Analyse on the variance between the planned and actual nett profit contribution of all the projects as of the 31st of March, and comment on the status of the projects.

Analyse on the variance between the planned and actual nett profit contribution of all the projects as of the 31st of March, and comment on the status of the projects.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 18M

Related questions

Question

Analyse on the variance between the planned and actual nett profit contribution of all the projects as of the 31st of March, and comment on

the status of the projects.

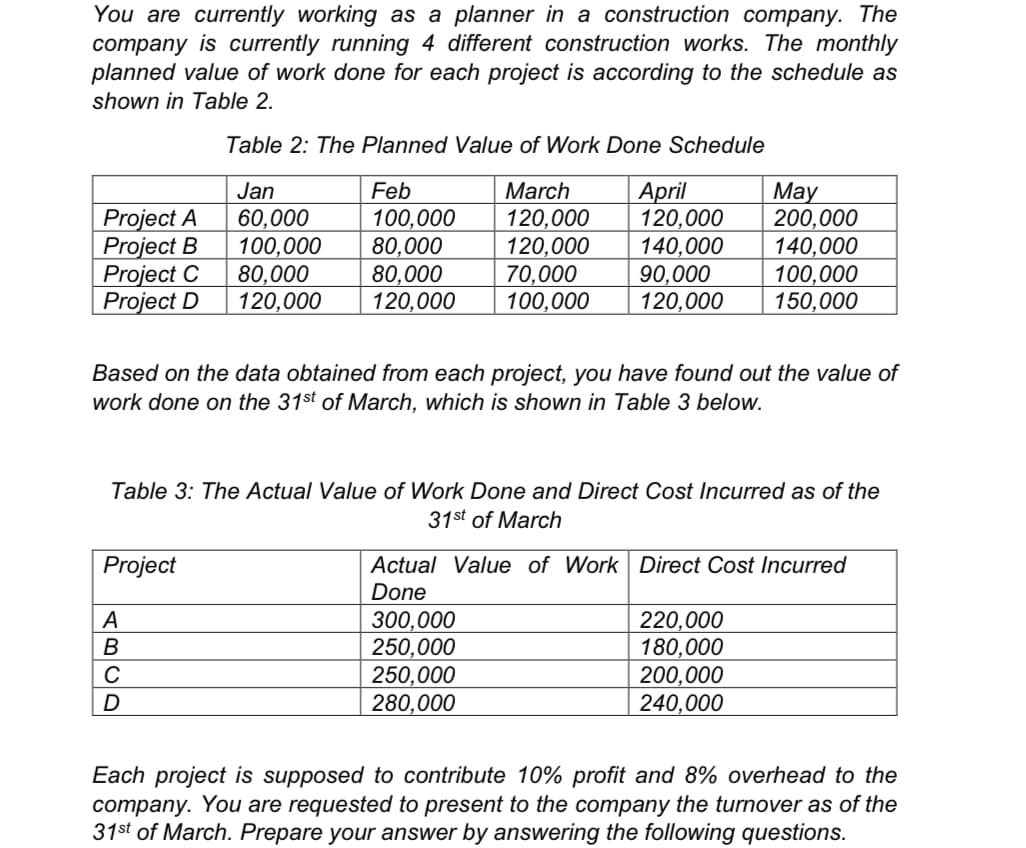

Transcribed Image Text:You are currently working as a planner in a construction company. The

company is currently running 4 different construction works. The monthly

planned value of work done for each project is according to the schedule as

shown in Table 2.

Table 2: The Planned Value of Work Done Schedule

March

120,000

120,000

70,000

100,000

April

120,000

140,000

90,000

120,000

May

200,000

140,000

100,000

150,000

Jan

Feb

Project A

Project B

Project C

Project D

60,000

100,000

80,000

120,000

100,000

80,000

80,000

120,000

Based on the data obtained from each project, you have found out the value of

work done on the 31st of March, which is shown in Table 3 below.

Table 3: The Actual Value of Work Done and Direct Cost Incurred as of the

31st of March

Project

Actual Value of Work Direct Cost Incurred

Done

300,000

250,000

250,000

280,000

A

220,000

180,000

200,000

240,000

B

C

D

Each project is supposed to contribute 10% profit and 8% overhead to the

company. You are requested to present to the company the turnover as of the

31st of March. Prepare your answer by answering the following questions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College