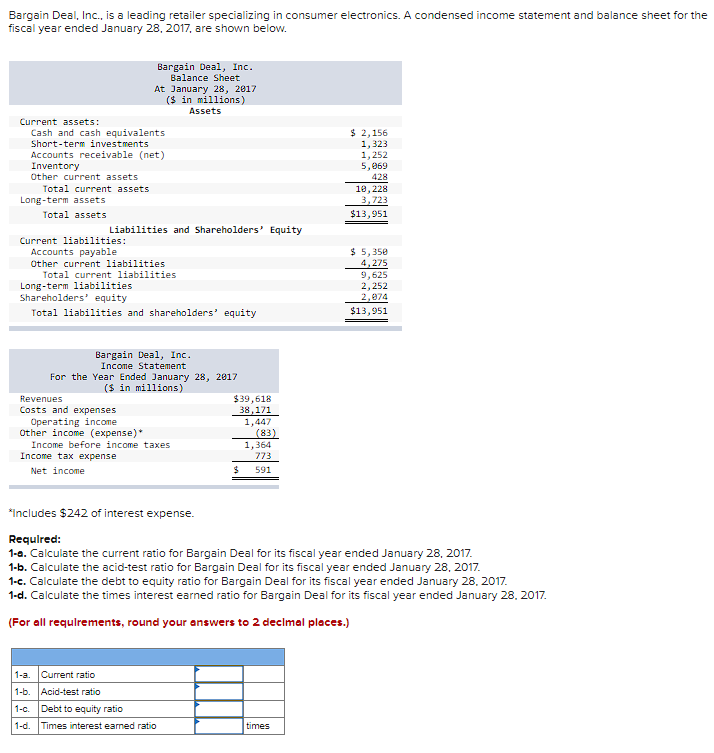

Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below. Current assets: Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets Long-term assets Total assets Bargain Deal, Inc. Balance Sheet At January 28, 2017 ($ in millions) Assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities. Long-term liabilities Shareholders' equity Total liabilities and shareholders' equity Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 ($ in millions) Revenues Costs and expenses Operating income Other income (expense)* Income before income taxes Income tax expense Net income $39,618 38,171 1,447 $ (83) 1,364 773 591 $ 2,156 1,323 1,252 5,069 428 10,228 3,723 $13,951 $ 5,350 4,275 9,625 2,252 2,074 $13,951 *Includes $242 of interest expense. Required: 1-6. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017. (For all requirements, round your answers to 2 decimal places.)

Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below. Current assets: Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets Long-term assets Total assets Bargain Deal, Inc. Balance Sheet At January 28, 2017 ($ in millions) Assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities. Long-term liabilities Shareholders' equity Total liabilities and shareholders' equity Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 ($ in millions) Revenues Costs and expenses Operating income Other income (expense)* Income before income taxes Income tax expense Net income $39,618 38,171 1,447 $ (83) 1,364 773 591 $ 2,156 1,323 1,252 5,069 428 10,228 3,723 $13,951 $ 5,350 4,275 9,625 2,252 2,074 $13,951 *Includes $242 of interest expense. Required: 1-6. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017. 1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017. (For all requirements, round your answers to 2 decimal places.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

Transcribed Image Text:Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the

fiscal year ended January 28, 2017, are shown below.

Current assets:

Cash and cash equivalents

Short-term investments

Accounts receivable (net)

Inventory

Other current assets

Total current assets.

Long-term assets

Total assets

Bargain Deal, Inc.

Balance Sheet

At January 28, 2017

($ in millions)

Assets

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable

Other current liabilities

Total current liabilities

Long-term liabilities

Shareholders' equity

Total liabilities and shareholders' equity

Bargain Deal, Inc.

Income Statement

For the Year Ended January 28, 2017

($ in millions)

Revenues

Costs and expenses

Operating income

Other income (expense)*

Income before income taxes

Income tax expense

Net income

Current ratio

1-a.

1-b. Acid-test ratio

1-c. Debt to equity ratio

1-d.

$39,618

38,171

1,447

Times interest earned ratio

$

(83)

1,364

773

591

$ 2,156

1,323

1,252

5,069

428

18, 228

3,723

$13,951

*Includes $242 of interest expense.

Required:

1-a. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017.

1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017.

(For all requirements, round your answers to 2 decimal places.)

times

$ 5,350

4,275

9,625

2,252

2,074

$13,951

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning