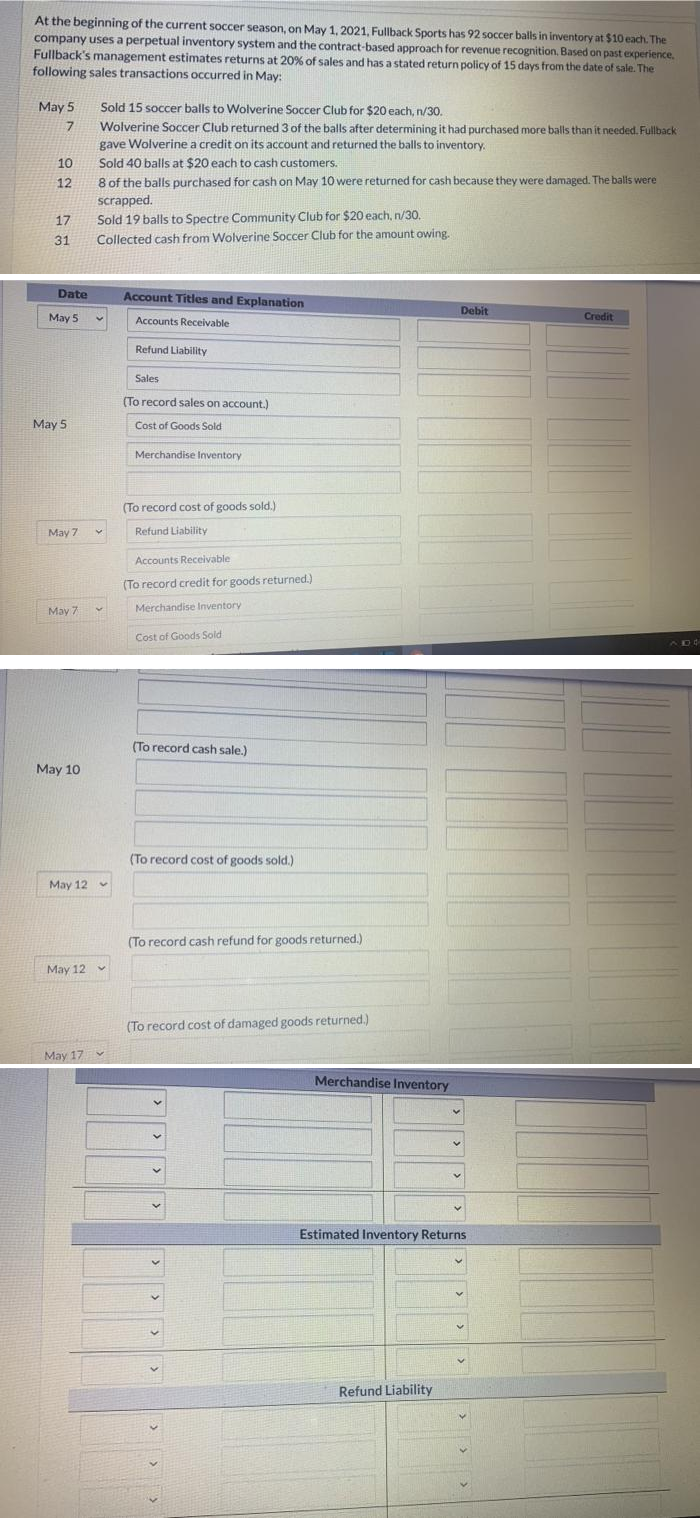

At the beginning of the current soccer season, on May 1, 2021, Fullback Sports has 92 soccer balls in inventory at $10 each. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. Based on past experience. Fullback's management estimates returns at 20% of sales and has a stated return policy of 15 days from the date of sale. The following sales transactions occurred in May:

At the beginning of the current soccer season, on May 1, 2021, Fullback Sports has 92 soccer balls in inventory at $10 each. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. Based on past experience. Fullback's management estimates returns at 20% of sales and has a stated return policy of 15 days from the date of sale. The following sales transactions occurred in May:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

Transcribed Image Text:At the beginning of the current soccer season, on May 1, 2021, Fullback Sports has 92 soccer balls in inventory at $10 each. The

company uses a perpetual inventory system and the contract-based approach for revenue recognition. Based on past experience.

Fullback's management estimates returns at 20% of sales and has a stated return policy of 15 days from the date of sale. The

following sales transactions occurred in May:

May 5

Sold 15 soccer balls to Wolverine Soccer Club for $20 each, n/30.

7.

Wolverine Soccer Club returned 3 of the balls after determining it had purchased more balls than it needed. Fullback

gave Wolverine a credit on its account and returned the balls to inventory.

10

Sold 40 balls at $20 each to cash customers.

12

8 of the balls purchased for cash on May 10 were returned for cash because they were damaged. The balls were

scrapped.

Sold 19 balls to Spectre Community Club for $20 each, n/30.

17

31

Collected cash from Wolverine Soccer Club for the amount owing.

Date

Account Titles and Explanation

Debit

May 5

Accounts Receivable

Credit

Refund Liability

Sales

(To record sales on account.)

May 5

Cost of Goods Sold

Merchandise Inventory

(To record cost of goods sold.)

May 7

Refund Liability

Accounts Receivable

(To record credit for goods returned.)

May 7

Merchandise Inventory

Cost of Goods Sold

(To record cash sale.)

May 10

(To record cost of goods sold.)

May 12

(To record cash refund for goods returned.)

May 12

(To record cost of damaged goods returned.)

May 17 v

Merchandise Inventory

Estimated Inventory Returns

Refund Liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College