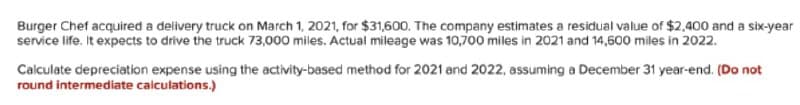

Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a December 31 year-end. (Do not round intermediate calculations.)

Q: QUESTION 2 Mark is a U.S. veteran who served in the U.S. Army and is receiving $10,000 annually in…

A: US veteran who served in US army have many benefits in taxation and specially if there are receiving…

Q: The following information was extracted from the records of SydMel Ltd for the year ended 30 June…

A: CONCEPT A Deferred Tax in form of asset or liability need to be recognized when there is difference…

Q: For puposes of computing the weighted average number of shares outstanding during the year, a…

A: Shares outstanding refer to the amount of stock of a business that is currently held by all of its…

Q: In the accounting process, financial statements must be prepared _________ A. After the adjusting…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: A former longstanding client of an accounting practice is being investigated by the tax authorities.…

A: Needs understand Professional ethics under given situation which lead us to correct selection of…

Q: lease help me to solve this problem

A: A budget is used in forecasting to determine supplier payments, and receipts from customers which in…

Q: 1- Payroll tax liability payments . А. Should be entered through pay bills. В. Can be entered…

A: In the process of recording transactions related to a business, every aspect of payment incurred and…

Q: 1. Property taxes on the factory building. 2. Production superintendents' salaries. 3. Memory boards…

A: The direct materials are the materials used for production process directly. The direct labor…

Q: Prepare a cash budget for September, October, November, and December. Enter all amounts as positive…

A: A cash budget is a statement showing the expected cash receipts and cash payments during a given…

Q: Below are the financial statements for Aspirations Pty Ltd. Statement of Financial Position at 30…

A: Formula to calculate the ratios 1. Net Income margin ratio = (Net income / Revenue) x 100 2.…

Q: Lambert Corporation sells merchandise at a list price of $70,000 with accompanying terms of 2/10, n/…

A: Every business should be documented in at least two locations, according to the logic of a journal…

Q: [17] Monetary-unit sampling (MUS) can be used to project the A. Monetary amount of error in a…

A: MUS (monetary-unit sampling) is a quantitative sampling approach for determining the amount of…

Q: the cash method of accounting is generally selected by the very small firm that wants to help its…

A: Under the cash basis of accounting, the revenues and expenses are recorded as and when it is…

Q: Grand Champion Inc. purchased America’s Sweethearts Corporation On January 1, 2019. At the time,…

A: The technique of integrating many business divisions of a company into a bigger organization is…

Q: Mimi and Gigi are partners sharing profits and losses in the ratio of 2:3 with capitals of 9,000 and…

A: The purchase of interest of old partners is recorded in the books but cash payment to purchase the…

Q: 1. How would you suggest the standard-setter or the regulator mitigate the potensial decrease in…

A: Here asked about the standard setter or the regulator mitigate the potential in the decrease in the…

Q: The Kyle Manufacturing Company produces various types of fertilizers. No beginning work in process…

A:

Q: when a company receives a deposit from a customer to protect itself against nonpayment for future…

A: Revenue is the amount of money created by typical business operations and is determined by…

Q: a. Entry to record the admission of the new partners. b. What is the interest of each partner in the…

A: Admission of a partner into the partnership means one more partner into partnership business which…

Q: How did they come up with the value 619,417 for PV of Benefits for the year 2015 using the formula…

A: The question is related to Time value of money. Present Value will be calculated with the help of…

Q: Your calendar year company places a $85,000 inventory order December 27 which shipped to your…

A: FOB Shipping Point: As per FOB Shipping Point, the buyer is responsible for goods damaged if any in…

Q: Miami Solar manufactures solar panels for industrial use. The company budgets production of 4,500…

A: Budgets are prepared to estimate the expected revenue and expenses. The direct labor budget can be…

Q: On January 2018, school bags for Tk. 1,00,000 and sold it to Arif Ltd for Tk. 1,20,000. Using these…

A: Needs to Calculated the Vat on the chain of transaction. Concept of Vat is to be use that value…

Q: Rand Company’s payroll on December 31 of the current year is as follows: Prepare the journal entries…

A: Payroll is the salary that a company is required to pay to its workers for a set period of time or…

Q: On July 1, Davidson Corporation had the following capital structure: Common stock ( $4 par value)…

A: In the context of the given question, two independent cases are there. In case no. 1, the Board of…

Q: When determining the estimated useful life of an intangible asset which factor is NOT important to…

A: The question is related to the Accounting for Intangible Assets. The intangible assets can have…

Q: There is a firm, which we have identified to buy. It has $100 million, $30 and $70 m assets, equity…

A: Answer:- Meaning of acquisition:- Acquisition is the process where one firm buys the majority…

Q: On September 1, 2021, Allied Moving Corp. borrows $90,000 cash from First National Bank. Alled signs…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: An asset is purchased at a cost of P110 000 on 1 January 2016. The asset has a useful of 10 years.…

A: Introduction: Depreciation : Decreasing value of fixed assets over its useful life period called as…

Q: 7- Presented below is selected information related to Sultan Company at December 31, 2020. Sultan…

A: The net income is calculated as difference between revenue and expenses of the current period.

Q: Problem 7-22 Adoption Expenses (LO 77) Carl and Jenny adopt a Korean orphan. The adoption takes 2…

A: Given: Adoption expenses in 2020 = $7000 Adoption expenses in 2021 = $7,500 Carl and Jenny have AGI…

Q: ABC Technologies has been growing quite rapidly in recent years and has a growth potential of 27%…

A: In the context of the given question, we can solve the question by using the Walter Model. The…

Q: The following selected events occurred for Orwell Company during the first quarter of 2019: 1.…

A: Journal entries are the cornerstone of the double accounting system, which has been used for…

Q: 2) A purchase of equipment for $18 000 also involved freight charges of $500 and installation costs…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life

Q: ebits and total credits in the income statement column has to be the same as the difference between…

A: A worksheet (sometimes known as a spreadsheet) is made up of cells into which data may be entered…

Q: Contrast the effects that LIFO vs. FIFO would have on ending inventory, net income and cash flow in…

A: Inventory Valuation There are many methods which are used to measure the inventory valuation in the…

Q: Caring Shop is a gift shop located in The Natural History Museum. Caring shop has annual sales…

A: Answer:- Tax definition:- Taxes are one of most important and necessary payment levied by the…

Q: Operating profit 43-7 Sales revenue 910-4 Share capital and reserves 182-3 Long-term borrowing 77.9…

A: Formula: Current ratio = Current Assets / Current liabilities

Q: Statement of profit or loss and other comprehensive income for Wiley Ltd for the year ending 30 June…

A: The question is related to Operating Cycle and Cash Operating Cycle. 1. Operating Cycle :-The…

Q: Which of the following statements is prepared by all not-for-profit organizations? O Satement of…

A: For non for profit organization the company shall prepare the fund flow statement showing the…

Q: Reporting a Note Payable Using the Fair Value Option On January 1, 2020, Nakoma Inc. issued an 8%…

A: Unrealized Profits: Unrealized profit is an amount which is not yet realized to the company as the…

Q: Required: Prepare the November bank reconciliation. Assume the error is committed by XYZ Co.

A: There are two type of cash balances that is being used and recorded in business. These are cash…

Q: Practice 1. solve for the Efficiency of the Given Company aple Company Statement of Financial…

A: The question is related to Efficiency Ratio. The Efficiency ratio are also known as performance…

Q: Caring Shop is a gift shop located in The Natural History Museum. Caring shop has annual sales…

A: A museum is a place where all the antique collections are displayed for sale. Therefore the…

Q: Required: Use the step method to allocate the service costs, using the following: a. The order of…

A: Solution:- a)Allocate the costs of service departments using step down method as follows under:-…

Q: 1) A monthly depreciation expense of $600 is recorded on a truck that was purchased for $27 000 and…

A: Formula: Depreciation rate = ( Annual depreciation expense / Depreciable value ) x 100

Q: Caring Shop is a gift shop located in The Natural History Museum. Caring shop has annual sales…

A: Endowment income reinvested in the endowment fund us exempt from tax

Q: Goldfish partnership has 3 partners, Susan, Tina, and Vivian. Each partner has a basis in her…

A: A business partnership is a sort of commercial entity in which two or more people or entities own…

Q: Which of the following statements is NOT CORRECT relative to source documents? a. The internally…

A: Source documents are those documents which are provided as evidence that a particular transaction…

Q: At December 31, 2022. the following information (in thousands) was available for Swifty Inc: ending…

A: Formula: Inventory turnover = Cost of goods sold / Average inventory

Step by step

Solved in 2 steps

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.

- At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.

- Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.