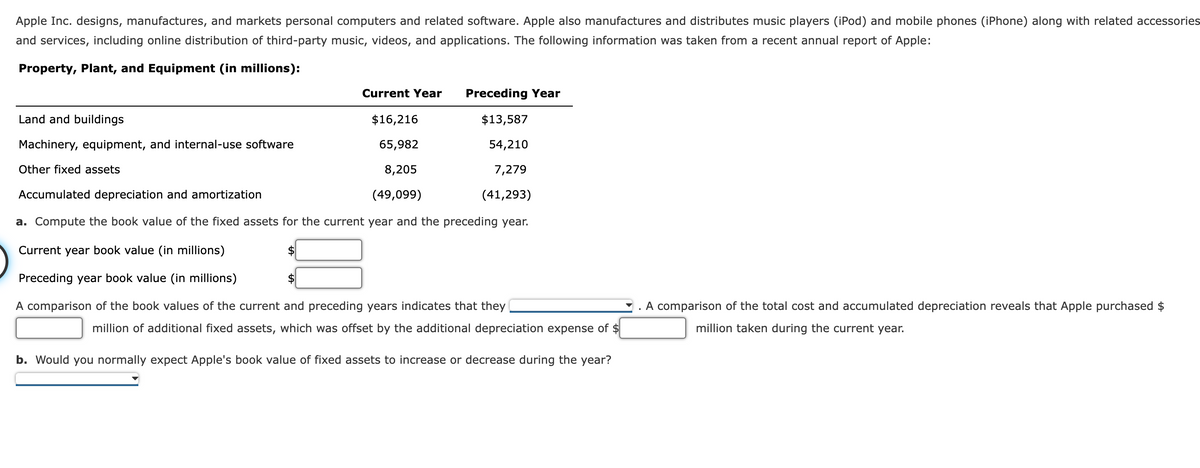

Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent annual report of Apple: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $16,216 $13,587 Machinery, equipment, and internal-use software 65,982 54,210 Other fixed assets 8,205 7,279 Accumulated depreciation and amortization (49,099) (41,293) a. Compute the book value of the fixed assets for the current year and the preceding year. Current year book value (in millions) Preceding year book value (in millions) A comparison of the book values of the current and preceding years indicates that they . A comparison of the total cost and accumulated depreciation reveals that Apple purchased $ million of additional fixed assets, which was offset by the additional depreciation expense of $ million taken during the current year. b. Would you normally expect Apple's book value of fixed assets to increase or decrease during the year?

Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent annual report of Apple: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $16,216 $13,587 Machinery, equipment, and internal-use software 65,982 54,210 Other fixed assets 8,205 7,279 Accumulated depreciation and amortization (49,099) (41,293) a. Compute the book value of the fixed assets for the current year and the preceding year. Current year book value (in millions) Preceding year book value (in millions) A comparison of the book values of the current and preceding years indicates that they . A comparison of the total cost and accumulated depreciation reveals that Apple purchased $ million of additional fixed assets, which was offset by the additional depreciation expense of $ million taken during the current year. b. Would you normally expect Apple's book value of fixed assets to increase or decrease during the year?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

Transcribed Image Text:Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories

and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent annual report of Apple:

Property, Plant, and Equipment (in millions):

Current Year

Preceding Year

Land and buildings

$16,216

$13,587

Machinery, equipment, and internal-use software

65,982

54,210

Other fixed assets

8,205

7,279

Accumulated depreciation and amortization

(49,099)

(41,293)

a. Compute the book value of the fixed assets for the current year and the preceding year.

Current year book value (in millions)

$

Preceding year book value (in millions)

$

A comparison of the book values of the current and preceding years indicates that they

A comparison of the total cost and accumulated depreciation reveals that Apple purchased $

million of additional fixed assets, which was offset by the additional depreciation expense of $

million taken during the current year.

b. Would you normally expect Apple's book value of fixed assets to increase or decrease during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning