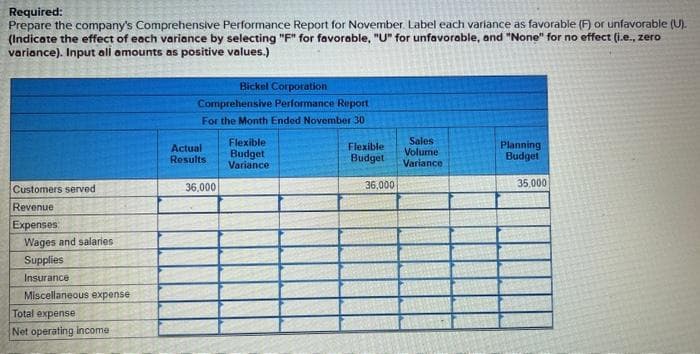

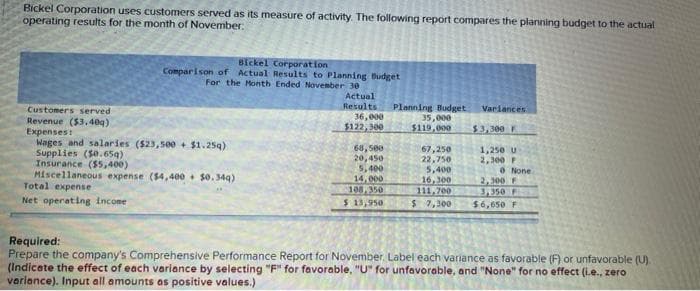

Bickel Corporation uses customers served as its measure of activity. The following report compares the planning budget to the actual operating results for the month of November: Customers served Revenue ($3.40q) Bickel Corporation Comparison of Actual Results to Planning Budget For the Month Ended November 30 Expenses: Wages and salaries ($23,500+ $1.254) Supplies ($0.654) Insurance ($5,400) Miscellaneous expense ($4,400+ $0.344) Total expense Net operating income Actual Results 36,000 $122,300 68,500 20,450 5,400 14,000 108,350 $ 13,950 Planning Budget 35,000 $119,000 67,250 22,750 5,400 16,300 111,700 $ 7,300 Variances $3,300 F 1,250 U 2,300 P 0 None 2,300 F 3,350 F $6,650 F equired: repare the company's Comprehensive Performance Report for November. Label each variance as favorable (F) or unfavorable (U). dicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (i.e., zero prinnce). Input all amounts os positive values)

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Please do not give solution in image format thanku

Trending now

This is a popular solution!

Step by step

Solved in 2 steps