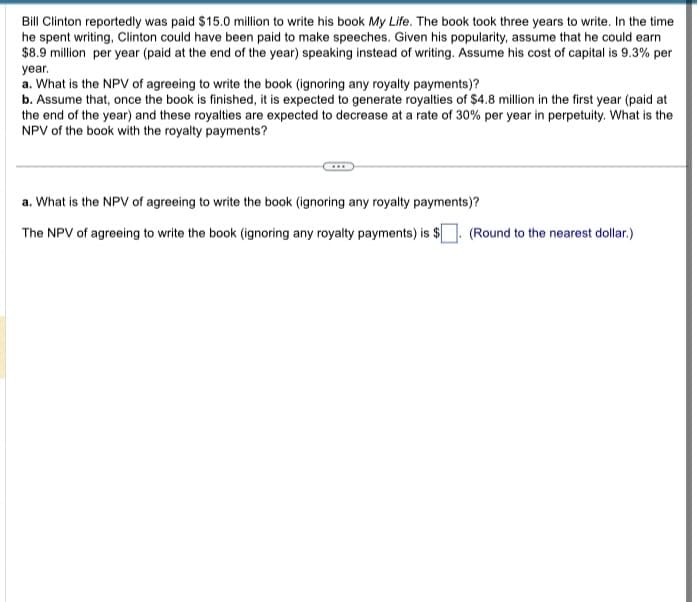

Bill Clinton reportedly was paid $15.0 million to write his book My Life. The book took three years to write. In the time he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn $8.9 million per year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.3% per year. a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? b. Assume that, once the book is finished, it is expected to generate royalties of $4.8 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments? a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? The NPV of agreeing to write the book (ignoring any royalty payments) is $. (Round to the nearest dollar.)

Bill Clinton reportedly was paid $15.0 million to write his book My Life. The book took three years to write. In the time he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn $8.9 million per year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.3% per year. a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? b. Assume that, once the book is finished, it is expected to generate royalties of $4.8 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments? a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? The NPV of agreeing to write the book (ignoring any royalty payments) is $. (Round to the nearest dollar.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Transcribed Image Text:Bill Clinton reportedly was paid $15.0 million to write his book My Life. The book took three years to write. In the time

he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn

$8.9 million per year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 9.3% per

year.

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

b. Assume that, once the book is finished, it is expected to generate royalties of $4.8 million in the first year (paid at

the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the

NPV of the book with the royalty payments?

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

The NPV of agreeing to write the book (ignoring any royalty payments) is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning