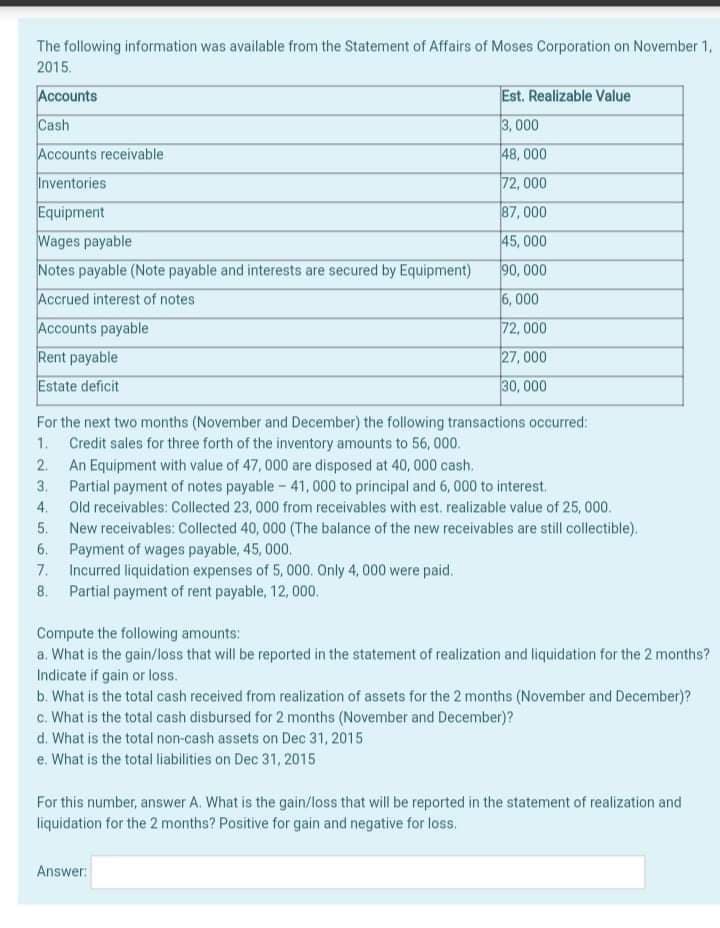

The following information was available from the Statement of Affairs of Moses Corporation on November 1, 2015. Accounts Est. Realizable Value Cash 3, 000 Accounts receivable 48, 000 Inventories 72, 000 Equipment 87, 000 Wages payable Notes payable (Note payable and interests are secured by Equipment) 45, 000 90, 000 Accrued interest of notes 6, 000 Accounts payable 72, 000 Rent payable 27, 000 Estate deficit 30, 000 For the next two months (November and December) the following transactions occurred: 1. Credit sales for three forth of the inventory amounts to 56, 000. 2. An Equipment with value of 47, 000 are disposed at 40, 000 cash. Partial payment of notes payable - 41, 000 to principal and 6, 000 to interest. 4. Old receivables: Collected 23, 000 from receivables with est. realizable value of 25, 000. 5. New receivables: Collected 40, 000 (The balance of the new receivables are still collectible). 6. Payment of wages payable, 45, 000. 7. Incurred liquidation expenses of 5, 000. Only 4, 000 were paid. 8. Partial payment of rent payable, 12, 000. 3. Compute the following amounts: a. What is the gain/loss that will be reported in the statement of realization and liquidation for the 2 months? Indicate if gain or loss. b. What is the total cash received from realization of assets for the 2 months (November and December)? c. What is the total cash disbursed for 2 months (November and December)? d. What is the total non-cash assets on Dec 31, 2015 e. What is the total liabilities on Dec 31, 2015 For this number, answer A. What is the gain/loss that will be reported in the statement of realization and liquidation for the 2 months? Positive for gain and negative for loss.

The following information was available from the Statement of Affairs of Moses Corporation on November 1, 2015. Accounts Est. Realizable Value Cash 3, 000 Accounts receivable 48, 000 Inventories 72, 000 Equipment 87, 000 Wages payable Notes payable (Note payable and interests are secured by Equipment) 45, 000 90, 000 Accrued interest of notes 6, 000 Accounts payable 72, 000 Rent payable 27, 000 Estate deficit 30, 000 For the next two months (November and December) the following transactions occurred: 1. Credit sales for three forth of the inventory amounts to 56, 000. 2. An Equipment with value of 47, 000 are disposed at 40, 000 cash. Partial payment of notes payable - 41, 000 to principal and 6, 000 to interest. 4. Old receivables: Collected 23, 000 from receivables with est. realizable value of 25, 000. 5. New receivables: Collected 40, 000 (The balance of the new receivables are still collectible). 6. Payment of wages payable, 45, 000. 7. Incurred liquidation expenses of 5, 000. Only 4, 000 were paid. 8. Partial payment of rent payable, 12, 000. 3. Compute the following amounts: a. What is the gain/loss that will be reported in the statement of realization and liquidation for the 2 months? Indicate if gain or loss. b. What is the total cash received from realization of assets for the 2 months (November and December)? c. What is the total cash disbursed for 2 months (November and December)? d. What is the total non-cash assets on Dec 31, 2015 e. What is the total liabilities on Dec 31, 2015 For this number, answer A. What is the gain/loss that will be reported in the statement of realization and liquidation for the 2 months? Positive for gain and negative for loss.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

100%

Transcribed Image Text:The following information was available from the Statement of Affairs of Moses Corporation on November 1,

2015.

Accounts

Cash

Est. Realizable Value

3, 000

Accounts receivable

48, 000

Inventories

72, 000

87, 000

Equipment

Wages payable

Notes payable (Note payable and interests are secured by Equipment)

45, 000

90, 000

Accrued interest of notes

6, 000

Accounts payable

72, 000

Rent payable

Estate deficit

27, 000

30, 000

For the next two months (November and December) the following transactions occurred:

1. Credit sales for three forth of the inventory amounts to 56, 000.

2. An Equipment with value of 47, 000 are disposed at 40, 000 cash.

3. Partial payment of notes payable - 41, 000 to principal and 6, 000 to interest.

Old receivables: Collected 23, 000 from receivables with est. realizable value of 25, 000.

4.

New receivables: Collected 40, 000 (The balance of the new receivables are still collectible).

6. Payment of wages payable, 45, 000.

7. Incurred liquidation expenses of 5, 000. Only 4, 000 were paid.

8. Partial payment of rent payable, 12, 000.

5.

Compute the following amounts:

a. What is the gain/loss that will be reported in the statement of realization and liquidation for the 2 months?

Indicate if gain or loss.

b. What is the total cash received from realization of assets for the 2 months (November and December)?

c. What is the total cash disbursed for 2 months (November and December)?

d. What is the total non-cash assets on Dec 31, 2015

e. What is the total liabilities on Dec 31, 2015

For this number, answer A. What is the gain/loss that will be reported in the statement of realization and

liquidation for the 2 months? Positive for gain and negative for loss.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College