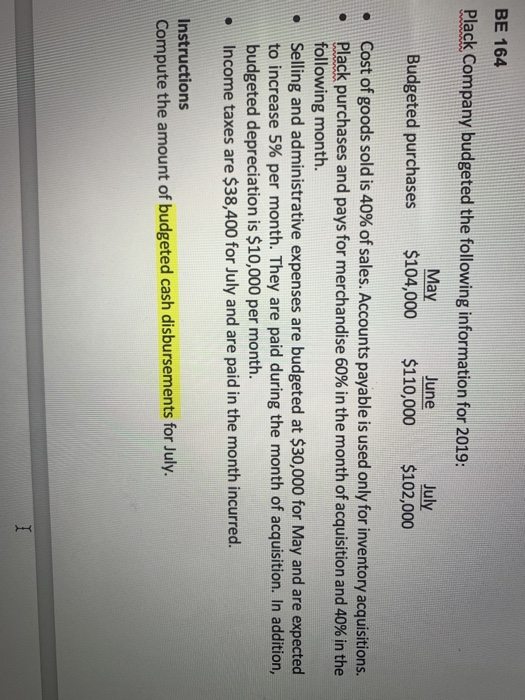

BE 164 Plack Company budgeted the following information for 2019: May $104,000 ● June $110,000 July $102,000 Budgeted purchases Cost of goods sold is 40% of sales. Accounts payable is used only for inventory acquisitions. Plack purchases and pays for merchandise 60% in the month of acquisition and 40% in the following month. Selling and administrative expenses are budgeted at $30,000 for May and are expected to increase 5% per month. They are paid during the month of acquisition. In addition, budgeted depreciation is $10,000 per month. Income taxes are $38,400 for July and are paid in the month incurred. Instructions Compute the amount of budgeted cash disbursements for July.

Q: Required information [The following information applies to the questions displayed below.]…

A: Interest revenue refers to an amount that is being earned by the investors on the initial amount…

Q: Starbucks sells coffee beans, which are sensitive to price fluctuations. Suppose the following…

A: Effective inventory management is essential for optimizing working capital, minimizing stockouts or…

Q: Factory Overhead Variance Corrections The data related to Shunda Enterprises Inc.'s factory overhead…

A: Total Factory Overhead Cost Variance is a comparative tool for actual costs versus standard costs…

Q: P Co acquired 75% of the ordinary shares of S Co on 1 September 20X5. At that date the fair value of…

A: In consolidation, financial statements are prepared by the parent company together with its…

Q: Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107-were…

A: T-accounts are an informal term for a group of financial records that use double-entry accounting.…

Q: Stuart Transport Company divides its operations into four divisions. A recent income statement for…

A: All the cost which are relevant in decision making process is called relevant cost that is avoidable…

Q: a non-VAT registered senio

A: In this question, we will calculate the exempt sales( Medical dental veterinary services except…

Q: On December 31, Year 3, Mueller Corp. acquired 80% of the outstanding shares of Wilson Inc. for a…

A: Consolidated Net Income :After deducting all costs, taxes, and other charges, a company's…

Q: Can someone please check my work on this? Aracel Engineering completed the following transactions…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: A company purchased inventory for $2,500 from a vendor on account, FOB shipping point, with terms of…

A: Note: 2/10, n/30: Here, 2 represents the discount rate if payment is made within ten days. And if…

Q: 1. On May 1, Harris purchased parts from a Japanese company for a U.S. dollar equivalent value of…

A: May 01:Debit: Inventory (or Purchases) - $6,600Credit: Accounts payable - $6,600June 20:Debit:…

Q: For each of the following situations, indicate the type of report that would be required as well as…

A: Answer to Question 1:The entity is subject to going concern uncertanity and has properly disclosed…

Q: General Motors corporate sustainability plan (2021) includes plans to: OOOO Reduce costs through the…

A: A sustainability plan is a strategic document that outlines an organization's goals, targets, and…

Q: Hampton Company reports the following information for its recent calendar year. $ 73,000 Selected…

A: CASH FLOW STATEMENTCash flow statement is additional information to user of financial statement.…

Q: Which kind of costs could be by closing a sales eliminated office?

A: It's important to note that the decision to close a sales office should be carefully evaluated,…

Q: On April 22, 2023, a company purchased equipment for $129,200. The company expects to use the…

A: Business organizations are required to charge the depreciation expense in the accounting books so…

Q: Assets: Current Assets: Cash Accounts Receivable (net) Inventory Prepaid Expenses Total Current…

A: The cash flow from various activities during the period are classified as operating, investing and…

Q: Coleman Company reports the following costs for the year. Direct Materials Used $ 110,000 Direct…

A: A period cost is the indirect cost which is not related to production. It is incurred over period of…

Q: IV. Given are the financial information of Bart Incorporated. Raw materials inventory 1/1/20 Raw…

A: Since you have posted a question multiple sub-parts, as per the guidelines only the first three…

Q: Assets Cash Accounts receivable Inventory Total current assets Equipment Accumulated…

A: It is important in the business entity to prepare the Cash flow statement which can be determine the…

Q: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising,…

A: Discontinued operations can involve selling off assets, ceasing production or services, and winding…

Q: The following is a condensed version of the comparative balance sheets for Teal Corporation for the…

A: Statement of Cash Flow:-The Statement of Cash Flows is a financial statement that provides…

Q: The manager of Gratiot Flooring estimates operating costs for the year will include $591,000 in…

A: Lets understand the basics.Break even point is a point at which no profit no loss condition arise.…

Q: Required Compute the following ratios for Fanning for Year 3 and Year 2. a. Number of times…

A: Interest Coverage Ratio or number of times interest earned is a ratio which represent the solvency…

Q: Martinez Company's December 31, 2025, trial balance includes the following accounts: Investment in…

A: Balance Sheet :— It is one of the financial statement that shows list of final ending balances of…

Q: 3. Which of the following should be presented as cash in the statement of financia position? a:…

A: The cash component represents the physical currency, such as bills and coins, held by the company as…

Q: Record the entries that stem from the following bank reconciliation report. Balance as per records…

A: Journal entries are the basic of accounting.Journal entries are used to record day to day…

Q: QS 26-18 (Algo) Profitability index LO P3 Yokam Company is considering two alternative projects.…

A: PROFITABILITY INDEX RATIOProfitability Index Ratio is one of the Important Capital Budgeting…

Q: Spring Appliances received an invoice dated February 15 with terms 3/10 E.O.M. for the items listed…

A: The following basic information as follows under:-Spring Appliances received an invoice dated…

Q: Gale Company has the following inventory and purchases during the fiscal year ended December 31,…

A: The inventory can be valued using various methods as FIFO, LIFO and average method. Using average…

Q: Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior month's reports.…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Lexi Belcher picked up the monthly report that Irvin Santamaria left on her desk. She smiled as her…

A: Variance analysis in cost accounting is a technique used to analyze and explain the difference…

Q: Journalze entries for the following related transactions of South Coast Heating & Air Company. Refer…

A: Journal entries are of critical importance in accounting as they provide a systematic and accurate…

Q: A donor gave the following donations during 2021: March 5 – Land located in the Philippines valued…

A: The donor's tax payable on the March 5 donation can be computed using the following formula:Donor's…

Q: Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for…

A:

Q: Holt Developments Ltd. put an asset in service on January 1, 2018. Its cost was $252,000, its…

A: Depreciation refers to the decrease in value of an asset over time due to wear and tear,…

Q: Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8) Selected financial data for Bahama Bay and…

A: THE TERM DEBT EQUITY RATIO MEANS HOW MUCH DEBT USED BY THE COMPANY TO FINANCE ITS ASSET RELATIVE…

Q: Evan, a single individual, operates a service business that earned $110,000 (after all applicable…

A: The taxable income can be defined as the total income subject to tax. The taxable income is used to…

Q: The following data from the just completed year are taken from the accounting records of Mason…

A: cost of Goods Manufactured = total manufacturing cost + Beginning work in process inventory - Ending…

Q: The cost of work in process in Department B at October 1 is $32,500, and the cost of work in process…

A: Work-in-process inventory also known as work-in-progress is the inventory or stock that is pending…

Q: Assuming Aravind's business does not qualify under the gross income test, what is the business…

A: To determine the business interest limitation that Aravind will be subject to, we need to calculate…

Q: Station Co holds three types of inventory. The following details are relevant: Inventory type Cost A…

A: The inventory is reported as current asset in the balance sheet. The inventory is reported as cost…

Q: When bond interest rates become more volatile, the demand for bonds___ and the interest rate________…

A: There are two questions asked by student and as per our protocol only one question has been solved…

Q: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales…

A: Variable costs or expenses are the costs or expenses which are variable in nature i.e, such costs…

Q: Dotterel Corporation uses the variable cost concept of product pricing. Below is the cost…

A: Desired profit is rate that company desires to make from the capital investment.

Q: Question Content AreaSunlight, Inc. had the following assets and liabilities as of September 30,…

A: Accounting equation indicates that company's total assets are equal to the sum of its liabilities…

Q: Required information Use the following information for the Exercises below. (Algo) [The following…

A: Financial statements includes income statement, balance sheet and cash flow statement. Financial…

Q: Gleason Guitars produces acoustic guitars. The table below contains budget and actual information…

A: Variance is the difference between Standard Cost and Actual Cost incurred. Variance may be…

Q: a) For each of these disposals, prepare a journal entry to record depreciation from January 1, 2024,…

A: Straight Line Depreciation = (Purchase Price - Salvage Value) / LifeBookValue of Asset = Purchase…

Q: Required: 1. By how much would the company's operating income increase if Vancouver increased its…

A: Increase in Sales of Vancouver $89,000Contribution margin of Vancouver 40%Increase in Operating…

Please do not give solution in image format thanku

Step by step

Solved in 4 steps

- Prepare a cost of goods sold budget for the Crest Hills Manufacturing Co. for the year ended December 31, 2016, from the following estimates. Inventories of production units: Direct materials purchased during the year, 854,000; beginning inventory of direct materials, 31,000; and ending inventory of direct materials, 26,000. Totals from other budgets included:Cash budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent 50,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of 40,000, marketable securities of 75,000, and accounts receivable of 300,000 (60,000 from July sales and 240,000 from August sales). Sales on account for July and August were 200,000 and 240,000, respectively. Current liabilities as of September 1 include 40,000 of accounts payable incurred in August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 55,000 will be made in October. Bridgeports regular quarterly dividend of 25,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of 50,000. Instructions Prepare a monthly cash budget and supporting schedules for September, October, and November. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?Pasadena Candle Inc. projected sales of 800,000 candles for January. The estimated January 1 inventory is 35,000 units, and the desired January 31 inventory is 20,000 units. What is the budgeted production (in units) for January?

- Preparing a Direct Materials Purchases Budget Patrick Inc. makes industrial solvents sold in 5-gallon drums. Planned production in units for the first 3 months of the coming year is: Each drum requires 5.5 gallons of chemicals and one plastic drum. Company policy requires that ending inventories of raw materials for each month be 15% of the next months production needs. That policy was met for the ending inventory of December in the prior year. The cost of one gallon of chemicals is 2.00. The cost of one drum is 1.60. (Note: Round all unit amounts to the nearest unit. Round all dollar amounts to the nearest dollar.) Required: 1. Calculate the ending inventory of chemicals in gallons for December of the prior year and for January and February. What is the beginning inventory of chemicals for January? 2. Prepare a direct materials purchases budget for chemicals for the months of January and February. 3. Calculate the ending inventory of drums for December of the prior year and for January and February. 4. Prepare a direct materials purchases budget for drums for the months of January and February.A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000Cash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month after sale). Depreciation, insurance, and property tax expense represent 12,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in February, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of June 1 include cash of 42,000, marketable securities of 25,000, and accounts receivable of 198,000 (150,000 from May sales and 48,000 from April sales). Sales on account in April and May were 120,000 and 150,000, respectively. Current liabilities as of June 1 include 13,000 of accounts payable incurred in May for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 24,000 will be made in July. Mercury Shoes regular quarterly dividend of 15,000 is expected to be declared in July and paid in August. Management desires to maintain a minimum cash balance of 40,000. Instructions Prepare a monthly cash budget and supporting schedules for June, July, and August. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?

- Pasadena Candle Inc. budgeted production of 785,000 candles for January. Wax is required to produce a candle. Assume 10 ounces of wax is required for each candle. The estimated January 1 wax inventory is 16,000 pounds. The desired January 31 wax inventory is 12,500 pounds. If candle wax costs 1.24 per pound, determine the direct materials purchases budget for January.CASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2014 and 2015: May 2014 180,000 June 180,000 July 360,000 August 540,000 September 720,000 October 360.000 November 360,000 December 90,000 January 2015 180.000 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2014 90,000 June 90,000 July 126,000 August 882.000 September 306,000 October 234,000 November 162,000 December 90,000 General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses arc S2,700 a month. Income tax payments of 63,000 arc due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2014. b. Prepare monthly estimates of the required financing or excess funds that is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 130 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal; and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.Operating Budget, Comprehensive Analysis Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing 166.06. The desired ending inventory for each month is 80% of the next months sales. b. The data on materials used are as follows: Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next months production needs. This is exactly the amount of material on hand on December 31 of the prior year. c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is 14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) f. The unit selling price of the subassembly is 205. g. All sales and purchases are for cash. The cash balance on January 1 equals 400,000. The firm requires a minimum ending balance of 50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January. Required: 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.) a. Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget g. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement j. Cash budget 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controller forecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.

- Refer to Cornerstone Exercise 8.1, through Requirement 1. FlashKick requires ending inventory of product to equal 20 percent of the next months unit sales. Beginning inventory in January was 3,100 practice soccer balls and 400 match soccer balls. Required: 1. Construct a production budget for each of the two product lines for FlashKick Company for the first three months of the coming year. 2. What if FlashKick wanted a production budget for the two product lines for the month of April? What additional information would you need to prepare this budget? FlashKick Company manufactures and sells soccer balls for teams of children in elementary and high school. FlashKicks best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ball line (high-performance soccer balls used in games). In the first four months of next year, FlashKick expects to sell the following: Required: 1. Construct a sales budget for FlashKick for the first three months of the coming year. Show total sales for each product line by month and in total for the first quarter. 2. What if FlashKick added a third linetournament quality soccer balls that were expected to take 40 percent of the units sold of the match balls and would have a selling price of 45 each in January and February, and 48 each in March? Prepare a sales budget for Flash- Kick for the first three months of the coming year. Show total sales for each product line by month and in total for the first quarter.CASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2016 and 2017. May 2016 180,000 June 180,000 July 360,000 August 540,000 September 720,000 October 360,000 November 360,000 December 90,000 January 2017 180,000 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale. 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2016 90,000 June 90,000 July 126,000 August 882,000 September 306,000 October 234,000 November 162,000 December 90,000 General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depredation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2016. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal; and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if ail financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning January 1, 20Y9, the following tentative trial balance as of December 31, 20Y8, is prepared by the Accounting Department of Mesa Publishing Co.: Factory output and sales for 20Y9 are expected to total 3,800 units of product, which are to be sold at 120 per unit. The quantities and costs of the inventories at December 31, 20Y9, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of 35,000 on 20Y9 taxable income will be paid during 20Y9. Regular quarterly cash dividends of 0.20 per share are expected to be declared and paid in March, June, September, and December on 20,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for 22,000 cash in May. Instructions Prepare a budgeted income statement for 20Y9. Prepare a budgeted balance sheet as of December 31, 20Y9, with supporting calculations.