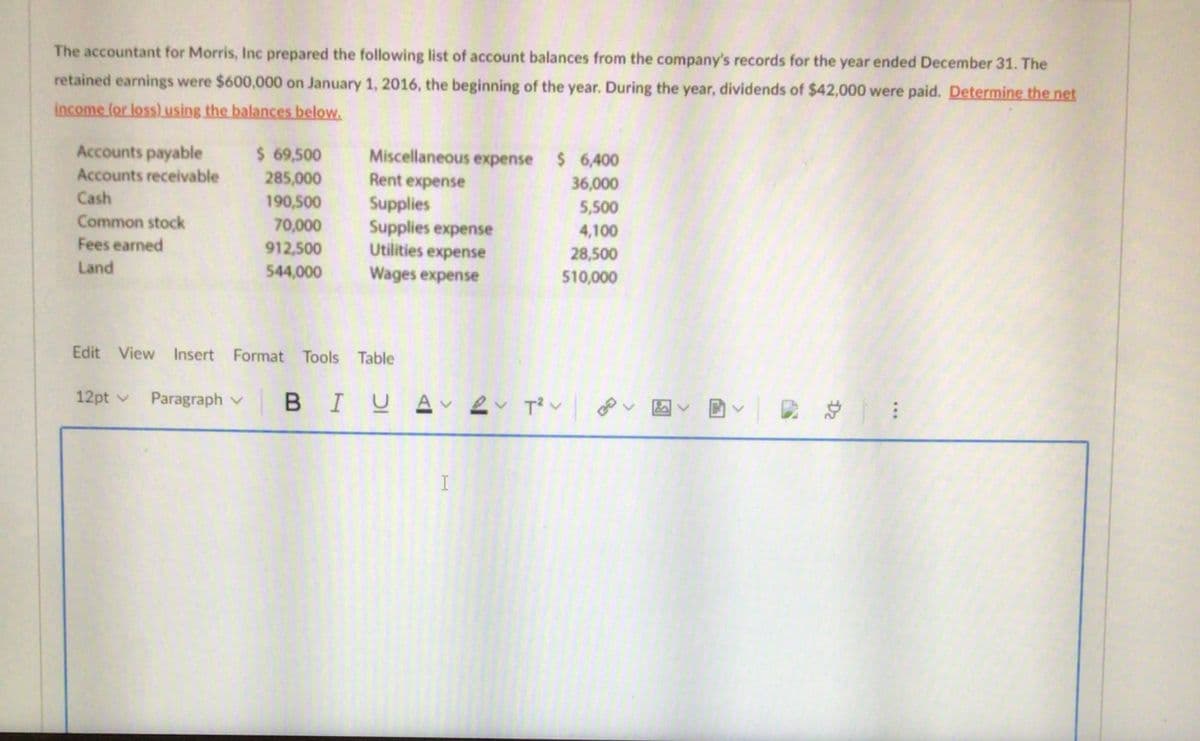

The accountant for Morris, Inc prepared the following list of account balances from the company's records for the year ended December 31. The retained earnings were $600,000 on January 1, 2016, the beginning of the year. During the year, dividends of $42,000 were paid. Determine the net income (or loss) using the balances below. Accounts payable Accounts receivable Cash Common stock Fees earned Land $ 69,500 285,000 190,500 70,000 912,500 544,000 Miscellaneous expense Rent expense Supplies Supplies expense Utilities expense Wages expense $ 6,400 36,000 5,500 4,100 28,500 510,000

The accountant for Morris, Inc prepared the following list of account balances from the company's records for the year ended December 31. The retained earnings were $600,000 on January 1, 2016, the beginning of the year. During the year, dividends of $42,000 were paid. Determine the net income (or loss) using the balances below. Accounts payable Accounts receivable Cash Common stock Fees earned Land $ 69,500 285,000 190,500 70,000 912,500 544,000 Miscellaneous expense Rent expense Supplies Supplies expense Utilities expense Wages expense $ 6,400 36,000 5,500 4,100 28,500 510,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:The accountant for Morris, Inc prepared the following list of account balances from the company's records for the year ended December 31. The

retained earnings were $600,000 on January 1, 2016, the beginning of the year. During the year, dividends of $42,000 were paid. Determine the net

income (or loss) using the balances below.

Accounts payable

$ 69,500

Miscellaneous expense

$ 6,400

Accounts receivable

285,000

Rent expense

36,000

Cash

190,500

Supplies

Supplies expense

Utilities expense

5,500

Common stock

70,000

4,100

Fees earned

912,500

28,500

Land

544,000

Wages expense

510,000

Edit View Insert Format Tools Table

12pt v

Paragraph v BIU

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning