that Raleigh and Dawes are the only sellers of bicycles in the UK. The inverse market demand function for bicycles is ?(?)=200−2?. Both firms have the same total cost function: ??(?)=12? and the same marginal cost: ??(?)=12.Suppose this market is a Stackelberg oligopoly and Raleigh is the first mover.a) Write down a formula for the reaction function of Dawes.b) Calculate the equilibrium quantity that each firm produces and the equilibrium price in the market.c) At the Stackelberg equilibrium, how much profit does each firm make?Suppose now that the two firms decide to act like a single monopolist.a) What will the total quantity of bicycles sold in the market be and what will the equilibrium price be? Represent the profit maximisation problem on a graph and indicate the price and quantity at the equilibrium.b) Calculate the total profit made by the two firms when they act like a monopoly. Compare it with the total profit they were making in the Stackelberg oligopoly.c) For the…

- Oligopolies: a) Based on the information in the table, what is the demand function for this market? b) Calculate total and marginal revenues for this market in the table c) if the total cost function for this market is TC = 500 + 10Q2 , calculate the total and marginal costs for each of the quantities in the table d) What are the profit-maximizing quantity, price, and profit for this market? e) If there are two firms Atlas and Bowden in this market with the same earlier total cost function and they engage in Cournot competition, what is each firm's equilibrium quantity, price, and profit? [NB: round quantities to nearest integer to find equilibrium quantity, price, and profit] f) Is this a long run equilibrium? Why or why not?1. Two firms compete in a market to sell a homogeneous product with inversedemand function P = 960-6Q. Each firm produces at a constant marginal cost of$60 and has no fixed costs.a. Assuming perfect competition, computei. Equilibrium price and quantityii. Profits and producer surplusiii. Consumer surplus and total surplusb. Assuming Cournot duopoly, computei. Reaction functions for each firmii. Profits of each firmiii. Consumer surplusiv. Total welfare loss relative to perfect competition (if any)c. Assuming the firms collude and act as a monopolist, computei. Equilibrium price and quantityii. Total profitsiii. Consumer surplusiv. Total welfare loss relative to perfect competition (if any)d. Rank the output quantities, profits, and total welfare by the three marketstructures aboveThe market demand curve faced by Cournot duopolistsis: Qd = 400 - 8P where Qd is the market quantity demanded and P is the commodity's price in dollars. a. Firm A has a constant marignal cost of $10. What is the equation for Firm A's reaction function with qa expressed as a function of qb? b. Firm B has a constant marginal cost of $7.50. What is the equation for Firm B's reaction function with qb expressed as a function of qa? c. What quantity of output will each firm produce in equilibrium? What price will be established for the commodity?