me tax and no other state or local taxes. In 2019, they received a $1,800 refund of the state income taxes that they paid in andard deduction for married filing jointly in 2018 was $24,000. x benefit rule, what amount of the state income tax refund is included in gross income in 2019? IX

me tax and no other state or local taxes. In 2019, they received a $1,800 refund of the state income taxes that they paid in andard deduction for married filing jointly in 2018 was $24,000. x benefit rule, what amount of the state income tax refund is included in gross income in 2019? IX

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 30CE

Related questions

Question

subject - Accounting

Transcribed Image Text:Exercise 5-26 (LO. 3)

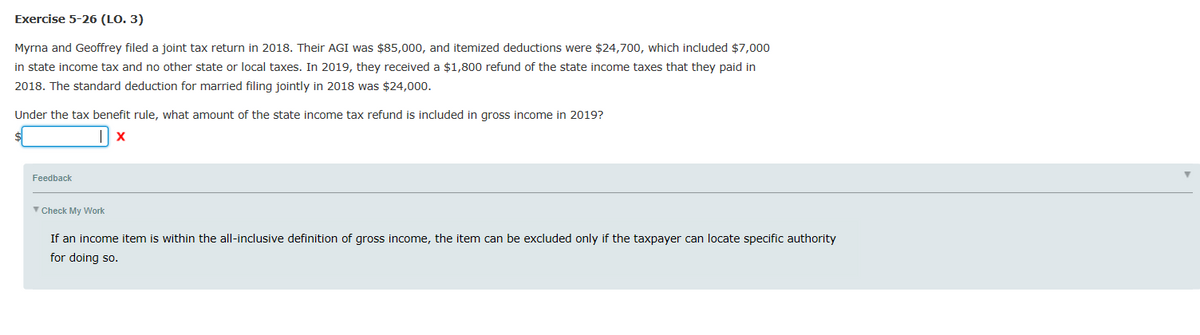

Myrna and Geoffrey filed a joint tax return in 2018. Their AGI was $85,000, and itemized deductions were $24,700, which included $7,000

in state income tax and no other state or local taxes. In 2019, they received a $1,800 refund of the state income taxes that they paid in

2018. The standard deduction for married filing jointly in 2018 was $24,000.

Under the tax benefit rule, what amount of the state income tax refund is included in gross income in 2019?

|x

Feedback

✓ Check My Work

If an income item is within the all-inclusive definition of gross income, the item can be excluded only if the taxpayer can locate specific authority

for doing so.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning