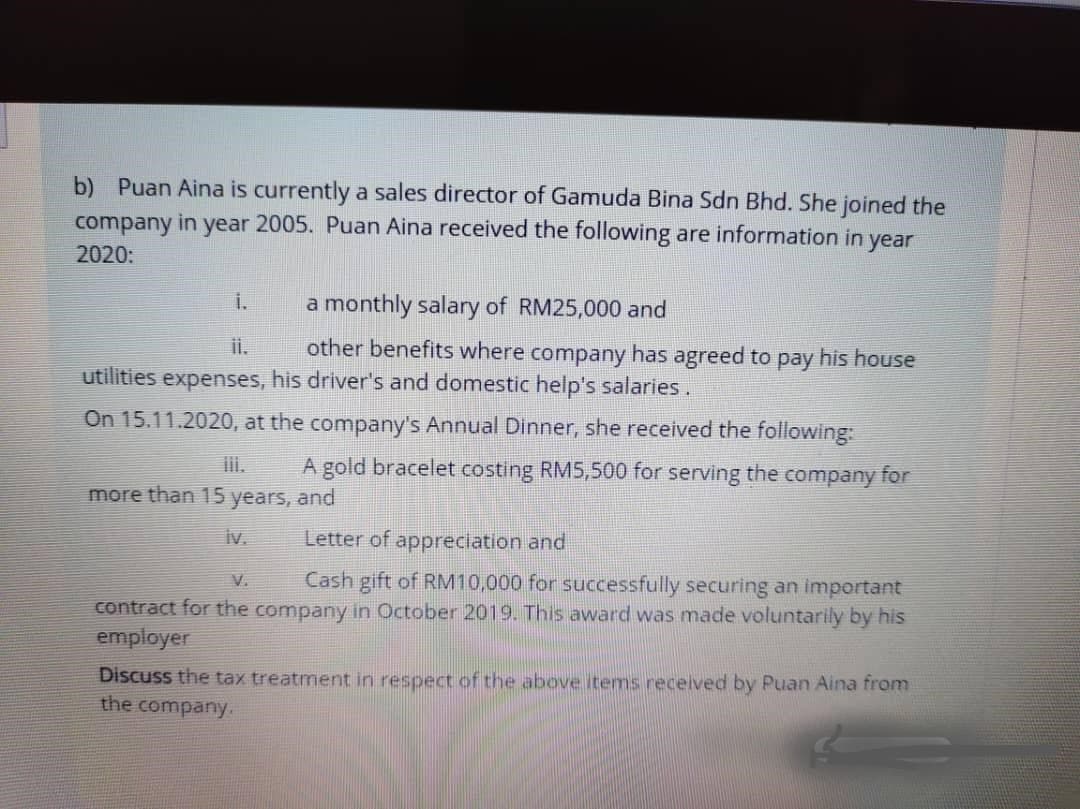

b) Puan Aina is currently a sales director of Gamuda Bina Sdn Bhd. She joined the company in year 2005. Puan Aina received the following are information in year 2020: i. a monthly salary of RM25,000 and ii. other benefits where company has agreed to pay his house utilities expenses, his driver's and domestic help's salaries. On 15.11.2020, at the company's Annual Dinner, she received the following: ii. A gold bracelet costing RM5,500 for serving the company for more than 15 years, and iv. Letter of appreciation and Cash gift of RM10,000 for successfully securing an important V. contract for the company in October 2019. This award was made voluntarily by his employer Discuss the tax treatment in respect of the above items received by Puan Aina from the company

b) Puan Aina is currently a sales director of Gamuda Bina Sdn Bhd. She joined the company in year 2005. Puan Aina received the following are information in year 2020: i. a monthly salary of RM25,000 and ii. other benefits where company has agreed to pay his house utilities expenses, his driver's and domestic help's salaries. On 15.11.2020, at the company's Annual Dinner, she received the following: ii. A gold bracelet costing RM5,500 for serving the company for more than 15 years, and iv. Letter of appreciation and Cash gift of RM10,000 for successfully securing an important V. contract for the company in October 2019. This award was made voluntarily by his employer Discuss the tax treatment in respect of the above items received by Puan Aina from the company

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:b) Puan Aina is currently a sales director of Gamuda Bina Sdn Bhd. She joined the

in

year 2005. Puan Aina received the following are information in year

company

2020:

i.

a monthly salary of RM25,000 and

ii.

other benefits where company has agreed to pay his house

utilities expenses, his driver's and domestic help's salaries.

On 15.11.2020, at the company's Annual Dinner, she received the following:

iii.

A gold bracelet costing RM5,500 for serving the company for

more than 15 years, and

iv.

Letter of appreciation and

Cash gift of RM10,000 for successfully securing an important

V.

contract for the company in October 2019. This award was made voluntarily by his

employer

Discuss the tax treatment in respect of the above items received by Puan Aina from

the company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education