Q: profit of a firm if a debenture is issued at

A: A debenture is said to be issued at a premium when the price charged is more than its nominal…

Q: Each answer choice illustrates the relationship among Debt/Equity, rs, rd(1-T), and WACC for a…

A: Weighted Average Cost of Capital(WACC) is average cost of financing the given capital structure of…

Q: D4) Of the following 4 firms, which one should have the highest dividend payout ratio? Group of…

A: The entity pays out higher dividend when the entity has no alternative investment option which can…

Q: (D/D+E)kd(1-T) + (E/D+E)k2 is also known as

A: The answer and the explanation is provided below:

Q: May I ask for a solution and explanation to the problem for a better understanding. Thank you! For…

A: The dividend payout ratio shows the proportion of total earnings of the company distributed among…

Q: Question 14 Your company has compiled the following data which is based on current costs relative to…

A: The weighted average cost of capital (WACC) is a method for assessing a company's cost of capital…

Q: Adams Inc. has the following data: rRF = 4.00%; RPM = 7.00%; and b = 1.20. What is the firm's cost…

A: Cost of common equity Using CAPM Formula Risk free rate + ( Market rate…

Q: Book value versus market value components. The CFO of DMI is trying to determine the company's WACC.…

A: WACC =Cost of equity×Weight of equity +After tax cost of debt × Weight of debt +Cost of preferred…

Q: You are looking to purchase Company A. Your projections for the EBITDA of Company A are as Follows:…

A: Value of a company Based on EBITDA and EBITDA multiple, the value of firm or enterprise is…

Q: Assume that you are a consultant to Broske Inc., and you have been provided with the following data:…

A: Next dividend (D1) = $0.80 Current price (P0) = $32.50 Growth rate (G) = 8.00% Formula Cost of…

Q: What is the comparison of Returned on Invested Capital between Alex Company and the industry…

A: Return on investment means the method used to estimate the efficiency or the profitability of the…

Q: ANSWER ALL. PLEASE SHOW YOUR WORKING SOLUTIONS WITHOUT USING EXCEL. 1) Based on current market…

A: As per the Q&A policy, an expert can answer only 1 question if multiple questions are asked.…

Q: 9. Determining the optimal capital structure Aa Aa Understanding the optimal capital structure…

A: The optimum Capital Structure of a firm is the best mix of debt and equity financing that…

Q: be 1%. Find out the cost of capital of debentures given that the firm has 50% tax rate. 9:17 E

A: Calculation of cost of capital are as follows:

Q: ssuming yourself to be Anna, narrate what you would have read in the file. Your narrative should…

A: Given: EBIT = $15,000,000 Interest = $5,000,000 Tax Rate - 34% Number of shares outstanding =…

Q: Aa Understanding the optimal capital structure Review this situation: Universal Exports Inc. is…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Instructions: Assume the following data for two firms (U = unlevered firm) and (L = levered firm).…

A: Leverage means borrowing money for increasing investment. Leverage is used to enhance the overall…

Q: Calculate the following values:a) Value of Unlevered Firm Assuming that there is an unlevered firm…

A: The formula to calculate value of unlevered firm is given below:

Q: TTa construction company does not have work lined up in the future then they do not have a QUESTION…

A: The answers for the given questions are as follows

Q: Simple ROI Calculations: Fill out the blanks: Div A Div B Div C Income percentage Capital turnover…

A: Hi student Since there are multiple questions, we will answer only first question that is 9.18

Q: Calculate the value of the levered firm based on: Assuming that there is an unlevered firm and a…

A: The debt for levered firm is calculated below:

Q: Financial Plan Components Cost Weights Weighted Cost A Debt 7.15% ? ? A Equity 5.15%…

A: WACC = We*Ke+Wd*Kd W is weight K is cost e is equity and d is debt

Q: if A firm's current balance sheet is as follows: Assets $100…

A:

Q: Assume that you are a consultant to Broske Inc., and you have been provided with the following data:…

A: The rate of return that is expected by investors on their equity investment is term as the cost of…

Q: find the Tobin's q.

A: The Q Ratio, or Tobin’s Q Ratio, is a ratio between a physical asset’s market value and its…

Q: Question 14 Your company has compiled the folowing data which is based on cument costs reiative to…

A: The weighted average cost of capital The weighted average cost of capital refers to a method for…

Q: You are a finance intern at Chambers and Sons and they have asked you to help estimate the company's…

A: given, D1 = $2.00 P0 = $27.00 g = 4.00% (constant) F = 5.00%

Q: Answer the following questions with SOLUTIONS. Pls choose only the answer in the choices. Q1.What…

A: As given The following financial data is being prepared by Gising Company for presentation to…

Q: Understanding the optimal capital structure Review this situation: Universal Exports Inc. is…

A: A company needs capital to run its business. This is raised by way of debt and equity each of which…

Q: Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company…

A: As per CAPM ,Required return=Risk free rate +Beta x market risk premium

Q: 4. CMD Asset Management has the following fee structure for clients in its equity fund: 1.00% of…

A: a. The annual dollar fees paid by client 1 is calculated below:

Q: D3) Finance Discuss optimal hedging strategies for an AAA-rated firm and a BBB-

A: AAA refers to the highest rating that can be given to the bond of an issuer by the credit rating…

Q: ____ determines the ultimate distribution of the firm’s earnings between reinvestment and cash…

A: Q30: Dividend policy determines the ultimate distribution of the firm’s earnings between…

Q: ER ALL. PLEASE SHOW YOUR WORKING SOLUTIONS. 1) Based on current market values, Shawn Supply's…

A: Given information : Market weights Debt 30% Equity 50% Preferred 20% Cost of capital…

Q: Review this situation: Universal Exports Inc. is trying to identify its optimal capital structure.…

A: Optimum capital structure is where minimizing the weighted average cost of capital (WACC) and…

Q: Book value versus market value components. The CFO of DMI is trying to determine the company's WACC.…

A: GIVEN, cost of debt (Kd) after tax= 8.2% cost of preferred stock (Kp)= 12.98% cost of equity (Ke) =…

Q: a) value of unlevered firm; b) value of the levered firm;

A: Modigliani - Miller approach (MM) theory introduced a theory based on the capital structure. This…

Q: O'Brien Inc. has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.70. What is the firm's cost…

A: In this problem we need to find out firm's cost of equity from retained earnings based on the CAPM.

Q: May I ask for an explanation and solution to the question for a better understanding. Thank you!…

A: Return on equity is net income divided by total equity.Total equity is sum of ordinary shares and…

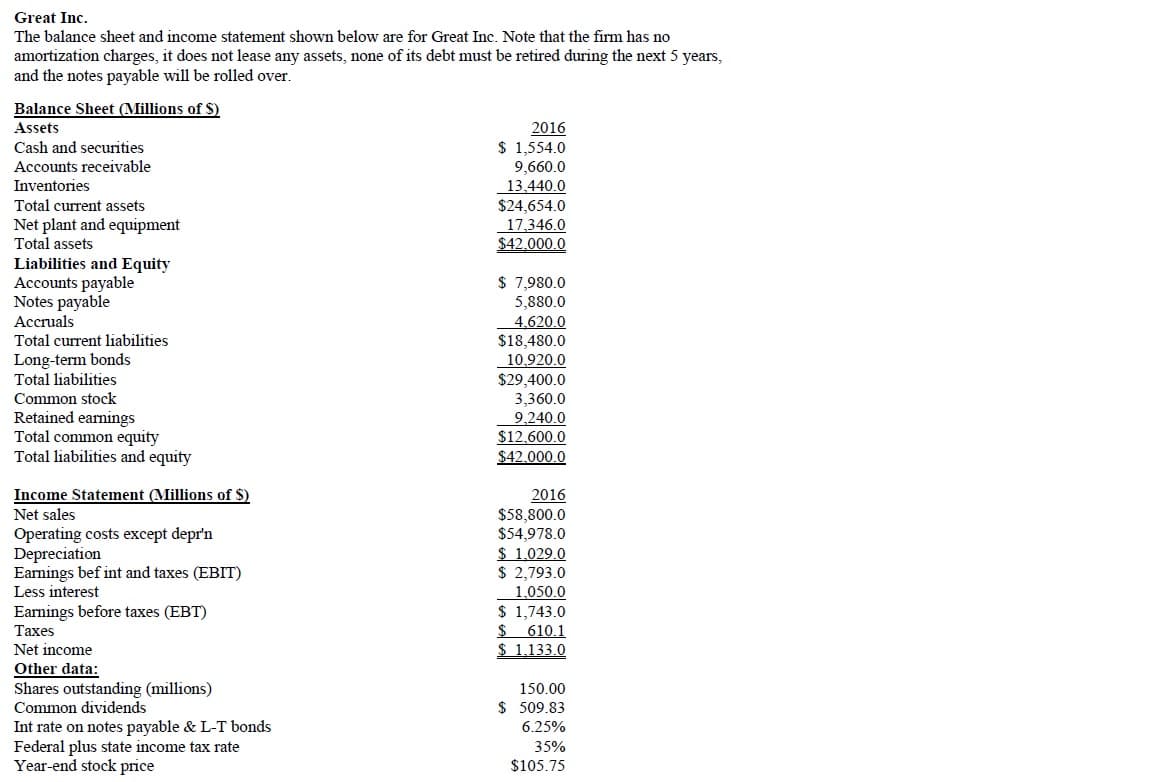

Q: Based on the information above, what is P/E ratio of the firm? Group of answer choices 12 14 13

A: Stock Price = 105.75 Net Income = 1133 Number of shares outstanding = 150

Q: Dividend policy can affect the value of the firm for which of the following reasons? a. Personal…

A: 1. Dividend policy can affect the value of the firm for which of the following reasons d. all of…

Q: Adams Inc. has the following data: r RF = 5.00%; RP M = 6.00%; and b = 1.05. What is the firm's cost…

A: Given: Risk free rate = 5% Market risk premium = 6% Beta = 1.05

Q: What is the different between right issue and private placements? What is included in underwriting…

A: NOTE: This set contains two questions Q2. and Q3. Further both the questions have 2-2 parts. The 2nd…

Q: Current Ratio Explain what it means for a firm to have a current ratio equal to .50. Would the firm…

A: Current ratio is the value of the current asset divided by the current liabilities. It helps in…

Q: The company capital structure consists of debt 230000 at 6.45%, preferred stock 260000 at 15.40% and…

A: The Weighted Average Cost of Capital(WACC) refers to the financial ratio that calculates the overall…

Q: jo un Refer to Exhibit 10.1. Based on the CAPM, what is the firm's cost of equity? O 10.65% %10'II O…

A: Capital asset pricing model is financial model which establishes a relationship between the risk…

Based on the information above, what is the is the firm's EPS?

Step by step

Solved in 3 steps

- Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: 1. Prepare a schedule showing annual cash flows fur the two notes in each of the 4 years.Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: Which figure, net income or net cash flow, does the better job of telling the banks stock-holders about the effect of these notes on the bank? Explain by reference to the schedules prepared in Requirements 1 and 2.Marmol Corporation uses the allowance method for bad debts. During 2019, Marmol charged 50,000 to bad debt expense and wrote off 45,200 of uncollectible accounts receivable. These transactions resulted in a decrease in working capital of: a. 0 b. 4,800 c. 45,200 d. 50,000

- Southwestern Wear Inc. has the following balance sheet: The trustees costs total 281,250, and the firm has no accrued taxes or wages. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of 2.5 million is received from sale of the assets?The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets,none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.Balance Sheet (Millions of $) 2021AssetsCash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and EquityAccounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021Net sales $112,000 Operating costs except depreciation 104,160 Depreciation 2,240 Earnings before interest and taxes (EBIT) $ 5,600 Less interest 840 Earnings before taxes (EBT) $ 4,760 Taxes (25%) 1,190 Net income $ 3,570 Other data:…The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets 2018 Cash and securities $3,000 Accounts receivable 15,000 Inventories 18,000 Total current assets $36,000 Net plant and equipment $24,000 Total assets $60,000 Liabilities and Equity Accounts payable $18,630 Accruals 8,370 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock $5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity $60,000 Income Statement (Millions of $)…

- The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets 2018 Cash and securities $3,000 Accounts receivable 15,000 Inventories 18,000 Total current assets $36,000 Net plant and equipment $24,000 Total assets $60,000 Liabilities and Equity Accounts payable $18,630 Accruals 8,370 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock $5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity $60,000 Income Statement (Millions of $) 2018 Net sales $84,000 Operating costs except depreciation 78,120 Depreciation 1,680…The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets 2018 Cash and securities $3,000 Accounts receivable 15,000 Inventories 18,000 Total current assets $36,000 Net plant and equipment $24,000 Total assets $60,000 Liabilities and Equity Accounts payable $18,630 Accruals 8,370 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock $5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity $60,000 Income Statement (Millions of $)…The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and Equity Accounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021 Net sales $ 112,000 Operating costs except depreciation 104,160 Depreciation…

- The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and Equity Accounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021 Net sales $ 112,000 Operating costs except depreciation 104,160 Depreciation…The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and Equity Accounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021 Net sales $ 112,000 Operating costs except depreciation 104,160 Depreciation…The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and Equity Accounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021 Net sales $ 112,000 Operating costs except depreciation 104,160 Depreciation…