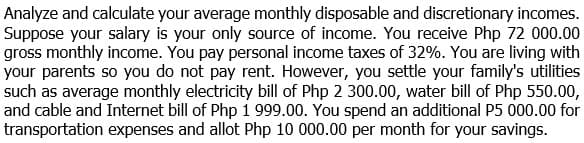

Analyze and calculate your average monthly disposable and discretionary incomes Suppose your salary is your only source of income. You receive Php 72 000.00 gross monthly income. You pay personal income taxes of 32%. You are living with your parents so you do not pay rent. However, you settle your family's utilities such as average monthly electricity bill of Php 2 300.00, water bill of Php 550.00 and cable and Internet bill of Php 1 999.00. You spend an additional P5 000.00 for transportation expenses and allot Php 10 000.00 per month for your savings.

Analyze and calculate your average monthly disposable and discretionary incomes Suppose your salary is your only source of income. You receive Php 72 000.00 gross monthly income. You pay personal income taxes of 32%. You are living with your parents so you do not pay rent. However, you settle your family's utilities such as average monthly electricity bill of Php 2 300.00, water bill of Php 550.00 and cable and Internet bill of Php 1 999.00. You spend an additional P5 000.00 for transportation expenses and allot Php 10 000.00 per month for your savings.

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Analyze and calculate your average monthly disposable and discretionary incomes.

Suppose your salary is your only source of income. You receive Php 72 000.00

gross monthly income. You pay personal income taxes of 32%. You are living with

your parents so you do not pay rent. However, you settle your family's utilities

such as average monthly electricity bill of Php 2 300.00, water bill of Php 550.00,

and cable and Internet bill of Php 1 999.00. You spend an additional P5 000.00 for

transportation expenses and allot Php 10 000.00 per month for your savings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you