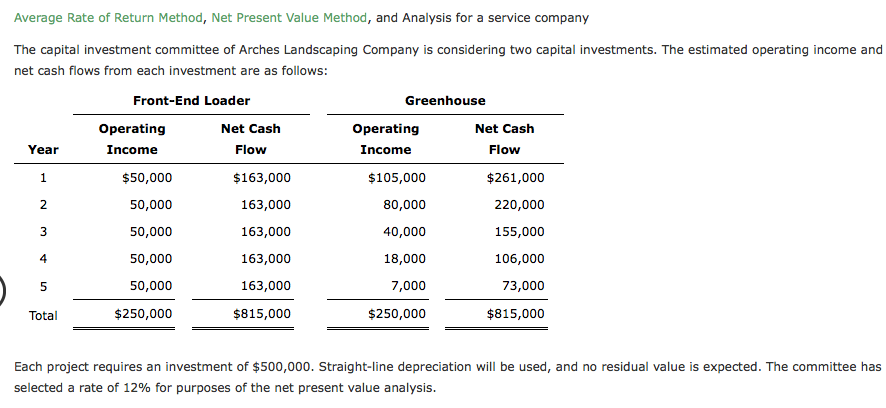

Average Rate of Return Method, Net Present Value Method, and Analysis for a service company The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Front-End Loader Greenhouse Operating Net Cash Operating Net Cash Year Income Flow Income Flow $50,000 $163,000 $105,000 $261,000 2 50,000 163,000 80,000 220,000 3 50,000 163,000 40,000 155,000 4 50,000 163,000 18,000 106,000 50,000 163,000 7,000 73,000 Total $250,000 $815,000 $250,000 $815,000 Each project requires an investment of $500,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis.

Average Rate of Return Method, Net Present Value Method, and Analysis for a service company The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Front-End Loader Greenhouse Operating Net Cash Operating Net Cash Year Income Flow Income Flow $50,000 $163,000 $105,000 $261,000 2 50,000 163,000 80,000 220,000 3 50,000 163,000 40,000 155,000 4 50,000 163,000 18,000 106,000 50,000 163,000 7,000 73,000 Total $250,000 $815,000 $250,000 $815,000 Each project requires an investment of $500,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1PA: Average rate of return method, net present value method, and analysis for a service company The...

Related questions

Question

Average

Transcribed Image Text:Average Rate of Return Method, Net Present Value Method, and Analysis for a service company

The capital investment committee of Arches Landscaping Company is considering two capital investments. The estimated operating income and

net cash flows from each investment are as follows:

Front-End Loader

Greenhouse

Operating

Net Cash

Operating

Net Cash

Year

Income

Flow

Income

Flow

$50,000

$163,000

$105,000

$261,000

2

50,000

163,000

80,000

220,000

3

50,000

163,000

40,000

155,000

4

50,000

163,000

18,000

106,000

50,000

163,000

7,000

73,000

Total

$250,000

$815,000

$250,000

$815,000

Each project requires an investment of $500,000. Straight-line depreciation will be used, and no residual value is expected. The committee has

selected a rate of 12% for purposes of the net present value analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning