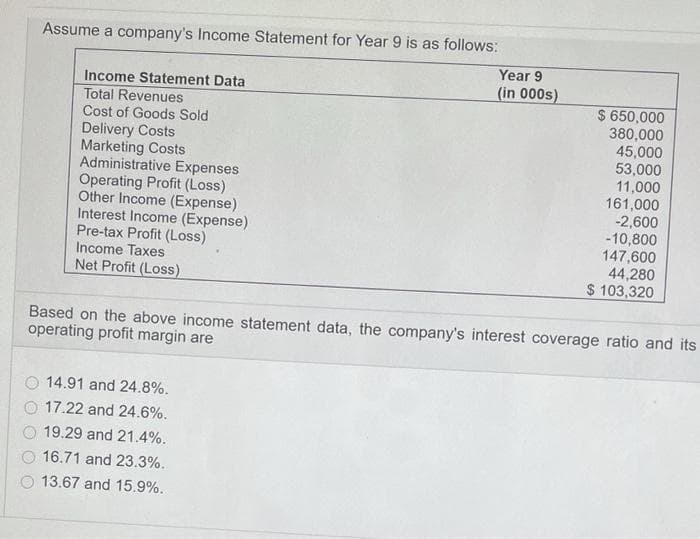

Assume a company's Income Statement for Year 9 is as follows: Year 9 (in 000s) Income Statement Data Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) Other Income (Expense) Interest Income (Expense) Pre-tax Profit (Loss) Income Taxes Net Profit (Loss) $ 650,000 380,000 45,000 53,000 11,000 161,000 -2,600 -10,800 147,600 44,280 $ 103,320 Based on the above income statement data, the company's interest coverage ratio anc operating profit margin are 14.91 and 24.8%. 17.22 and 24.6%. 19.29 and 21.4%. 16.71 and 23.3%. 13.67 and 15.9%.

Assume a company's Income Statement for Year 9 is as follows: Year 9 (in 000s) Income Statement Data Total Revenues Cost of Goods Sold Delivery Costs Marketing Costs Administrative Expenses Operating Profit (Loss) Other Income (Expense) Interest Income (Expense) Pre-tax Profit (Loss) Income Taxes Net Profit (Loss) $ 650,000 380,000 45,000 53,000 11,000 161,000 -2,600 -10,800 147,600 44,280 $ 103,320 Based on the above income statement data, the company's interest coverage ratio anc operating profit margin are 14.91 and 24.8%. 17.22 and 24.6%. 19.29 and 21.4%. 16.71 and 23.3%. 13.67 and 15.9%.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Assume a company's Income Statement for Year 9 is as follows:

Year 9

(in 000s)

Income Statement Data

Total Revenues

Cost of Goods Sold

Delivery Costs

Marketing Costs

Administrative Expenses

Operating Profit (Loss)

Other Income (Expense)

Interest Income (Expense)

Pre-tax Profit (Loss)

Income Taxes

Net Profit (Loss)

$ 650,000

380,000

45,000

53,000

11,000

161,000

-2,600

-10,800

147,600

44,280

$ 103,320

Based on the above income statement data, the company's interest coverage ratio and its

operating profit margin are

14.91 and 24.8%.

17.22 and 24.6%.

19.29 and 21.4%.

16.71 and 23.3%.

13.67 and 15.9%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning