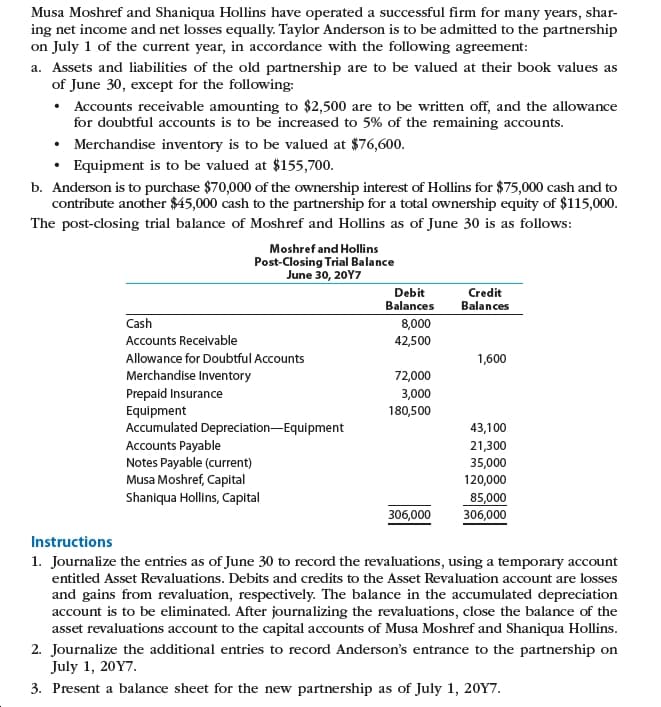

Musa Moshref and Shaniqua Hollins have operated a successful firm for many years, shar- ing net income and net losses equally. Taylor Anderson is to be admitted to the partnership on July 1 of the current year, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at their book values as of June 30, except for the following: Accounts receivable amounting to $2,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts. • Merchandise inventory is to be valued at $76,600. Equipment is to be valued at $155,700. b. Anderson is to purchase $70,000 of the ownership interest of Hollins for $75,000 cash and to contribute another $45,000 cash to the partnership for a total ownership equity of $115,000. The post-closing trial balance of Moshref and Hollins as of June 30 is as follows: Moshref and Hollins Post-Closing Trial Balance June 30, 20Y7 Debit Balances Credit Balances Cash 8,000 Accounts Receivable 42,500 Allowance for Doubtful Accounts 1,600 Merchandise Inventory 72,000 Prepaid Insurance Equipment Accumulated Depreciation-Equipment 3,000 180,500 43,100 Accounts Payable Notes Payable (current) Musa Moshref, Capital Shaniqua Hollins, Capital 21,300 35,000 120,000 85,000 306,000 306,000 Instructions 1. Journalize the entries as of June 30 to record the revaluations, using a temporary account entitled Asset Revaluations. Debits and credits to the Asset Revaluation account are losses and gains from revaluation, respectively. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Musa Moshref and Shaniqua Hollins. 2. Journalize the additional entries to record Anderson's entrance to the partnership on July 1, 20Y7. 3. Present a balance sheet for the new partnership as of July 1, 20Y7.

Musa Moshref and Shaniqua Hollins have operated a successful firm for many years, shar- ing net income and net losses equally. Taylor Anderson is to be admitted to the partnership on July 1 of the current year, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at their book values as of June 30, except for the following: Accounts receivable amounting to $2,500 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts. • Merchandise inventory is to be valued at $76,600. Equipment is to be valued at $155,700. b. Anderson is to purchase $70,000 of the ownership interest of Hollins for $75,000 cash and to contribute another $45,000 cash to the partnership for a total ownership equity of $115,000. The post-closing trial balance of Moshref and Hollins as of June 30 is as follows: Moshref and Hollins Post-Closing Trial Balance June 30, 20Y7 Debit Balances Credit Balances Cash 8,000 Accounts Receivable 42,500 Allowance for Doubtful Accounts 1,600 Merchandise Inventory 72,000 Prepaid Insurance Equipment Accumulated Depreciation-Equipment 3,000 180,500 43,100 Accounts Payable Notes Payable (current) Musa Moshref, Capital Shaniqua Hollins, Capital 21,300 35,000 120,000 85,000 306,000 306,000 Instructions 1. Journalize the entries as of June 30 to record the revaluations, using a temporary account entitled Asset Revaluations. Debits and credits to the Asset Revaluation account are losses and gains from revaluation, respectively. The balance in the accumulated depreciation account is to be eliminated. After journalizing the revaluations, close the balance of the asset revaluations account to the capital accounts of Musa Moshref and Shaniqua Hollins. 2. Journalize the additional entries to record Anderson's entrance to the partnership on July 1, 20Y7. 3. Present a balance sheet for the new partnership as of July 1, 20Y7.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Musa Moshref and Shaniqua Hollins have operated a successful firm for many years, shar-

ing net income and net losses equally. Taylor Anderson is to be admitted to the partnership

on July 1 of the current year, in accordance with the following agreement:

a. Assets and liabilities of the old partnership are to be valued at their book values as

of June 30, except for the following:

Accounts receivable amounting to $2,500 are to be written off, and the allowance

for doubtful accounts is to be increased to 5% of the remaining accounts.

• Merchandise inventory is to be valued at $76,600.

Equipment is to be valued at $155,700.

b. Anderson is to purchase $70,000 of the ownership interest of Hollins for $75,000 cash and to

contribute another $45,000 cash to the partnership for a total ownership equity of $115,000.

The post-closing trial balance of Moshref and Hollins as of June 30 is as follows:

Moshref and Hollins

Post-Closing Trial Balance

June 30, 20Y7

Debit

Balances

Credit

Balances

Cash

8,000

Accounts Receivable

42,500

Allowance for Doubtful Accounts

1,600

Merchandise Inventory

72,000

Prepaid Insurance

Equipment

Accumulated Depreciation-Equipment

3,000

180,500

43,100

Accounts Payable

Notes Payable (current)

Musa Moshref, Capital

Shaniqua Hollins, Capital

21,300

35,000

120,000

85,000

306,000

306,000

Instructions

1. Journalize the entries as of June 30 to record the revaluations, using a temporary account

entitled Asset Revaluations. Debits and credits to the Asset Revaluation account are losses

and gains from revaluation, respectively. The balance in the accumulated depreciation

account is to be eliminated. After journalizing the revaluations, close the balance of the

asset revaluations account to the capital accounts of Musa Moshref and Shaniqua Hollins.

2. Journalize the additional entries to record Anderson's entrance to the partnership on

July 1, 20Y7.

3. Present a balance sheet for the new partnership as of July 1, 20Y7.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage