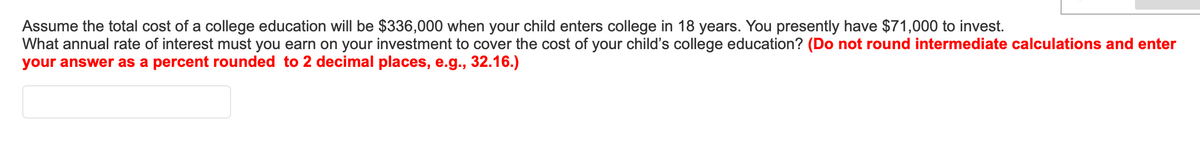

Assume the total cost of a college education will be $336,000 when your child enters college in 18 years. You presently have $71,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's college education? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Q: Refer to Figure 11-1. Assuming that higher education spending means better quality, how many…

A: The goal of free public education is to ensure that every individual has equal access to education…

Q: There is a new government in a developing country which is a member of the IMF and the World Bank.…

A: Introduction A new government of a developing country, which is a member of the IMF, and World Bank…

Q: 5. CostCo is a retail outlet that requires members to pay an annual fee to access its stores.…

A: In two-part tariff the price of the good or service will be comprised of two parts: a fixed fee and…

Q: A company produces a special new type of TV. The company has fixed costs of $453,000, and it costs…

A: Given information: A company produces a TV. Let's assume Q units of TV are produced.…

Q: Calculate the future value if present value (PV) = $1548, interest rate (r) = 9.0% and number of…

A: The formula for calculating future value from present value is:- Future value x= Present value (…

Q: It must be answered in a maximum of five sentences only. Is being trapped within the processes and…

A: By exchanging commodities, ideas, and services, which is made possible by advances in technology and…

Q: In Zimbabwe the rate of inflation hit 90 sextillion percent in 2009, with prices increasing tenfold…

A: Hyperinflation refers to a scenario in which inflation is extremely higher and acceleration. In such…

Q: Which of the following is a fundamental principle of utilitarianism? Select one: a. Inequalities in…

A: Utilitarianism refers to the theory that gives more importance to morals and happiness.

Q: If the marginal revenue from a product is $15 and the price elasticity of demand is −1.5, what is…

A: Introduction: The additional revenue a business earns by selling one more unit of a good or service…

Q: Using a 5% annual compound interest rate, what investment today is needed in order to withdraw…

A: Present Value (PV) The PV of a future return relies upon the amount and timing of the investments,…

Q: With Russia's and Ireland's biggest export, discuss the potential of a comparative advantage, and…

A: A comparative advantage exists when a country can produce a good or service at a lower opportunity…

Q: 12. If Portugal has a total of 180 man-hours of resources available for production, while England…

A: Absolute advantage in international trade refers to the fact that a country can produce any…

Q: Briefly describe some of the key characteristics of a perfectly competitive market. Explain the…

A: In a perfectly competitive market, with a large number of buyers and sellers, the seller produces a…

Q: Figure 11-1 depicts three families, X, Y, and Z, and their utility based on spending on education…

A: Free public education refers to a system in which the government provides primary, secondary, and/or…

Q: en enjoys doing volunteer work very much. During weekends, he often goes to the community center…

A: Opportunity cost is defined as the next best alternative forgone.

Q: Suppose that Larry and Megan are the only consumers of ice cream cones in a particular market. The…

A: Market demand refers to the total amount of a good demanded by all the consumers of that good in the…

Q: Table. Sales per employee for the apparel and textile industries in the United States and China, as…

A: Table reflects that United States experiences an absolute advantage in all the products but has a…

Q: Select one: a. Borrowing allows all households to raise their consumer spending given an anticipated…

A: When talking about savings and consumption decisions of an individual, it can be said that these…

Q: C = 2000 + 0.8Yd; T = 1000 + 0.3Y; G = 6000; TR = 1200; I = 4000 + 0.24Y – 100r; M = 3000 + 0.2Y; X…

A: An economic model called the IS-LM model describes the interaction between the money market and the…

Q: In the graph below, the equilibrium price level and the equilibrium real GDP are found where the two…

A: Aggregate demand and aggregate supply: The aggregate supply of an economy signifies the total…

Q: Major colleges make literally Billions on college athletic and alumni programs. As of July 1,…

A: NCAA has enacted a temporary policy so that athletes can perform NIL agreements and other…

Q: The accompanying graph shows the labor market in the country of Harmonia. Assume that the Harmonia…

A: The equilibrium in the labor market is a situation when the supply of labor by the households is…

Q: Question 02: Marginal Principle: How Many Hours at the Barber Shop? The opportunity cost of your…

A: Marginal analysis is the process of examining of cost and benefit of an activity. The optimal choice…

Q: The Sydney Transportation Company operates an urban bus system in New South Wales, Australia.…

A: Elasticity of demand is the responsiveness of the quantity demanded of a product to changes in one…

Q: (a). The following information is given about country X and Y Indicators Life Expectancy at Birth…

A: Human Development Index: Human Development Index or HDI determines the rank of nations by using a…

Q: The Weibracht Corporation designs and manufactures custom beer steins for some of the numerous brew…

A: To find the profit-maximizing price, we first have to find the profit-maximizing quantity.…

Q: The table below shows some macroeconomic data for the economy of Langhorne. GDP values are in…

A: Okun's Law is given as:Y¯ - YY¯ = c(u - u¯)Y¯ : Potential OutputY : Actual outputu : unemployment…

Q: A company sells one of its products for $42 each. The monthly fixed costs are $2700. The marginal…

A: Given information: A company sells its product for $42 each => P = $42 -------------------------…

Q: ind the equilibrium price ratio and calculate the consumers’ demand for each of the two goods…

A: Both utility functions are perfect substitutes. Hence, consumer is willing to spend all her income…

Q: Quantity Price Original $ $ New Average $ Change Percentage Change Step 1: Fill in the appropriate…

A: Price elasticity of demand measures the responsiveness of demand resulting from change in price.

Q: Doyle and Samphantharak (2008) find that when a 5% gas tax is implemented, prices consumers pay for…

A: Elasticity of demand The demand elasticity is the proportional change in the quantity required as a…

Q: what are four different factors that would increase a bonds price, but not by interest rates or…

A: Bonds and interest rates have an inverse relationship, meaning that when interest rates rise, bond…

Q: What are the implications of imbalances between injections and leakages?

A: In an economy, injections refer to the total amount of spending that enters the economy, while…

Q: It must be answered in a maximum of five sentences only. Is being trapped within the processes…

A: The process of greater interdependence and interconnection across nations, economies, and…

Q: 3. sider a market in which a monopolist would charge at a price of $10 for a particular good. Assume…

A: Bertrand duopoly is a market structure in which two firms produce identical goods and compete on…

Q: 4.8 Two of the simplest utility functions are: 1. Fixed proportions: U(x, y) = min[x, y]. 2. Perfect…

A: Utility functions provide the level of utility that is attained by the consumer for the given…

Q: Select one or more: a. The trend growth rate over the period was around 2.14 % per annum. b. The…

A: The linear growth straight line shows a constant level of growth per year. if the actual growth…

Q: c) The consumers utility function is given by U(XY)-4X+3Y and the given bundle is X-3 and Y - 12. i)…

A:

Q: 4. Suppose that diffusion occurs via the "threshold" procedure in Beaman et al. (2018). N agents are…

A: In the "threshold" procedure for diffusion, an agent i can only become infected if a certain number…

Q: Which of the following is an example of capital as a factor of production?

A: Inputs used in the production of goods and services are known as factors of production. There are…

Q: The figure to the right illustrates the demand for taxi rides in a large city. Suppose the price per…

A: Price elasticity of demand measures the responsiveness of change in quantity demanded to change in…

Q: What is the purpose of citation in business research? Please use reference

A: Business research refers to the research done in the fields of management, business decisions, and…

Q: 2 COLD BREW VS. ICED COFFEE Lauren's preferences over cold brew, C, and iced coffee, I, are given by…

A:

Q: Assume that a steel company sold $152 million worth of steel, paid $64 million in wages, purchased…

A: National income is the total income obtained from all goods and services produced within a boundary…

Q: When sold for $790.00, a certain desktop has an annual supply of 129.5 million computers and an…

A: Given : P1=$790 S1=129.5 million D1=155.5 million P2=$865 S2=147.5 million D2=134.5 million To…

Q: The tables below show the aggregate demand and two aggregate supplies for the economy of Zandu.…

A: According to Neo-Classical theory, supply generates demand on its own. According to the neoclassical…

Q: Nominal GDP $550 560 576 586 5 604 The economy described in the table has experienced a Orising…

A: Real GDP is calculated based on the base year price. It is an inflation-adjusted calculation of the…

Q: Chapter 20, End of Chapter, WORKING WITH NUMBERS AND GRAPHS, Exercise 2 Fill in blanks A-D in the…

A: Utility is an economic term that is used to explain consumer's satisfaction from the consumption of…

Q: The table below shows national data for the economy of Westfall. Round your intermediate…

A: Inflation is the percentage in the value of the Wholesale Price Index on a year-to-year basis. It is…

Q: Subject: Islamic banking & applied finanace Q): What is the application of Istisna?

A: Istisna is a financing technique utilized in Islamic banking, which depends on the standards of…

In economics the concept of the time value of money (TVM) states that sum of money is worth presently compared to the same amount at a future date

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A study by the New York Federal Reserve Bank concludes that an engineering bachelor’s degree generates approximately a 15% return on investment over the course of a decade. Suppose the typical engineering student spends $15,000 per year for four years on his/her education. What extra annual return (in dollars) does the typical student realize during the 10 years following graduation? State your assumptions.What is the definition of internal rate of return (IRR)? If you expect the annual interest rates are much different in the next 10 years, would the IRR be the ideal measure? Why or why not?Suppose that annual income from a rental property is expected to start at$1,100 per year and decrease at a uniform amount of $50 each year after the first year for the 14-year expected life of the property. The investment cost is$8,600,and i is 7% per year. Is this a good investment? Assume that the investment occurs at time zero (now) and that the annual income is first received at EOY one. The present equivalent of the rental income equals $ . (Round to the nearest dollar

- Suppose that Anna's college education would cost around $500,000 when they enter college in 15 years. At present, She have $100,000 to invest.What annual interest must she earn on her investment to cover the costQs 15: Which one of the following statement regarding Factor of Production is correct? (a) It is the input that a firm uses in the production process. (b) It is the output which is produced in the production process. (c) It is the additional input that is required to achieve the maximum output. (d) It is the ratio of the output to that of the input of the production process.Suppose that you purchase a tractor for $170,000 and sell it in 10 years for $50,000. What is the annualized cost (capital recovery) if your required return on capital is 12%?

- Compute how much a business is worth if it is expected to generate cash flows to its owners of $0 for the next three years, $42,800 in three years, $60,000 in four years, then $85,000 per year for the subsequent U years (i.e., $85,000 per year after four years in the future and then continuing for the next U years until 4+U years into the future), and finally generates cash inflows to its owners of $100,000 per year thereafter forever (i.e., $100,000 forever after 4+U years), assuming that businesses with similar relevant risk have expected returns of 15%. U=44A large electronic retailer is considering the purchase of software that will minimize shipping expenses in its supply chain network. This software, including installation and training, would be a $10-million investment for the retailer. If the firm’s effective interest rate is 15% per year and the life of the software is four years, what annual savings in shipping expenses must there be to justify the purchase of the software?Suppose the maintenance for a piece of equipment costs P2,669 on year 1 and increases by 5.69% every year for 20 years. The value of money is 9.12%. What is the equivalent present cost over the time horizon? Write your final answer in two decimal places.

- Assume that your father is now 50 years old and plans to retire after 10 years from now. He is expected to live for another 25 years after retirement. He wants a fixed retirement income of Rs. 5,00,000 per annum. His retirement income will begin the day he retires, 10 years from today, and then he will get 24 additional payments annually. Your father has current savings of Rs. 10,00,000 and he expects to earn a return on his savings @ 10% p.a., annually compounding. How much (to the nearest of rupee) must your father save during each of next 10 years to meet his retirement goal?An environmentally friendly green home (99% air tight) costs about 8% more to construct than a conventional home. Most green homes can save 15% per year on energy expenses to heat and cool the dwelling. For a $250,000 conventional home, how much would have to be saved in energy expenses per year when the life of the home is 30 years and the interest rate is 10% per year? Assume the additional cost of a green home has no value at the end of 30 years.Suppose an individual places his money in a bank for a year then invests in apples for a year. Suppose the bank has an annual rate of 5%, compounded continuously. During the year in which the individual's money is in the bank, the apple grows in price from $1 to $1.25. Suppose its return doubles in the second year, when the individual's money is invested in the apples. He starts the first investment period with $100. How much money does he have after two years following the investment plan given above? Group of answer choices $105.1 $124.7 $154.4 $157.7