Assuming the tax cut of $245 billion, what is the total amount of taxes paid by the families in the $200,000 and over income bracket before the tax cut? What is the total amount of taxes paid by families in the $20,000 to $30,000 income bracket before the tax cut?

Assuming the tax cut of $245 billion, what is the total amount of taxes paid by the families in the $200,000 and over income bracket before the tax cut? What is the total amount of taxes paid by families in the $20,000 to $30,000 income bracket before the tax cut?

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter30: Government Budgets And Fiscal Policy

Section: Chapter Questions

Problem 38CTQ: Why is spending by the U.S. government on scientific research at NASA fiscal policy while spending...

Related questions

Question

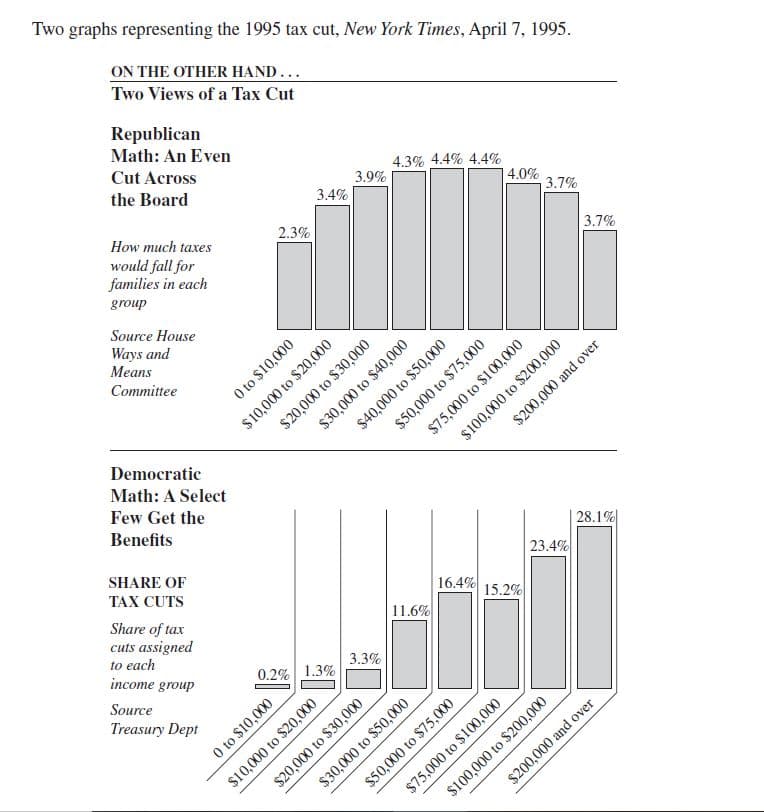

Assuming the tax cut of $245 billion, what is the total amount of taxes paid by

the families in the $200,000 and over income bracket before the tax cut? What

is the total amount of taxes paid by families in the $20,000 to $30,000 income

bracket before the tax cut?

Transcribed Image Text:Two graphs representing the 1995 tax cut, New York Times, April 7, 1995.

ON THE OTHER HAND…..

Two Views of a Tax Cut

Republican

Math: An Even

Cut Across

the Board

How much taxes

would fall for

families in each

group

Source House

Ways and

Means

Committee

Democratic

Math: A Select

Few Get the

Benefits

SHARE OF

TAX CUTS

Share of tax

cuts assigned

to each

income group

Source

Treasury Dept

2.3%

3.4%

0 to $10,000

$10,000 to $20,000

0.2% 1.3%

3.9%

$20,000 to $30,000

0 to $10,000

$10,000 to $20,000

3.3%

4.3% 4.4% 4.4%

$20,000 to $30,000

$30,000 to $40,000

11.6%

$30,000 to $50,000

4.0%

$40,000 to $50,000

$50,000 to $75,000

$75,000 to $100,000

16.4%

$50,000 to $75,000

$200,000 and over

$100,000 to $200,000

3.7%

15.2%

$75,000 to $100,000

23.4%

3.7%

28.1%

$200,000 and over

$100,000 to $200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning