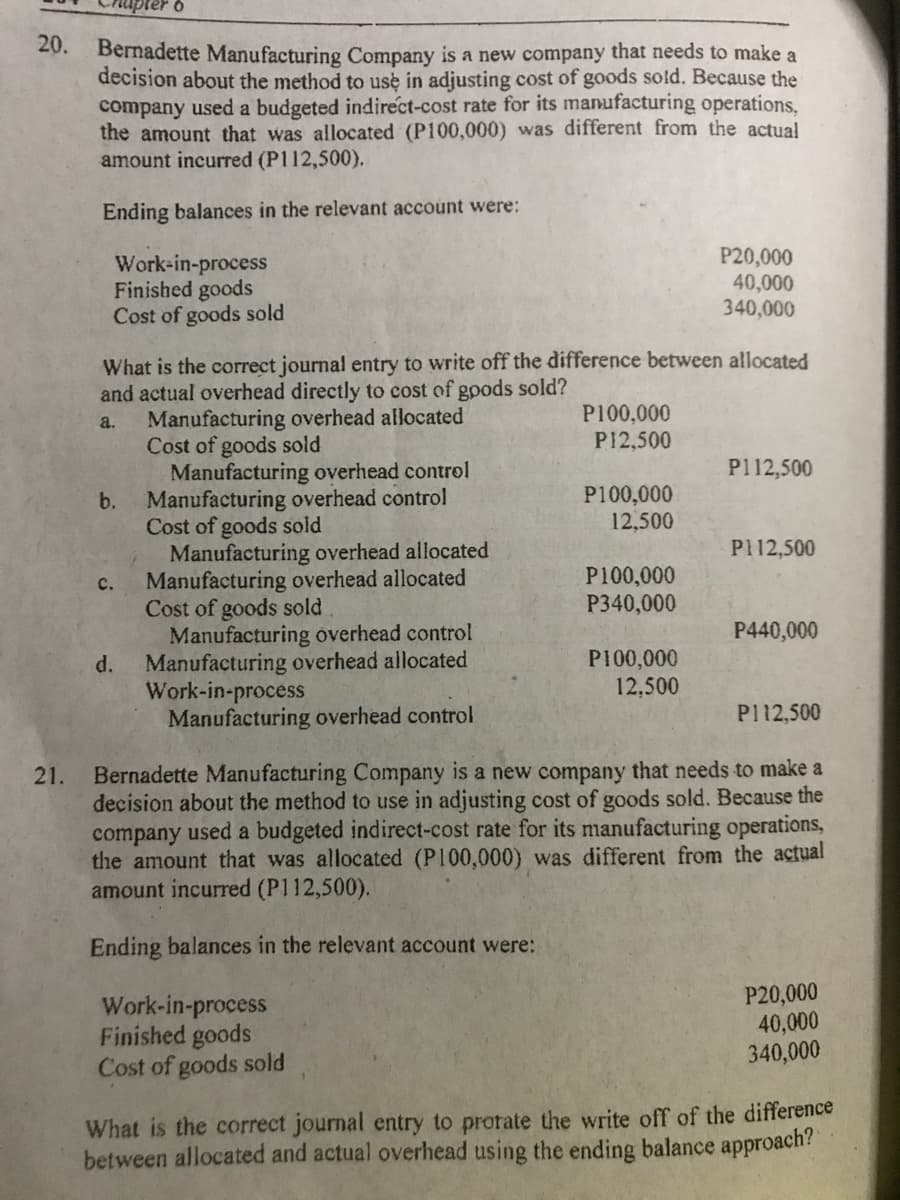

Bernadette Manufacturing Company is a new company that needs to make a decision about the method to use in adjusting cost of goods sold. Because the company used a budgeted indirect-cost rate for its manufacturing operations. the amount that was allocated (P100,000) was different from the actual amount incurred (P112,500). Ending balances in the relevant account were: Work-in-process Finished goods Cost of goods sold P20,000 40,000 340,000

Bernadette Manufacturing Company is a new company that needs to make a decision about the method to use in adjusting cost of goods sold. Because the company used a budgeted indirect-cost rate for its manufacturing operations. the amount that was allocated (P100,000) was different from the actual amount incurred (P112,500). Ending balances in the relevant account were: Work-in-process Finished goods Cost of goods sold P20,000 40,000 340,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter9: Standard Costing: A Functional-based Control Approach

Section: Chapter Questions

Problem 5CE: Yohan Company has the following balances in its direct materials and direct labor variance accounts...

Related questions

Question

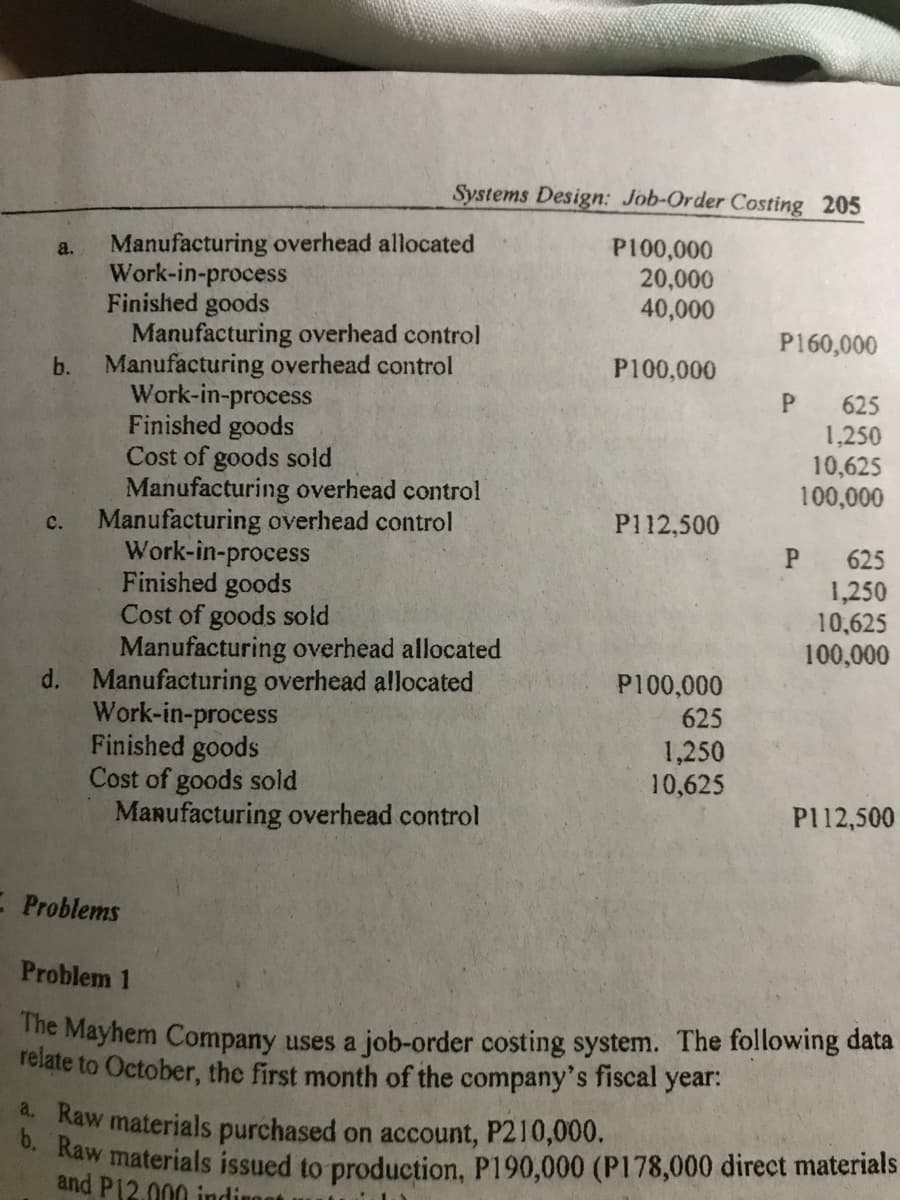

Transcribed Image Text:Systems Design: Job-Order Costing 205

Manufacturing overhead allocated

Work-in-process

Finished goods

Manufacturing overhead control

Manufacturing overhead control

Work-in-process

Finished goods

Cost of goods sold

Manufacturing overhead control

Manufacturing overhead control

Work-in-process

Finished goods

Cost of goods sold

Manufacturing overhead allocated

d. Manufacturing overhead allocated

Work-in-process

Finished goods

Cost of goods sold

Manufacturing overhead control

P100,000

20,000

a.

40,000

P160,000

b.

P100,000

P

625

1,250

10,625

100,000

c.

P112,500

P

625

1,250

10,625

100,000

P100,000

625

1,250

10,625

P112,500

E Problems

Problem 1

The Mayhem Company uses a job-order costing system. The following data

relate to October, the first month of the company's fiscal year:

a. Raw materials purchased on account, P210,000.

Kaw materials issued to production, P190,000 (P178,000 direct materials

and P12.000 indi

Transcribed Image Text:20.

Bernadette Manufacturing Company is a new company that needs to make a

decision about the method to use in adjusting cost of goods sold. Because the

company used a budgeted indirect-cost rate for its manufacturing operations,

the amount that was allocated (P100,000) was different from the actual

amount incurred (P112,500),

Ending balances in the relevant account were:

Work-in-process

Finished goods

Cost of goods sold

P20,000

40,000

340,000

What is the correct journal entry to write off the difference between allocated

and actual overhead directly to cost of goods sold?

Manufacturing overhead allocated

Cost of goods sold

Manufacturing overhead control

P100,000

P12,500

a.

P112,500

Manufacturing overhead control

Cost of goods sold

Manufacturing overhead allocated

Manufacturing overhead allocated

Cost of goods sold

Manufacturing óverhead control

Manufacturing overhead allocated

Work-in-process

Manufacturing overhead control

P100,000

12,500

b.

P112,500

P100,000

P340,000

с.

P440,000

P100,000

12,500

d.

P112,500

Bernadette Manufacturing Company is a new company that needs to make a

decision about the method to use in adjusting cost of goods sold. Because the

company used a budgeted indirect-cost rate for its manufacturing operations,

the amount that was allocated (P100,000) was different from the actual

amount incurred (P112,500).

21.

Ending balances in the relevant account were:

Work-in-process

Finished goods

Cost of goods sold

P20,000

40,000

340,000

What is the correct journal entry to prorate the write off of the difference

between allocated and actual overhead using the ending balance approach?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning