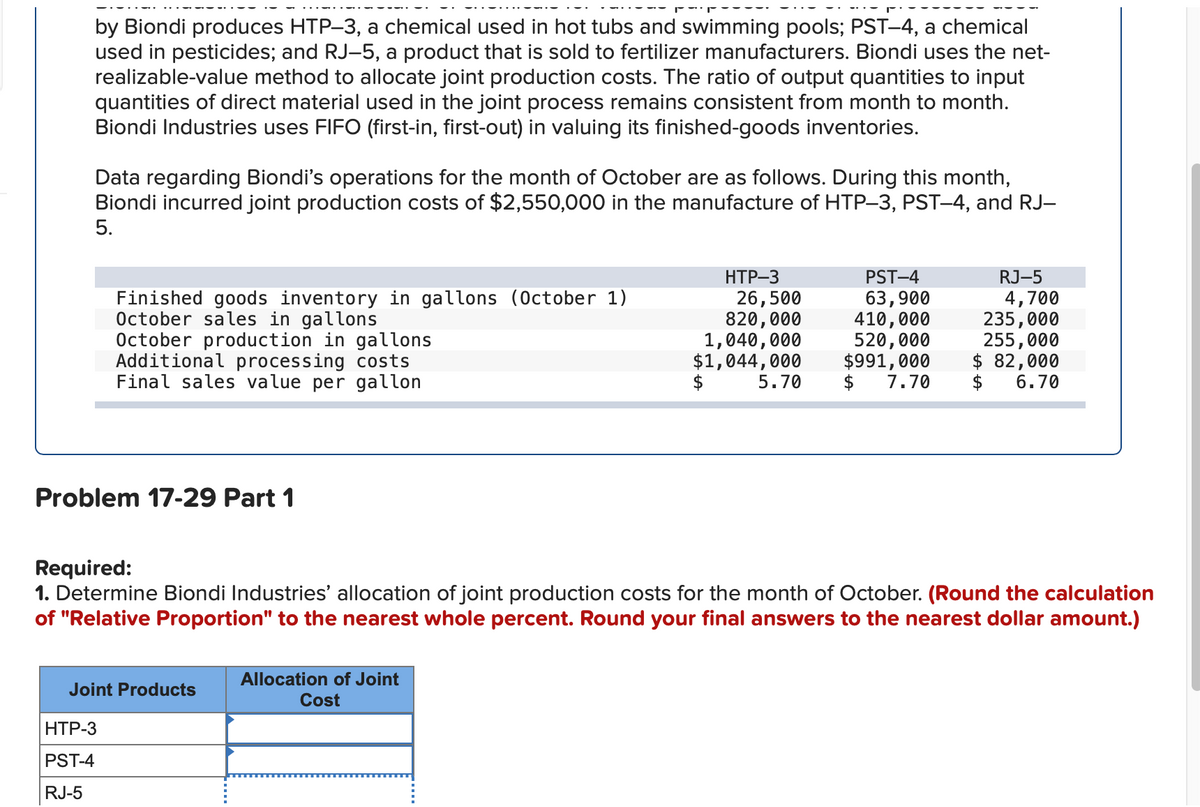

by Biondi produces HTP-3, a chemical used in hot tubs and swimming pools; PST-4, a chemical used in pesticides; and RJ-5, a product that is sold to fertilizer manufacturers. Biondi uses the net- realizable-value method to allocate joint production costs. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. Biondi Industries uses FIFO (first-in, first-out) in valuing its finished-goods inventories. Data regarding Biondi's operations for the month of October are as follows. During this month, Biondi incurred joint production costs of $2,550,000 in the manufacture of HTP-3, PST-4, and RJ- 5. Finished goods inventory in gallons (October 1) October sales in gallons October production in gallons Additional processing costs Final sales value per gallon Problem 17-29 Part 1 HTP-3 PST-4 RJ-5 Joint Products HTP-3 26,500 820,000 1,040,000 $1,044,000 5.70 Required: 1. Determine Biondi Industries' allocation of joint production costs for the month of October. (Round the calculation of "Relative Proportion" to the nearest whole percent. Round your final answers to the nearest dollar amount.) Allocation of Joint Cost $ PST-4 63,900 RJ-5 4,700 410,000 235,000 520,000 255,000 $991,000 $82,000 $ 7.70 $ 6.70

by Biondi produces HTP-3, a chemical used in hot tubs and swimming pools; PST-4, a chemical used in pesticides; and RJ-5, a product that is sold to fertilizer manufacturers. Biondi uses the net- realizable-value method to allocate joint production costs. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. Biondi Industries uses FIFO (first-in, first-out) in valuing its finished-goods inventories. Data regarding Biondi's operations for the month of October are as follows. During this month, Biondi incurred joint production costs of $2,550,000 in the manufacture of HTP-3, PST-4, and RJ- 5. Finished goods inventory in gallons (October 1) October sales in gallons October production in gallons Additional processing costs Final sales value per gallon Problem 17-29 Part 1 HTP-3 PST-4 RJ-5 Joint Products HTP-3 26,500 820,000 1,040,000 $1,044,000 5.70 Required: 1. Determine Biondi Industries' allocation of joint production costs for the month of October. (Round the calculation of "Relative Proportion" to the nearest whole percent. Round your final answers to the nearest dollar amount.) Allocation of Joint Cost $ PST-4 63,900 RJ-5 4,700 410,000 235,000 520,000 255,000 $991,000 $82,000 $ 7.70 $ 6.70

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 13P: Venezuela Oil Inc. transports crude oil to its refinery where it is processed into main products...

Related questions

Question

Transcribed Image Text:by Biondi produces HTP-3, a chemical used in hot tubs and swimming pools; PST-4, a chemical

used in pesticides; and RJ–5, a product that is sold to fertilizer manufacturers. Biondi uses the net-

realizable-value method to allocate joint production costs. The ratio of output quantities to input

quantities of direct material used in the joint process remains consistent from month to month.

Biondi Industries uses FIFO (first-in, first-out) in valuing its finished-goods inventories.

Data regarding Biondi's operations for the month of October are as follows. During this month,

Biondi incurred joint production costs of $2,550,000 in the manufacture of HTP–3, PST–4, and RJ-

5.

Finished goods inventory in gallons (October 1)

October sales in gallons

October production in gallons

Additional processing costs

Final sales value per gallon

Problem 17-29 Part 1

HTP-3

PST-4

RJ-5

Joint Products

HTP-3

26,500

820,000

1,040,000

$1,044,000

5.70

Required:

1. Determine Biondi Industries' allocation of joint production costs for the month of October. (Round the calculation

of "Relative Proportion" to the nearest whole percent. Round your final answers to the nearest dollar amount.)

Allocation of Joint

Cost

PST-4

63,900

410,000

520,000

$991,000

7.70

RJ-5

4,700

235,000

255,000

$82,000

$ 6.70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College