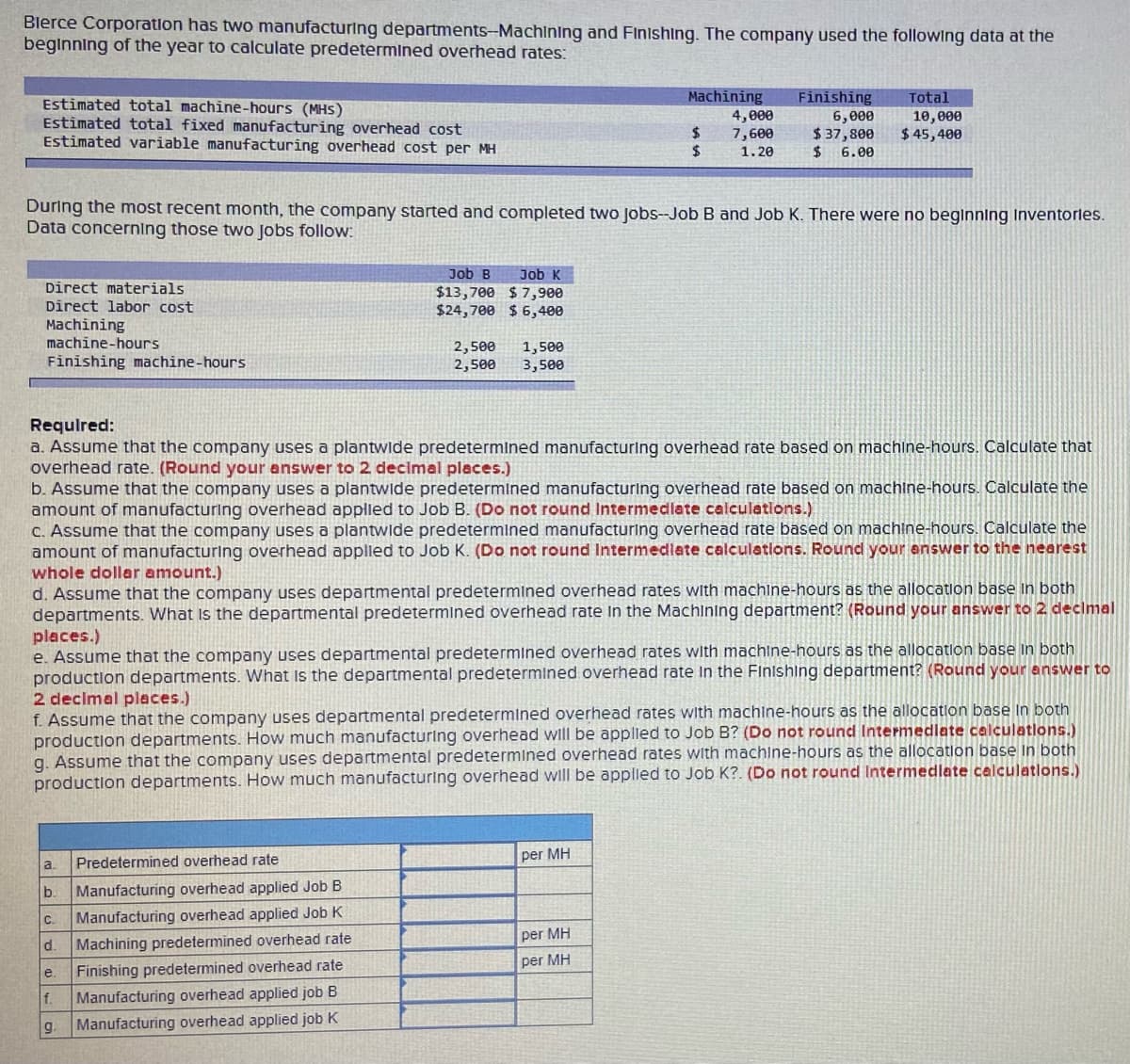

Blerce Corporation has two manufacturing departments-Machining and Finishing. The company used the following data at the beglnning of the year to calculate predetermined overhead rates: Machining 4,000 7,600 1.20 Finishing 6,000 $37,800 $ 6.00 Total Estimated total machine-hours (MHS) Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per MH 10,000 $ 45,400 %24 24

Blerce Corporation has two manufacturing departments-Machining and Finishing. The company used the following data at the beglnning of the year to calculate predetermined overhead rates: Machining 4,000 7,600 1.20 Finishing 6,000 $37,800 $ 6.00 Total Estimated total machine-hours (MHS) Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per MH 10,000 $ 45,400 %24 24

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 3CE: Lansing. Inc., provided the following data for its two producing departments: Machine hours are used...

Related questions

Question

14

Transcribed Image Text:Blerce Corporatlon has two manufacturing departments-Machining and Finishing. The company used the followIng data at the

beglnning of the year to calculate predetermined overhead rates:

Machining

Finishing

6,000

$ 37,800

$ 6.00

Total

Estimated total machine-hours (MHS)

Estimated total fixed manufacturing overhead cost

Estimated variable manufacturing overhead cost per MH

%24

24

4,000

7,600

1. 20

10,000

$ 45,400

During the most recent month, the company started and completed two Jobs-Job B and Job K. There were no beglnning Inventorles.

Data concerning those two Jobs follow:

Job B

Job K

$13,700 $7,900

$24,700 $ 6,400

Direct materials

Direct labor cost

Machining

machine-hours

Finishing machine-hours

2,500

2,500

1,500

3,500

Requlred:

a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that

overhead rate. (Round your answer to 2 decimal places.)

b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the

amount of manufacturing overhead applled to Job B. (Do not round Intermedlate calculations.)

C. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the

amount of manufacturing overhead applled to Job K. (Do not round Intermedlate calculations. Rounc your enswer to the nearest

whole dollar amount.)

d. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both

departments. What Is the departmental predetermined overhead rate In the Machining department? (Round your answer to 2 decimal

places.)

e. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both

production departments. What Is the departmental predetermined overhead rate In the Finishing department? (Round your answer to

2 declmal places.)

f. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base In both

production departments. How much manufacturing overhead wll be applled to Job B? (Do not round Intermedlate celculatlons.)

g. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both

production departments. How much manufacturing overhead will be appled to Job K?. (Do not round Intermedlate celculatlons.)

Predetermined overhead rate

per MH

a.

b.

Manufacturing overhead applied Job B

C.

Manufacturing overhead applied Job K

per MH

d.

Machining predetermined overhead rate

per MH

Finishing predetermined overhead rate

f.

Manufacturing overhead applied job B

g.

Manufacturing overhead applied job K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,