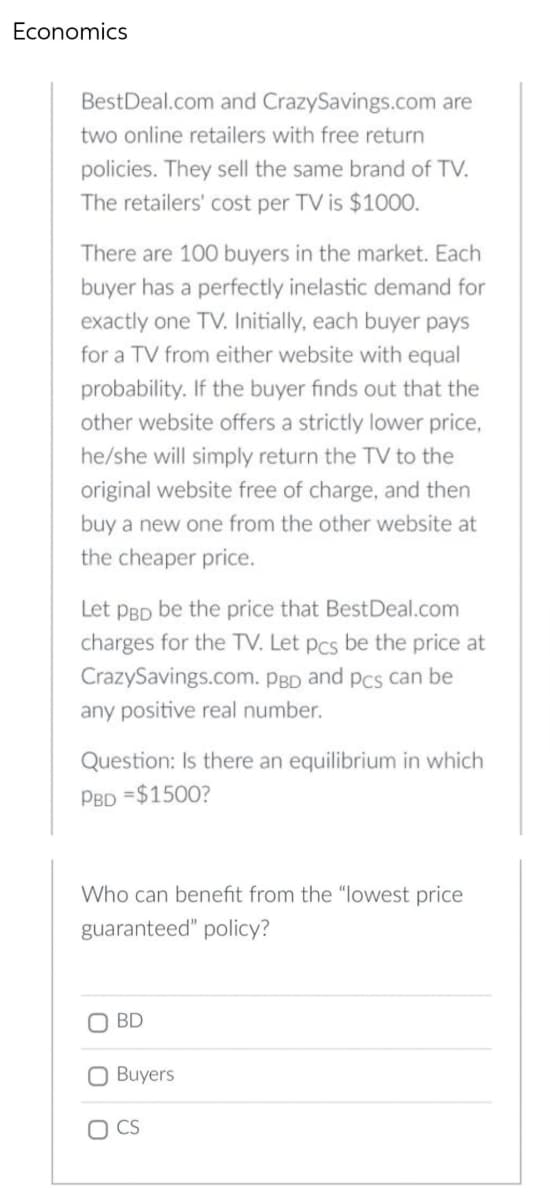

BestDeal.com and CrazySavings.com are two online retailers with free return policies. They sell the same brand of TV. The retailers' cost per TV is $1000. There are 100 buyers in the market. Each buyer has a perfectly inelastic demand for exactly one TV. Initially, each buyer pays for a TV from either website with equal probability. If the buyer finds out that the other website offers a strictly lower price, he/she will simply return the TV to the original website free of charge, and then buy a new one from the other website at the cheaper price. Let PBD be the price that BestDeal.com charges for the TV. Let pcs be the price at

BestDeal.com and CrazySavings.com are two online retailers with free return policies. They sell the same brand of TV. The retailers' cost per TV is $1000. There are 100 buyers in the market. Each buyer has a perfectly inelastic demand for exactly one TV. Initially, each buyer pays for a TV from either website with equal probability. If the buyer finds out that the other website offers a strictly lower price, he/she will simply return the TV to the original website free of charge, and then buy a new one from the other website at the cheaper price. Let PBD be the price that BestDeal.com charges for the TV. Let pcs be the price at

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

2

Transcribed Image Text:Economics

BestDeal.com and CrazySavings.com are

two online retailers with free return

policies. They sell the same brand of TV.

The retailers' cost per TV is $1000.

There are 100 buyers in the market. Each

buyer has a perfectly inelastic demand for

exactly one TV. Initially, each buyer pays

for a TV from either website with equal

probability. If the buyer finds out that the

other website offers a strictly lower price,

he/she will simply return the TV to the

original website free of charge, and then

buy a new one from the other website at

the cheaper price.

Let PBD be the price that BestDeal.com

charges for the TV. Let pcs be the price at

CrazySavings.com. PBD and pcs can be

any positive real number.

Question: Is there an equilibrium in which

PBD =$1500?

Who can benefit from the "lowest price

guaranteed" policy?

BD

O Buyers

CS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning