Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 5CE

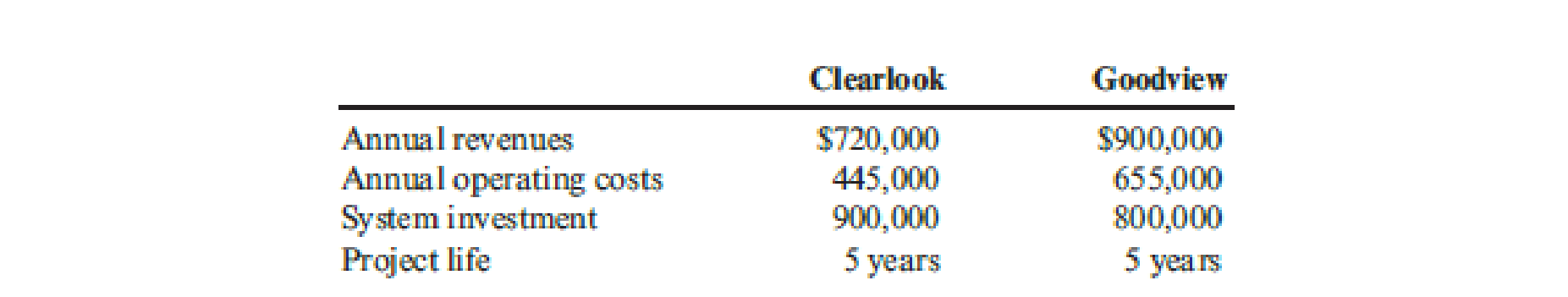

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax

Assume that the cost of capital for the company is 8 percent.

Required:

- 1. Calculate the

NPV for the Clearlook System. - 2. Calculate the NPV for the Goodview System. Which MRI system would be chosen?

- 3. What if Keating Hospital wants to know why

IRR is not being used for the investment analysis? Calculate the IRR for each project and explain why it is not suitable for choosing among mutually exclusive investments.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows:

Clearlook Goodview

Annual revenues $720,000 $900,000

Annual operating costs 445,000 655,000

System investment 900,000 800,000

Project life 5 years 5 years

Assume that the cost of capital for the company is 8%.

Required:

1. Calculate the NPV for the Clearlook System.

2. Calculate the NPV for the Goodview System. Which MRI system would be chosen?

3. What if Keating Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project and explain why it is not suitable for choosing among…

Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows:

Clearlook

Goodview

Annual revenues

$720,000

$900,000

Annual operating costs

445,000

655,000

System investment

900,000

800,000

Project life

5 years

5 years

Assume that the cost of capital for the company is 8 percent.

The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems.

Required:

Calculate the NPV for the Clearlook System.$

Calculate the NPV for the Goodview System.$

Which MRI system would be chosen?

Clearlook System

Goodview System3. What if Keating Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project. Round the discount factor to three decimal places. Round the IRR…

Two locations are considered for a new public small hospital. Location A would require an investrment of $3.4 million and $55,000 per ycar to maintain. Location B would cost $4.8 million to construct. The operating cost of location B will be $43,000 per year. The benefits will be $550,000 per year at location A and 5750000 at location B The disbenefits associated with each location are $35,000 per year for location A and $45,000 per year for location B. Assame the hospital will be maintained indefinitely Use an interest rate of 12% per year to determine which location, if either, should be selected on the basis of the BC method.

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 19 - Explain the difference between independent...Ch. 19 - Explain why the timing and quantity of cash flows...Ch. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - What is the accounting rate of return?Ch. 19 - What is the cost of capital? What role does it...Ch. 19 - Prob. 7DQCh. 19 - Explain how the NPV is used to determine whether a...Ch. 19 - Explain why NPV is generally preferred over IRR...Ch. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Jan Booth is considering investing in either a...Ch. 19 - Prob. 2CECh. 19 - Carsen Sorensen, controller of Thayn Company, just...Ch. 19 - Manzer Enterprises is considering two independent...Ch. 19 - Keating Hospital is considering two different...Ch. 19 - Prob. 6CECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Each of the following scenarios is independent....Ch. 19 - Roberts Company is considering an investment in...Ch. 19 - NPV A clinic is considering the possibility of two...Ch. 19 - Refer to Exercise 19.11. 1. Compute the payback...Ch. 19 - Buena Vision Clinic is considering an investment...Ch. 19 - Consider each of the following independent cases....Ch. 19 - Gina Ripley, president of Dearing Company, is...Ch. 19 - Covington Pharmacies has decided to automate its...Ch. 19 - Postman Company is considering two independent...Ch. 19 - Prob. 18ECh. 19 - Prob. 19ECh. 19 - Prob. 20ECh. 19 - Assume there are two competing projects, X and Y....Ch. 19 - Prob. 22ECh. 19 - Assume that an investment of 100,000 produces a...Ch. 19 - Prob. 24PCh. 19 - Prob. 25PCh. 19 - Prob. 26PCh. 19 - Kent Tessman, manager of a Dairy Products...Ch. 19 - Friedman Company is considering installing a new...Ch. 19 - Okmulgee Hospital (a large metropolitan for-profit...Ch. 19 - Mallette Manufacturing, Inc., produces washing...Ch. 19 - Jonfran Company manufactures three different...Ch. 19 - Prob. 32P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forwardHome Garden Inc. is considering the construction of a distribution warehouse in West Virginia to service its east coast stores based on the following estimates: a. Determine the net present value of building the warehouse, assuming a construction cost of 20,000,000, an annual net cost savings of 4,000,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. b. Determine the net present value of building the warehouse, assuming a construction cost of 25,000,000, an annual net cost savings of 2,500,000, and a desired rate of return of 14%. Use the present value tables provided in Appendix A. c. Interpret the results of parts (a) and (b).arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forward

- Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardPostman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Required: Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.arrow_forward

- If a garden center is considering the purchase of a new tractor with an initial investment cost of $120,000, and the center expects a return of $30,000 in year one, $20,000 in years two and three. $15,000 In years four and five, and $10,000 in year six and beyond, what is the payback period?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.arrow_forward

- ABC Medical has invested RM2 million in a Health Diagnostic Support system. To maintain the system, the hospital has to pay the vendor RM10,000 monthly for monitoring and support activities. The system is projected to increase the hospital revenue by RM50,000 monthly. If the system is to be utilized by the hospital for 10 years, calculate the rate of return of the investment using ROI.arrow_forwardJohn’s Gyms is choosing between two new offerings, a Playhouse and a Fort-The Playhouse line will cost $30,000 to set up and generate cash flows of $15,000 and $20,000 over two years. -The Fort project will cost $80,000 to set up but is expected to yield cash flows of $39,000 and $52,000. a. What is the cross-over rate for the Fort and Playhouse projects?arrow_forward. A hospital director is considering two alternative investment programs. Both have costs of $5,000 in year 1 only. Project 1 provides benefits of $2,000 in each of the first 4 years only. Project 2 provides benefits of $ 2,000 for years 6 to 10 only. a. Compute the net benefits using a discount rate of 6 percent. b. Knowing that the calculations are dependent on the discount rate, conduct a sensitivity analysis by re - calculating with a discount rate of 12 percent. Based on your calculations, which investment program should the director choose?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License