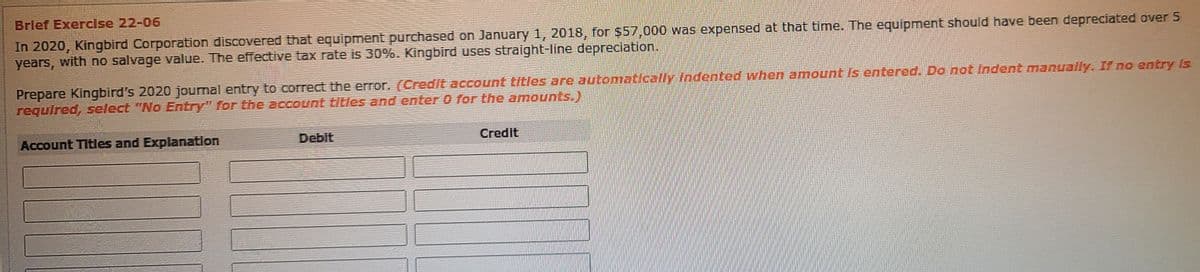

Brief Exercise 22-06 In 2020, Kingbird Corporation discovered that equipment purchased on January 1, 2018, for $57,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Kingbird uses straight-line depreciation. Prepare Kingbird's 2020 journal entry to correct the error. (Credit account titles are automatically Indented when amount is entered. Do not Indent manualy. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Brief Exercise 22-06 In 2020, Kingbird Corporation discovered that equipment purchased on January 1, 2018, for $57,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Kingbird uses straight-line depreciation. Prepare Kingbird's 2020 journal entry to correct the error. (Credit account titles are automatically Indented when amount is entered. Do not Indent manualy. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8MC: On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was...

Related questions

Question

Transcribed Image Text:Brlef Exercise 22-06

In 2020, Kingbird Corporation discovered that equipment purchased on January 1, 2018, for $57,000 was expensed at that time. The equipment should have been depreciated over 5

years, with no salvage value. The effective tax rate is 30%. Kingbird uses straight-line depreciation.

Prepare Kingbird's 2020 journal entry to correct the error. (CrediIt account titles are automatically Indented when amount Is entered. Do not Indent manually. If no entry Is

required, select "No Entry" for the account titles and enter0 for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

Step 1

From 2018 to 2020, Equipment has been used for 2 years.

In 2018, Equipment was expensed for 57,000 but now it should have been expensed for only $22,800 (2-year depreciation).

The overcharged expense also leads to less tax which was $17,100 (57,000*30%). Now tax liability occurs for 3 years life left for the equipment, ie $10,260 (17,100 * 3/5).

The balance would go the Retained Earnings, (it is a difference of increase in income as an expense of equipment has been reduced and decrease in income as expense of tax has been increased).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,