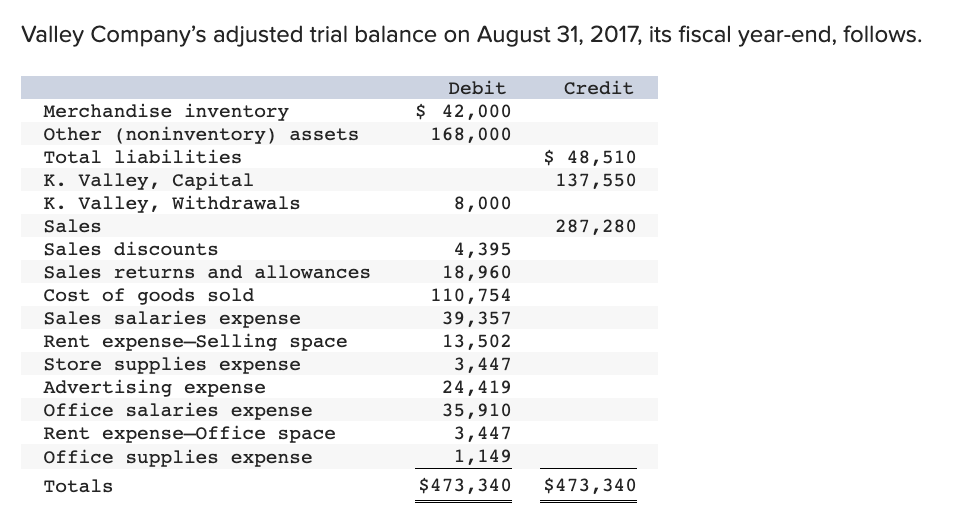

Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows. Debit Credit Merchandise inventory Other (noninventory) assets Total liabilities $ 42,000 168,000 $ 48,510 137,550 K. Valley, Capital K. Valley, Withdrawals 8,000 Sales 287,280 Sales discounts 4,395 18,960 Sales returns and allowances Cost of goods sold Sales salaries expense 110,754 Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense 39,357 13,502 3,447 24,419 35,910 3,447 1,149 Rent expense-Office space Office supplies expense Totals $473,340 $473,340

Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows. Debit Credit Merchandise inventory Other (noninventory) assets Total liabilities $ 42,000 168,000 $ 48,510 137,550 K. Valley, Capital K. Valley, Withdrawals 8,000 Sales 287,280 Sales discounts 4,395 18,960 Sales returns and allowances Cost of goods sold Sales salaries expense 110,754 Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense 39,357 13,502 3,447 24,419 35,910 3,447 1,149 Rent expense-Office space Office supplies expense Totals $473,340 $473,340

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter8: Gross Profit Method (gp)

Section: Chapter Questions

Problem 3R: On December 31, 2013, the year-to-date account balances of selected accounts were as follows:...

Related questions

Question

3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses.

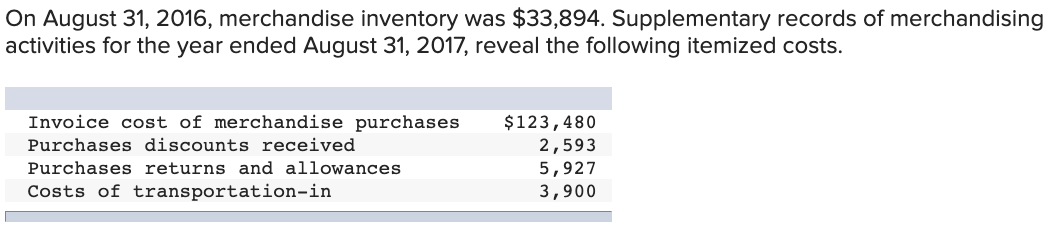

Transcribed Image Text:On August 31, 2016, merchandise inventory was $33,894. Supplementary records of merchandising

activities for the year ended August 31, 2017, reveal the following itemized costs.

Invoice cost of merchandise purchases

$123,480

Purchases discounts received

2,593

Purchases returns and allowances

5,927

3,900

Costs of transportation-in

Transcribed Image Text:Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows.

Debit

Credit

Merchandise inventory

$ 42,000

168,000

Other (noninventory) assets

$ 48,510

137,550

Total liabilities

к. Valley, Сapital

K. Valley, Withdrawals

8,000

Sales

287,280

4,395

18,960

110,754

39,357

13,502

3,447

Sales discounts

Sales returns and allowances

Cost of goods sold

Sales salaries expense

Rent expense-Selling space

Store supplies expense

Advertising expense

Office salaries expense

24,419

Rent expense-Office space

Office supplies expense

35,910

3,447

1,149

Totals

$473,340

$473,340

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College