Beskar Metals Inc. began operations on June 5, 2021. June 5 Sold 4,000 common shares for $85,200 in cash to investors. 15 Received $23 cash per share for the issuance of 82,000 common shares. 16 Issued 10,000 preferred shares for cash of $46 per share. 17 8,000 common shares were issued in exchange for cash of $137,000. 18 The board of directors declared a cash dividend of $20,200 on the preferred shares and $5,700 on the common shares to shareholders of record on June 20, payable July 1. July 1 The dividends declared on June 18 were paid. Required: Prepare the required journal entries for the above transactions. Explanations are not required for the journal entries. diuidondo doolon ah ologg fou na divid.

Beskar Metals Inc. began operations on June 5, 2021. June 5 Sold 4,000 common shares for $85,200 in cash to investors. 15 Received $23 cash per share for the issuance of 82,000 common shares. 16 Issued 10,000 preferred shares for cash of $46 per share. 17 8,000 common shares were issued in exchange for cash of $137,000. 18 The board of directors declared a cash dividend of $20,200 on the preferred shares and $5,700 on the common shares to shareholders of record on June 20, payable July 1. July 1 The dividends declared on June 18 were paid. Required: Prepare the required journal entries for the above transactions. Explanations are not required for the journal entries. diuidondo doolon ah ologg fou na divid.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

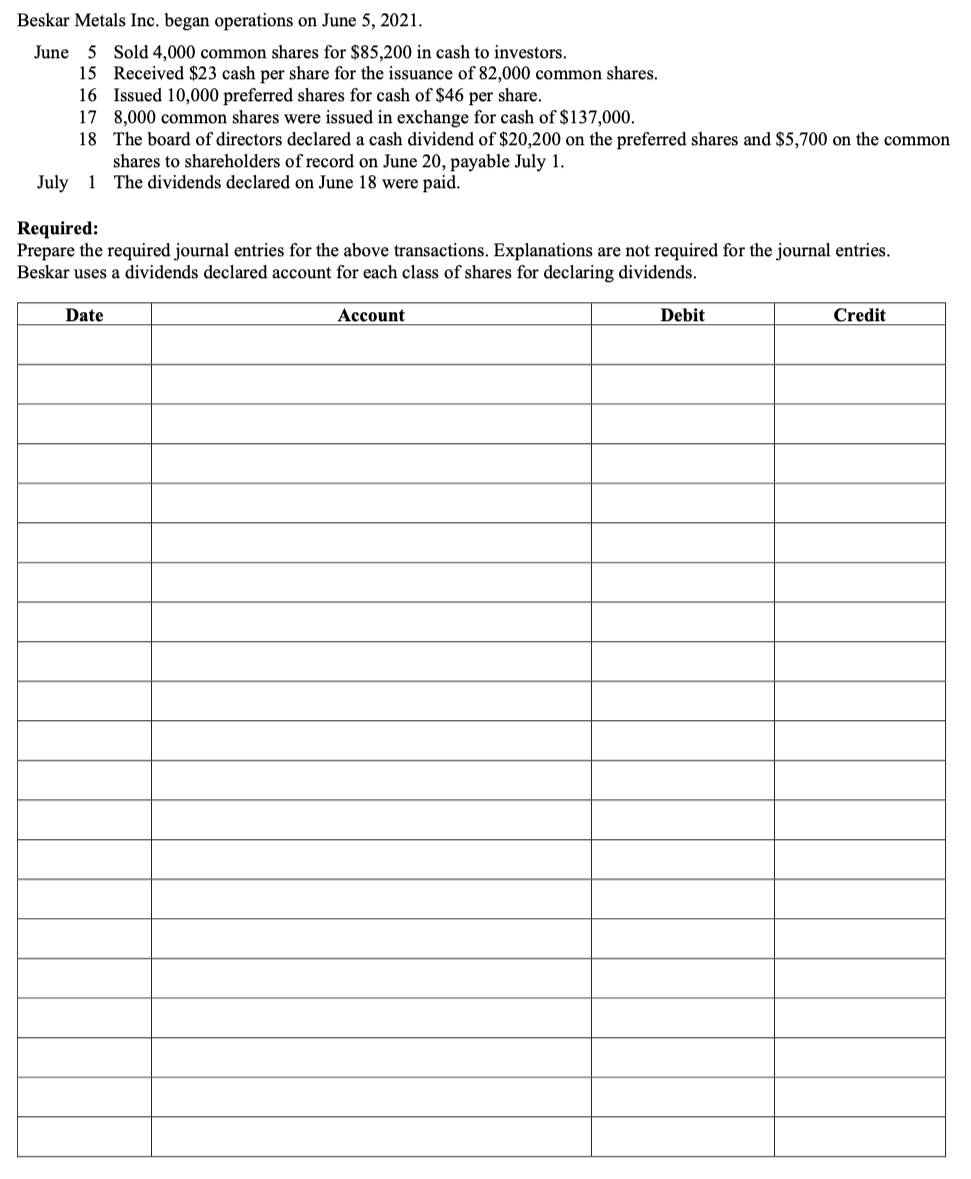

Transcribed Image Text:Beskar Metals Inc. began operations on June 5, 2021.

June 5 Sold 4,000 common shares for $85,200 in cash to investors.

15 Received $23 cash per share for the issuance of 82,000 common shares.

16 Issued 10,000 preferred shares for cash of $46 per share.

17 8,000 common shares were issued in exchange for cash of $137,000.

18 The board of directors declared a cash dividend of $20,200 on the preferred shares and $5,700 on the common

shares to shareholders of record on June 20, payable July 1.

July 1 The dividends declared on June 18 were paid.

Required:

Prepare the required journal entries for the above transactions. Explanations are not required for the journal entries.

Beskar uses a dividends declared account for each class of shares for declaring dividends.

Date

Account

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning