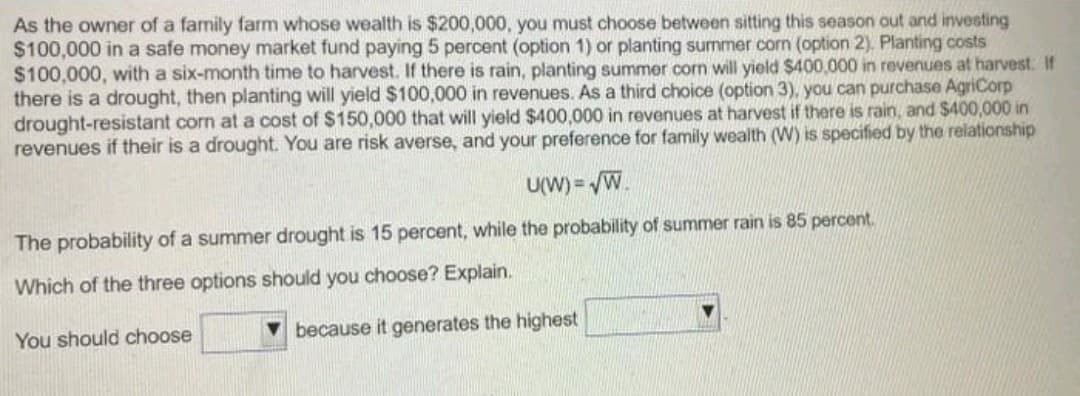

As the owner of a family farm whose wealth is $200,000, you must choose between sitting this season out and investing $100,000 in a safe money market fund paying 5 percent (option 1) or planting summer corn (option 2). Planting costs $100,000, with a six-month time to harvest. If there is rain, planting summer corn will yield $400,000 in revenues at harvest: If there is a drought, then planting will yield $100,000 in revenues. As a third choice (option 3), you can purchase AgriCorp drought-resistant corn at a cost of $150,000 that will yield $400,000 in revenues at harvest if there is rain, and $400,000 in revenues if their is a drought. You are risk averse, and your preference for family wealth (W) is specified by the relationship U(W)=√W. The probability of a summer drought is 15 percent, while the probability of summer rain is 85 percent. Which of the three options should you choose? Explain. You should choose because it generates the highest

As the owner of a family farm whose wealth is $200,000, you must choose between sitting this season out and investing $100,000 in a safe money market fund paying 5 percent (option 1) or planting summer corn (option 2). Planting costs $100,000, with a six-month time to harvest. If there is rain, planting summer corn will yield $400,000 in revenues at harvest: If there is a drought, then planting will yield $100,000 in revenues. As a third choice (option 3), you can purchase AgriCorp drought-resistant corn at a cost of $150,000 that will yield $400,000 in revenues at harvest if there is rain, and $400,000 in revenues if their is a drought. You are risk averse, and your preference for family wealth (W) is specified by the relationship U(W)=√W. The probability of a summer drought is 15 percent, while the probability of summer rain is 85 percent. Which of the three options should you choose? Explain. You should choose because it generates the highest

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 13CQ

Related questions

Question

Transcribed Image Text:As the owner of a family farm whose wealth is $200,000, you must choose between sitting this season out and investing

$100,000 in a safe money market fund paying 5 percent (option 1) or planting summer corn (option 2). Planting costs

$100,000, with a six-month time to harvest. If there is rain, planting summer corn will yield $400,000 in revenues at harvest: If

there is a drought, then planting will yield $100,000 in revenues. As a third choice (option 3), you can purchase AgriCorp

drought-resistant corn at a cost of $150,000 that will yield $400,000 in revenues at harvest if there is rain, and $400,000 in

revenues if their is a drought. You are risk averse, and your preference for family wealth (W) is specified by the relationship

U(W) = √W.

The probability of a summer drought is 15 percent, while the probability of summer rain is 85 percent.

Which of the three options should you choose? Explain.

You should choose

because it generates the highest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning