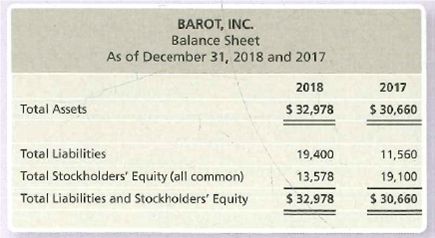

BAROT, INC. Balance Sheet As of December 31, 2018 and 2017 2018 2017 Total Assets $ 32,978 $ 30,660 Total Liabilities 19,400 11,560 Total Stockholders' Equity (all common) 13,578 19,100 Total Liabilities and Stockholders' Equity $ 32,978 $ 30,660

Q: Calculate each of following ratios for year 2017 using the financial statement in Table 1-3.…

A: Hi Student Since there are multiple sub parts, we will answer only first three subparts. If you…

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 Sales…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: The 2017 annual report of Tootsie Roll Industries contains the following information. (in…

A: Since multiple subparts were posted, only the first three sub-parts will be answered.

Q: Calculating trend analysis Muscateer Corp. reported the following revenues and net income amounts:…

A: Trend analysis for revenue = Current year revenue / base year revenue

Q: Birtle Corporation reports the following statement of financial position information for 2017 and…

A: Source or use of cash - Source or uses of cash means the increase or decrease in Assets or…

Q: a. What was net operating working capital for 2017 and 2018? Assume the firm has noexcess cash.b.…

A: a) Computation:

Q: Financial statement analysis The financial statements of Zach Industries for the year ended December…

A: In order to determine the time's interest earned ratio, the Earning before interest and taxed (EBIT)…

Q: Return on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial…

A: Return on Assets (ROA): This financial ratio evaluates a company's efficiency in operating the…

Q: The formula for determining the rate earned on total assets is Net Income + Interest Expense/Average…

A: Rate earned on total assets = (Net Income + Interest Expense)/Average Total Assets.

Q: Performing horizontal analysis Verifine Corp reported the following on its comparative income…

A: Gross Profit = Revenue - Cost of Goods sold

Q: Selected balance sheet and income statement information for Home Depot follows. $ millions Jan. 31,…

A: Formulas to be used are as follows Return on net operating assets Net Income/ Average net operating…

Q: Return on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial…

A: First, there is a need to calculate average total assets:

Q: Selected balance sheet and income statement information from Illinois Tool Works follows. $…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Presented below is a condensed version of the comparative balance sheets for Bramble Corporation for…

A: The comparative balance sheets for Bramble Corporation for the last two years at December 31.…

Q: The current sections of Teal Mountain Inc.’s balance sheets at December 31, 2016 and 2017, are…

A: Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and…

Q: Calculate each of following ratios for year 2017 using the financial statement in Table 1-3. Total…

A: Following are the requisite Ratios

Q: Calculating trend analysis Muscateer Corp reported the following revenues and net income amounts:…

A: Requirement 1: Compute the trend in revenue.

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 $3,432,000…

A: Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the…

Q: The current sections of Bridgeport Corp.'s balance sheets at December 31, 2016 and 2017, are…

A: Statement of cash flows: It is one of the financial statement that shows the cash and cash…

Q: Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois…

A: It is a multi part quesion and we assume to answer only three part here but here only 2 part but in…

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 Sales…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: Contrast the company's 2019 financial ratios with the financial ratios presented by the industry.…

A: Quick Assets = Total Current Assets - Inventory - Prepaid Expenses =…

Q: Calculate each of following ratios for year 2017 using the financial statement in Table 1-3.…

A: Hi student Since there are multiple sub parts, we will answer only first three sub parts. If you…

Q: (Balance Sheet Adjustment and Preparation) Presented below is the balance sheet of Sargent…

A: Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the…

Q: Use the following information to answer this question. Bayside, Inc. 2017 Income Statement ($ in…

A: The return on equity (ROE) measure is calculated by dividing net income by shareholders' equity or…

Q: Complete the below table to calculate the balance sheet data in trend percents with 2017 as base…

A: The balance sheet data in trend percentage forms provides the comparison of assets and liabilities…

Q: Pretty Co.'s total liabilities and equity amounted to $285,000 for year 2018. The financial…

A: Formula: Accounting Equation: Assets = Liabilities + Owners equity

Q: he following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: Quick ratio = Quick Assets / Current liabilities

Q: Forecast an Income Statement Seagate Technology reports the following income statement for fiscal…

A: Income statement: Under this Statement showing the company’s performance over a period of time by…

Q: Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois…

A: RNOA=Net operating profit after tax (NOPAT)Average Net operating profit after tax (NOA)×100ROA=Net…

Q: Gildan Activewear Inc. reported the following selected financial information (all in U.S. $…

A: The asset turnover ratio assesses a company's assets' ability to create income or sales. Net sales…

Q: Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois…

A: Answer A Return on Net Operating Assets Net operating profit after tax / Average Net operating…

Q: Preparing the statement of cash flows—indirect method with non-cash transactions The 2018 income…

A: Prepare the statement of cash flows:

Q: Lan & Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dollars)…

A: "Hello student! Since there are multiple sub-parts posted, we will answer the first three sub-parts.…

Q: Selected balance sheet and income statement information from Illinois Tool Works follows. $…

A: RNOA=Net operating profit after tax Total Assets×100 RNOA (2019)=$9,224$15,671×100=58.9% RNOA…

Q: Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois…

A: a. Return on Net Operating Assets (RNOA) = Net operating profit after taxAverage net operating…

Q: Gildan Activewear Inc. reported the following selected financial information (all in U.S. $…

A: Ratio analysis is the technique used to analyze the financial health of the company. Different…

Q: a. Calculate the firm's current and quick ratios for each year. Compare the resulting time series…

A: Hello, since the student has posted multiple requirements, only the first one is answerable. Thank…

Q: Compute for the Current ratio for 2017, Interest Coverage ratio, Profit margin or Return on Sales…

A: Current ratio for 2017 Current Assets/ Current Liabilities 2588000/640000 4.04

Q: Using the fiscal year end 2019 annual report for General Mills, Inc. and the figures from the 2017…

A: "Since you have asked multiple sub part question we will solve the first three sub part question for…

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 $3,432,000…

A: Introduction: Income statement: All revenues and expenses are recorded in Income statement. It tells…

Q: KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets…

A: We have the following information:

Q: Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois…

A: Adjusted equity = Unadjusted equity + Treasury stock Adjusted total assets = Unadjusted assets…

Q: Return on Assets Ratio and Asset Turnover Ratio United Systems reported the following financial data…

A: Generally, the assets turnover is calculated by dividing the net sales by average total assets. In…

Q: Use the following information to answer this question. Windswept, Inc. 2017 Income Statement ($…

A: Equity multiplier is a ratio calculated to use see the company used it for how much assets are used…

Q: Forecast the Balance Sheet Following is the balance sheet for Medtronic PLC for the year ended…

A: The forecasting of a balance sheet permits independent ventures to perceive what they're probably…

Q: Filling in the missing values

A: Step1: Calculating the value of account payable for the year 2017. We have,Free Cash Flow = Earnings…

Computing

Barot’s 2018 financial statements reported the following items—with 2017 figures given for comparison:

Net income for 2018 was $3,910, and interest expense was $240. Compute Barot’s rate of return on total assets for 2018. (Round to the nearest percent.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Gray Company lists the following shareholders equity items on its December 31, 2018, balance sheet: The following stock transactions occurred during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 225,000).

- Using the following Company X information, prepare a Retained Earnings Statement: Retained earnings balance January 1, 2019, $121,500 Net income for year 2019, $145,800 Dividends declared and paid for year 2019, $53,000Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Included in the December 31, 2018, Jacobi Company balance sheet was the following shareholders equity section: The company engaged in the following stock transactions during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 270,000).Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.

- Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Comprehensive The shareholders equity section of Superior Corporations balance sheet as of December 31, 2018, is as follows: The following events occurred during 2019: Required: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior's legal capital at December 31, 2019.Statement of stockholders equity The stockholders equity T accounts of I-Cards Inc. for the year ended December 31, 20Y9, are as follows. Prepare a statement of stockholders equity for the year ended December 31, 20Y9.