Bankruptcy Risk and Z-Score Analysis Following are selected ratios for Logitech International SA for the company's 2019 fiscal year. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. in thousands (except price per share and shares outstanding) Current assets $1,350,436 EBIT $263,194 Current liabilities $455,815 Total liabilities $538,343 Total assets $1,285,319 Sales revenue $1,770,584 Retained earnings 165,862,887 $1,365,036 Shares outstanding $39.34 Price per share Compute and interpret the Altman Z-score. Note: Convert shares outstanding to "in thousands" for your computation. Z-score

Bankruptcy Risk and Z-Score Analysis Following are selected ratios for Logitech International SA for the company's 2019 fiscal year. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. in thousands (except price per share and shares outstanding) Current assets $1,350,436 EBIT $263,194 Current liabilities $455,815 Total liabilities $538,343 Total assets $1,285,319 Sales revenue $1,770,584 Retained earnings 165,862,887 $1,365,036 Shares outstanding $39.34 Price per share Compute and interpret the Altman Z-score. Note: Convert shares outstanding to "in thousands" for your computation. Z-score

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 88PSA: Ratio Analysis Consider the following information taken from the stockholders equity section: How do...

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

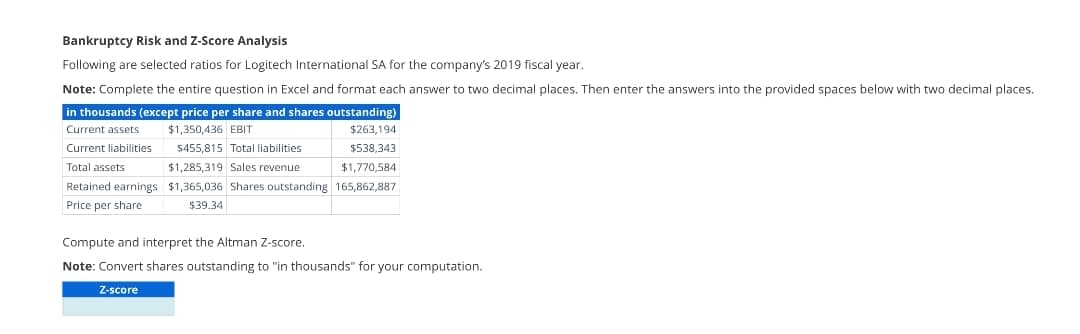

Transcribed Image Text:Bankruptcy Risk and Z-Score Analysis

Following are selected ratios for Logitech International SA for the company's 2019 fiscal year.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

in thousands (except price per share and shares outstanding)

Current assets

$1,350,436 EBIT

$263,194

$455,815 Total liabilities

$538,343

Current liabilities

Total assets

$1,285,319 Sales revenue

$1,770,584

$1,365,036 Shares outstanding 165,862,887

$39.34

Retained earnings

Price per share

Compute and interpret the Altman Z-score.

Note: Convert shares outstanding to "in thousands" for your computation.

Z-score

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning