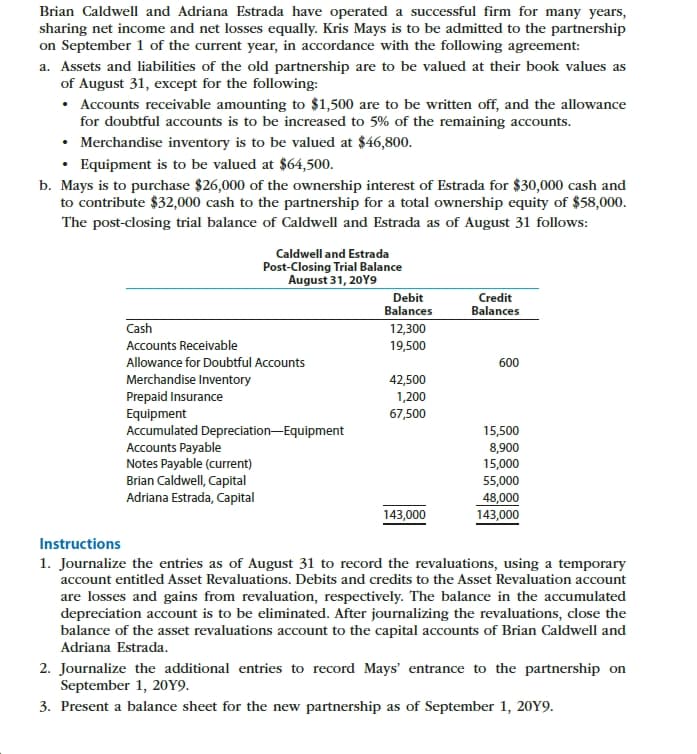

Brian Caldwell and Adriana Estrada have operated a successful firm for many years, sharing net income and net losses equally. Kris Mays is to be admitted to the partnership on September 1 of the current year, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at their book values as of August 31, except for the following: • Accounts receivable amounting to $1,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts. • Merchandise inventory is to be valued at $46,800. • Equipment is to be valued at $64,500. b. Mays is to purchase $26,000 of the ownership interest of Estrada for $30,000 cash and to contribute $32,000 cash to the partnership for a total ownership equity of $58,000. The post-closing trial balance of Caldwell and Estrada as of August 31 follows: Caldwell and Estrada Post-Closing Trial Balance August 31, 20Y9 Debit Balances Credit Balances Cash 12,300 Accounts Receivable 19,500 Allowance for Doubtful Accounts 600 Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Notes Payable (current) Brian Caldwell, Capital Adriana Estrada, Capital 42,500 1,200 67,500 15,500 8,900 15,000 55,000 48,000 143,000 143,000 Instructions 1. Journalize the entries as of August 31 to record the revaluations, using a temporary account entitled Asset Revaluations. Debits and credits to the Asset Revaluation account are losses and gains from revaluation, respectively. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Brian Caldwell and Adriana Estrada. 2. Journalize the additional entries to record Mays' entrance to the partnership on September 1, 20Y9. 3. Present a balance sheet for the new partnership as of September 1, 20Y9.

Brian Caldwell and Adriana Estrada have operated a successful firm for many years, sharing net income and net losses equally. Kris Mays is to be admitted to the partnership on September 1 of the current year, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at their book values as of August 31, except for the following: • Accounts receivable amounting to $1,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts. • Merchandise inventory is to be valued at $46,800. • Equipment is to be valued at $64,500. b. Mays is to purchase $26,000 of the ownership interest of Estrada for $30,000 cash and to contribute $32,000 cash to the partnership for a total ownership equity of $58,000. The post-closing trial balance of Caldwell and Estrada as of August 31 follows: Caldwell and Estrada Post-Closing Trial Balance August 31, 20Y9 Debit Balances Credit Balances Cash 12,300 Accounts Receivable 19,500 Allowance for Doubtful Accounts 600 Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Notes Payable (current) Brian Caldwell, Capital Adriana Estrada, Capital 42,500 1,200 67,500 15,500 8,900 15,000 55,000 48,000 143,000 143,000 Instructions 1. Journalize the entries as of August 31 to record the revaluations, using a temporary account entitled Asset Revaluations. Debits and credits to the Asset Revaluation account are losses and gains from revaluation, respectively. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Brian Caldwell and Adriana Estrada. 2. Journalize the additional entries to record Mays' entrance to the partnership on September 1, 20Y9. 3. Present a balance sheet for the new partnership as of September 1, 20Y9.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Brian Caldwell and Adriana Estrada have operated a successful firm for many years,

sharing net income and net losses equally. Kris Mays is to be admitted to the partnership

on September 1 of the current year, in accordance with the following agreement:

a. Assets and liabilities of the old partnership are to be valued at their book values as

of August 31, except for the following:

• Accounts receivable amounting to $1,500 are to be written off, and the allowance

for doubtful accounts is to be increased to 5% of the remaining accounts.

• Merchandise inventory is to be valued at $46,800.

• Equipment is to be valued at $64,500.

b. Mays is to purchase $26,000 of the ownership interest of Estrada for $30,000 cash and

to contribute $32,000 cash to the partnership for a total ownership equity of $58,000.

The post-closing trial balance of Caldwell and Estrada as of August 31 follows:

Caldwell and Estrada

Post-Closing Trial Balance

August 31, 20Y9

Debit

Balances

Credit

Balances

Cash

12,300

Accounts Receivable

19,500

Allowance for Doubtful Accounts

600

Merchandise Inventory

Prepaid Insurance

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Notes Payable (current)

Brian Caldwell, Capital

Adriana Estrada, Capital

42,500

1,200

67,500

15,500

8,900

15,000

55,000

48,000

143,000

143,000

Instructions

1. Journalize the entries as of August 31 to record the revaluations, using a temporary

account entitled Asset Revaluations. Debits and credits to the Asset Revaluation account

are losses and gains from revaluation, respectively. The balance in the accumulated

depreciation account is to be eliminated. After journalizing the revaluations, close the

balance of the asset revaluations account to the capital accounts of Brian Caldwell and

Adriana Estrada.

2. Journalize the additional entries to record Mays' entrance to the partnership on

September 1, 20Y9.

3. Present a balance sheet for the new partnership as of September 1, 20Y9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning