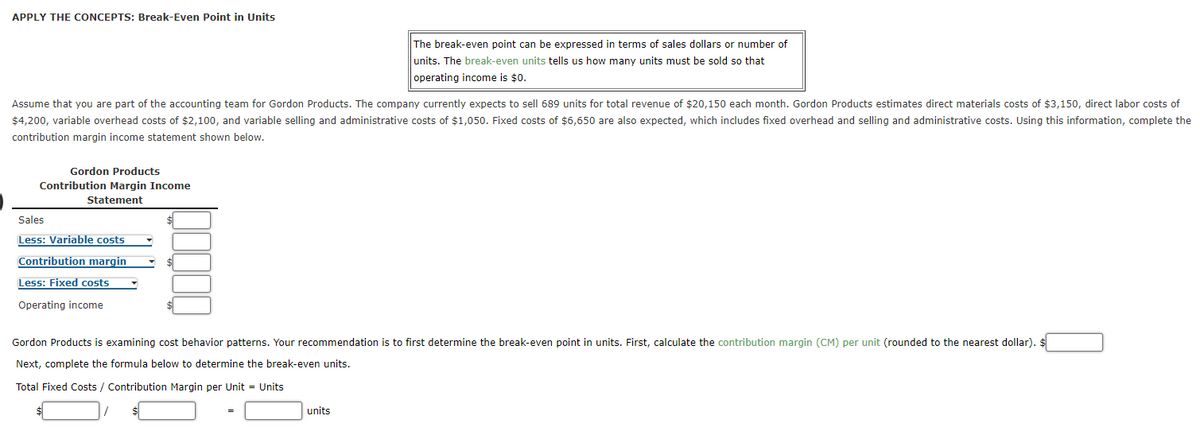

APPLY THE CONCEPTS: Break-Even Point in Units The break-even point can be expressed in terms units. The break-even units tells us how many units must be sold so that operating income is $0. sales dollars or number of Assume that you are part of the accounting team for Gordon Products. The company currently expects to sell 689 units for total revenue of $20,150 each month. Gordon Products estimates direct materials costs of $3,150, direct labor costs of $4,200, variable overhead costs of $2,100, and variable selling and administrative costs of $1,050. Fixed costs of $6,650 are also expected, which includes fixed overhead and selling and administrative costs. Using this information, complete the contribution margin income statement shown below. Gordon Products Contribution Margin Income Statement Sales Less: Variable costs Contribution margin Less: Fixed costs Operating income Gordon Products is examining cost behavior patterns. Your recommendation is to first determine the break-even point in units. First, calculate the contribution margin (CM) per unit (rounded to the nearest dollar). Next, complete the formula below to determine the break-even units. Total Fixed Costs / Contribution Margin per Unit - Units %3D units

APPLY THE CONCEPTS: Break-Even Point in Units The break-even point can be expressed in terms units. The break-even units tells us how many units must be sold so that operating income is $0. sales dollars or number of Assume that you are part of the accounting team for Gordon Products. The company currently expects to sell 689 units for total revenue of $20,150 each month. Gordon Products estimates direct materials costs of $3,150, direct labor costs of $4,200, variable overhead costs of $2,100, and variable selling and administrative costs of $1,050. Fixed costs of $6,650 are also expected, which includes fixed overhead and selling and administrative costs. Using this information, complete the contribution margin income statement shown below. Gordon Products Contribution Margin Income Statement Sales Less: Variable costs Contribution margin Less: Fixed costs Operating income Gordon Products is examining cost behavior patterns. Your recommendation is to first determine the break-even point in units. First, calculate the contribution margin (CM) per unit (rounded to the nearest dollar). Next, complete the formula below to determine the break-even units. Total Fixed Costs / Contribution Margin per Unit - Units %3D units

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 29BEB: Sales Needed to Earn Target Income Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in...

Related questions

Question

Transcribed Image Text:APPLY THE CONCEPTS: Break-Even Point in Units

The break-even point can be expressed in terms of sales dollars or number of

units. The break-even units tells us how many units must be sold so that

operating income is $0.

Assume that you are part of the accounting team for Gordon Products. The company currently expects to sell 689 units for total revenue of $20,150 each month. Gordon Products estimates direct materials costs of $3,150, direct labor costs of

$4,200, variable overhead costs of $2,100, and variable selling and administrative costs of $1,050. Fixed costs of $6,650 are also expected, which includes fixed overhead and selling and administrative costs. Using this information, complete the

contribution margin income statement shown below.

Gordon Products

Contribution Margin Income

Statement

Sales

Less: Variable costs

Contribution margin

Less: Fixed costs

Operating income

Gordon Products is examining cost behavior patterns. Your recommendation is to first determine the break-even point in units. First, calculate the contribution margin (CM) per unit (rounded to the nearest dollar). $

Next, complete the formula below to determine the break-even units.

Total Fixed Costs / Contribution Margin per Unit = Units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,