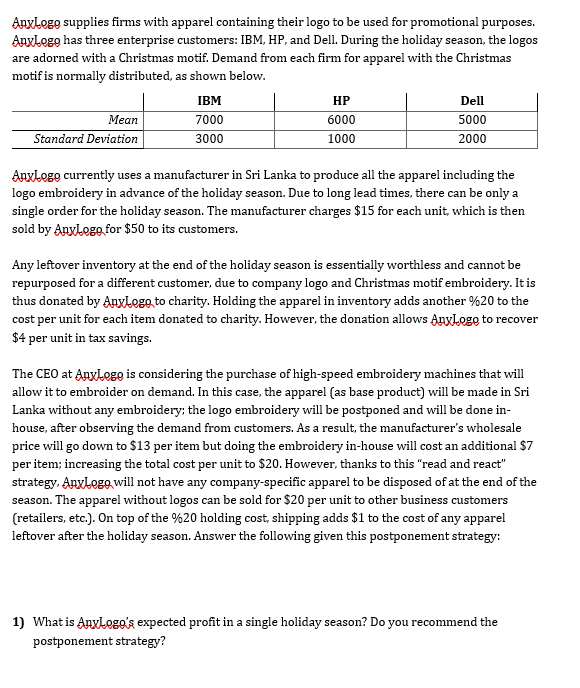

Anxloge supplies firms with apparel containing their logo to be used for promotional purposes. Anxlego has three enterprise customers: IBM, HP, and Dell. During the holiday season, the logos are adorned with a Christmas motif. Demand from each firm for apparel with the Christmas motif is normally distributed, as shown below. IBM HP Dell Mean Standard Deviation 7000 6000 1000 5000 2000 3000 Anxlogo currently uses a manufacturer in Sri Lanka to produce all the apparel including the logo embroidery in advance of the holiday season. Due to long lead times, there can be only a single order for the holiday season. The manufacturer charges $15 for each unit, which is then sold by AnyLego,for $50 to its customers. Any leftover inventory at the end of the holiday season is essentially worthless and cannot be repurposed for a different customer, due to company logo and Christmas motif embroidery. It is thus donated by AnyLogo to charity. Holding the apparel in inventory adds another %20 to the cost per unit for each item donated to charity. However, the donation allows AnyLogo to recover $4 per unit in tax savings. The CEO at Anylogo is considering the purchase of high-speed embroidery machines that will allow it to embroider on demand. In this case, the apparel (as base product) will be made in Sri Lanka without any embroidery; the logo embroidery will be postponed and will be done in- house, after observing the demand from customers. As a result, the manufacturer's wholesale price will go down to $13 per item but doing the embroidery in-house will cost an additional $7 per item: increasing the total cost per unit to $20. However, thanks to this "read and react" strategy. AnyLogo will not have any company-specific apparel to be disposed of at the end of the season. The apparel without logos can be sold for $20 per unit to other business customers (retailers, etc.). On top of the %20 holding cost, shipping adds $1 to the cost of any apparel leftover after the holiday season. Answer the following given this postponement strategy:

Anxloge supplies firms with apparel containing their logo to be used for promotional purposes. Anxlego has three enterprise customers: IBM, HP, and Dell. During the holiday season, the logos are adorned with a Christmas motif. Demand from each firm for apparel with the Christmas motif is normally distributed, as shown below. IBM HP Dell Mean Standard Deviation 7000 6000 1000 5000 2000 3000 Anxlogo currently uses a manufacturer in Sri Lanka to produce all the apparel including the logo embroidery in advance of the holiday season. Due to long lead times, there can be only a single order for the holiday season. The manufacturer charges $15 for each unit, which is then sold by AnyLego,for $50 to its customers. Any leftover inventory at the end of the holiday season is essentially worthless and cannot be repurposed for a different customer, due to company logo and Christmas motif embroidery. It is thus donated by AnyLogo to charity. Holding the apparel in inventory adds another %20 to the cost per unit for each item donated to charity. However, the donation allows AnyLogo to recover $4 per unit in tax savings. The CEO at Anylogo is considering the purchase of high-speed embroidery machines that will allow it to embroider on demand. In this case, the apparel (as base product) will be made in Sri Lanka without any embroidery; the logo embroidery will be postponed and will be done in- house, after observing the demand from customers. As a result, the manufacturer's wholesale price will go down to $13 per item but doing the embroidery in-house will cost an additional $7 per item: increasing the total cost per unit to $20. However, thanks to this "read and react" strategy. AnyLogo will not have any company-specific apparel to be disposed of at the end of the season. The apparel without logos can be sold for $20 per unit to other business customers (retailers, etc.). On top of the %20 holding cost, shipping adds $1 to the cost of any apparel leftover after the holiday season. Answer the following given this postponement strategy:

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter10: Introduction To Simulation Modeling

Section10.5: Introduction To @risk

Problem 19P: In Problem 12 of the previous section, suppose that the demand for cars is normally distributed with...

Related questions

Question

Transcribed Image Text:Anxlege supplies firms with apparel containing their logo to be used for promotional purposes.

Anxlogo has three enterprise customers: IBM, HP, and Dell. During the holiday season, the logos

are adorned with a Christmas motif. Demand from each firm for apparel with the Christmas

motif is normally distributed, as shown below.

IBM

HP

Dell

Мean

7000

6000

5000

Standard Deviation

3000

1000

2000

Anxlogo currently uses a manufacturer in Sri Lanka to produce all the apparel including the

logo embroidery in advance of the holiday season. Due to long lead times, there can be only a

single order for the holiday season. The manufacturer charges $15 for each unit, which is then

sold by Anylego.for $50 to its customers.

Any leftover inventory at the end of the holiday season is essentially worthless and cannot be

repurposed for a different customer, due to company logo and Christmas motif embroidery. It is

thus donated by AnyLego to charity. Holding the apparel in inventory adds another %20 to the

cost per unit for each item donated to charity. However, the donation allows Anxloge to recover

$4 per unit in tax savings.

The CEO at AnyLogo is considering the purchase of high-speed embroidery machines that will

allow it to embroider on demand. In this case, the apparel (as base product) will be made in Sri

Lanka without any embroidery: the logo embroidery will be postponed and will be done in-

house, after observing the demand from customers. As a result, the manufacturer's wholesale

price will go down to $13 per item but doing the embroidery in-house will cost an additional $7

per item; increasing the total cost per unit to $20. However, thanks to this "read and react"

strategy, AnyLogo will not have any company-specific apparel to be disposed of at the end of the

season. The apparel without logos can be sold for $20 per unit to other business customers

(retailers, etc.). On top of the %20 holding cost, shipping adds $1 to the cost of any apparel

leftover after the holiday season. Answer the following given this postponement strategy:

1) What is Anylogo's expected profit in a single holiday season? Do you recommend the

postponement strategy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,