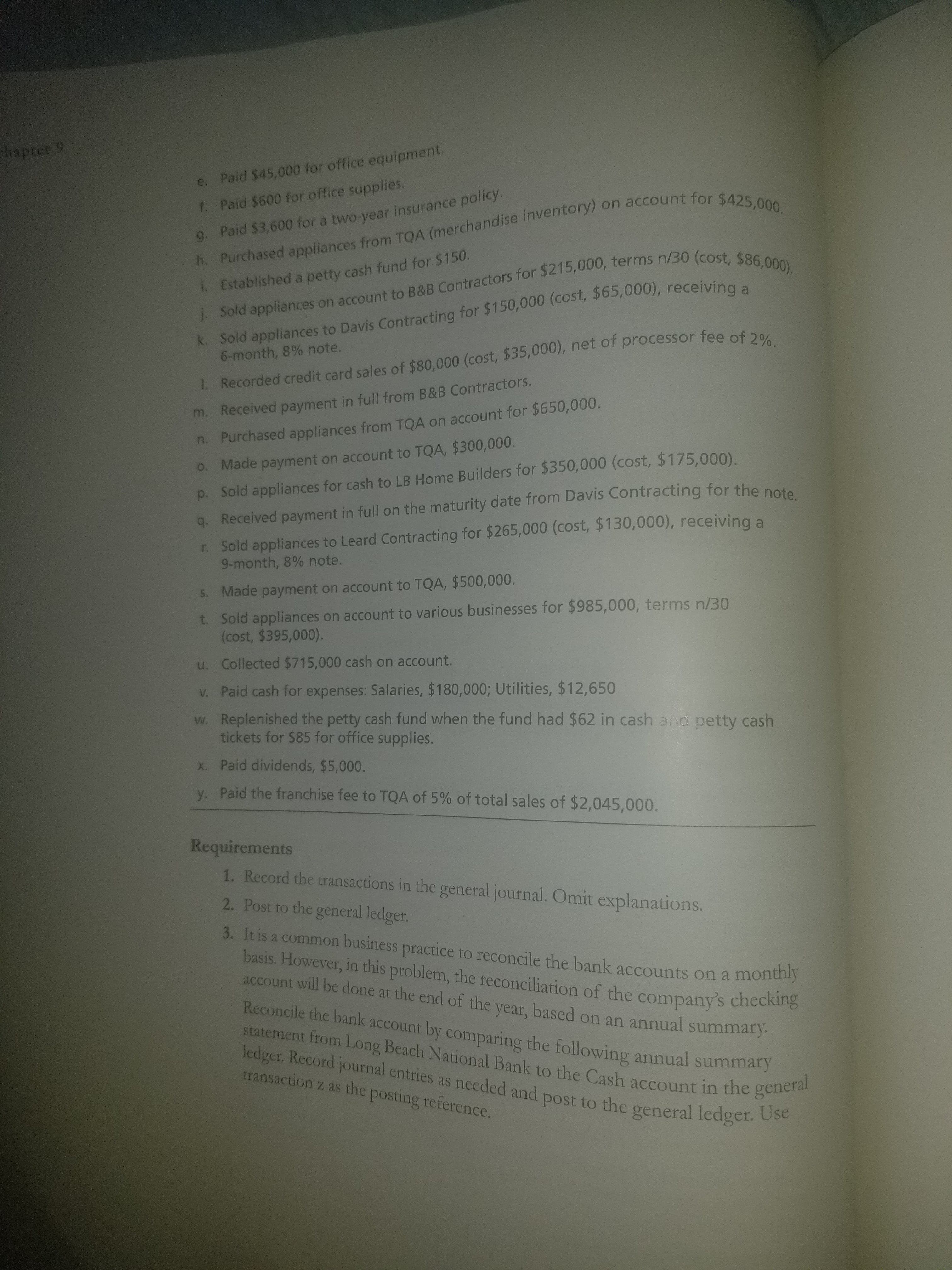

e. Paid $45,000 for office equipment f. Paid $600 for office supplies 9. Paid $3,600 for a two-year insurance polic h. Purch . Established a petty cash fund for $150. i. Sold applia k. Sold appliances to Davis Contracting for 5 (merchandise inventory) on account for $425 ased appliances from TQA ), nces on account to B&B Contractors for $215,000, terms tracting for $150,000 (cost, $65,00o), receiving a 6-month, 8% note. l. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2% m. Received payment in full from B&B Contractors. n. Purchased appliances from TQA on account for $650,000. o. Made payment on account to TQA, $300,000. p. Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000) . Received payment in full on the maturity date from Davis Contracting for the note r. Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. s. Made payment on account to TQA, $500,000 t. Sold appliances on account to various businesses for $985,000, terms n/30 (cost, $395,000) u. Collected $715,000 cash on account. v. Paid cash for expenses: Salaries, $180,000; Utilities, $12,650 w. Replenished the petty cash fund when the fund had $62 in cash ae petty cash tickets for $85 for office supplies x. Paid dividends, $5,000. y, paid the franchise fee to TQA of 5% of total sales of $2,045,000. Requirements 1. Record the transactions in the general journal. Omit explanations. 2. Post to the general ledger. 3. It is a common business practice to reconcile the bank accounts on a monthly basis. However,in this problem, the reconcliation of the company's checking account will be done at the end of the year, based on an annual summary Reconcile the bank account by comparing the following a statement from Long Beach National Bank to the Cash account ledget. Record journal entries as needed and post to the gener transaction z as the posting reference. nnual summary in the general al ledger. Use

e. Paid $45,000 for office equipment f. Paid $600 for office supplies 9. Paid $3,600 for a two-year insurance polic h. Purch . Established a petty cash fund for $150. i. Sold applia k. Sold appliances to Davis Contracting for 5 (merchandise inventory) on account for $425 ased appliances from TQA ), nces on account to B&B Contractors for $215,000, terms tracting for $150,000 (cost, $65,00o), receiving a 6-month, 8% note. l. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2% m. Received payment in full from B&B Contractors. n. Purchased appliances from TQA on account for $650,000. o. Made payment on account to TQA, $300,000. p. Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000) . Received payment in full on the maturity date from Davis Contracting for the note r. Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. s. Made payment on account to TQA, $500,000 t. Sold appliances on account to various businesses for $985,000, terms n/30 (cost, $395,000) u. Collected $715,000 cash on account. v. Paid cash for expenses: Salaries, $180,000; Utilities, $12,650 w. Replenished the petty cash fund when the fund had $62 in cash ae petty cash tickets for $85 for office supplies x. Paid dividends, $5,000. y, paid the franchise fee to TQA of 5% of total sales of $2,045,000. Requirements 1. Record the transactions in the general journal. Omit explanations. 2. Post to the general ledger. 3. It is a common business practice to reconcile the bank accounts on a monthly basis. However,in this problem, the reconcliation of the company's checking account will be done at the end of the year, based on an annual summary Reconcile the bank account by comparing the following a statement from Long Beach National Bank to the Cash account ledget. Record journal entries as needed and post to the gener transaction z as the posting reference. nnual summary in the general al ledger. Use

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5PA: Inner Resources Company started its business on April 1, 2019. The following transactions occurred...

Related questions

Question

100%

I need this( https://www.chegg.com/homework-help/top-quality-appliance-long-beach-purchased-franchise-top-qua-chapter-9-problem-1cpp-solution-9780134486833-exc ) problem solved for requirment 1 only. I can not apload more than one picture thats why I send half of it from website and other half in picture. Thank you.

Transcribed Image Text:e. Paid $45,000 for office equipment

f. Paid $600 for office supplies

9. Paid $3,600 for a two-year insurance polic

h. Purch

. Established a petty cash fund for $150.

i. Sold applia

k. Sold appliances to Davis Contracting for 5

(merchandise inventory) on account for $425

ased appliances from TQA

),

nces on account to B&B Contractors for $215,000, terms

tracting for $150,000 (cost, $65,00o), receiving a

6-month, 8% note.

l. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%

m. Received payment in full from B&B Contractors.

n. Purchased appliances from TQA on account for $650,000.

o. Made payment on account to TQA, $300,000.

p. Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000)

. Received payment in full on the maturity date from Davis Contracting for the note

r. Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a

9-month, 8% note.

s. Made payment on account to TQA, $500,000

t. Sold appliances on account to various businesses for $985,000, terms n/30

(cost, $395,000)

u. Collected $715,000 cash on account.

v. Paid cash for expenses: Salaries, $180,000; Utilities, $12,650

w. Replenished the petty cash fund when the fund had $62 in cash ae petty cash

tickets for $85 for office supplies

x. Paid dividends, $5,000.

y, paid the franchise fee to TQA of 5% of total sales of $2,045,000.

Requirements

1. Record the transactions in the general journal. Omit explanations.

2. Post to the general ledger.

3. It is a common business practice to reconcile the bank accounts on a monthly

basis. However,in this problem, the reconcliation of the company's checking

account will be done at the end of the year, based on an annual summary

Reconcile the bank account by comparing the following a

statement from Long Beach National Bank to the Cash account

ledget. Record journal entries as needed and post to the gener

transaction z as the posting reference.

nnual summary

in the general

al ledger. Use

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT