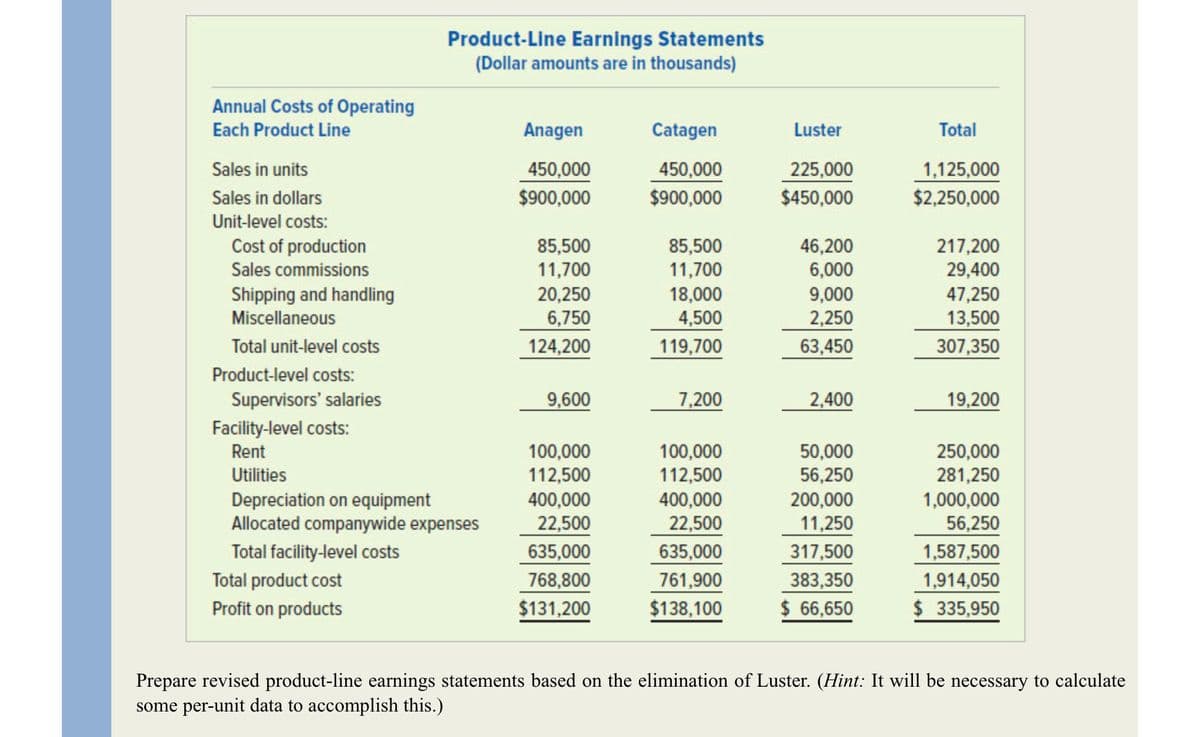

Annual Costs of Operating Each Product Line Sales in units Sales in dollars Unit-level costs: Cost of production Sales commissions Shipping and handling Miscellaneous Total unit-level costs Product-level costs: Supervisors' salaries Facility-level costs: Rent Utilities Depreciation on equipment Allocated companywide expenses Total facility-level costs Product-Line Earnings Statements (Dollar amounts are in thousands) Total product cost Profit on products Anagen 450,000 $900,000 85,500 11,700 20,250 6,750 124,200 9,600 100,000 112,500 400,000 22,500 635,000 768,800 $131,200 Catagen 450,000 $900,000 85,500 11,700 18,000 4,500 119,700 7,200 100,000 112,500 400,000 22,500 635,000 761,900 $138,100 Luster 225,000 $450,000 46,200 6,000 9,000 2,250 63,450 2,400 50,000 56,250 200,000 11,250 317,500 383,350 $ 66,650 Total 1,125,000 $2,250,000 217,200 29,400 47,250 13,500 307,350 19,200 250,000 281,250 1,000,000 56,250 1,587,500 1,914,050 $ 335,950 Prepare revised product-line earnings statements based on the elimination of Luster. (Hint: It will be necessary to calculate some per-unit data to accomplish this.)

Annual Costs of Operating Each Product Line Sales in units Sales in dollars Unit-level costs: Cost of production Sales commissions Shipping and handling Miscellaneous Total unit-level costs Product-level costs: Supervisors' salaries Facility-level costs: Rent Utilities Depreciation on equipment Allocated companywide expenses Total facility-level costs Product-Line Earnings Statements (Dollar amounts are in thousands) Total product cost Profit on products Anagen 450,000 $900,000 85,500 11,700 20,250 6,750 124,200 9,600 100,000 112,500 400,000 22,500 635,000 768,800 $131,200 Catagen 450,000 $900,000 85,500 11,700 18,000 4,500 119,700 7,200 100,000 112,500 400,000 22,500 635,000 761,900 $138,100 Luster 225,000 $450,000 46,200 6,000 9,000 2,250 63,450 2,400 50,000 56,250 200,000 11,250 317,500 383,350 $ 66,650 Total 1,125,000 $2,250,000 217,200 29,400 47,250 13,500 307,350 19,200 250,000 281,250 1,000,000 56,250 1,587,500 1,914,050 $ 335,950 Prepare revised product-line earnings statements based on the elimination of Luster. (Hint: It will be necessary to calculate some per-unit data to accomplish this.)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 19E

Related questions

Question

Consider the additional information presented as follows, which is hypothetical. All dollar amounts are in thousands, unit amounts are not. Assume that P&G decides to eliminate one shampoo product-line, Luster, for one of its segments that currently produces three products. As a result, the following are expected to occur.

Transcribed Image Text:Annual Costs of Operating

Each Product Line

Sales in units

Sales in dollars

Unit-level costs:

Cost of production

Sales commissions

Shipping and handling

Miscellaneous

Total unit-level costs

Product-level costs:

Supervisors' salaries

Facility-level costs:

Rent

Utilities

Depreciation on equipment

Allocated companywide expenses

Total facility-level costs

Product-Line Earnings Statements

(Dollar amounts are in thousands)

Total product cost

Profit on products

Anagen

450,000

$900,000

85,500

11,700

20,250

6,750

124,200

9,600

100,000

112,500

400,000

22,500

635,000

768,800

$131,200

Catagen

450,000

$900,000

85,500

11,700

18,000

4,500

119,700

7,200

100,000

112,500

400,000

22,500

635,000

761,900

$138,100

Luster

225,000

$450,000

46,200

6,000

9,000

2,250

63,450

2,400

50,000

56,250

200,000

11,250

317,500

383,350

$ 66,650

Total

1,125,000

$2,250,000

217,200

29,400

47,250

13,500

307,350

19,200

250,000

281,250

1,000,000

56,250

1,587,500

1,914,050

$ 335,950

Prepare revised product-line earnings statements based on the elimination of Luster. (Hint: It will be necessary to calculate

some per-unit data to accomplish this.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,