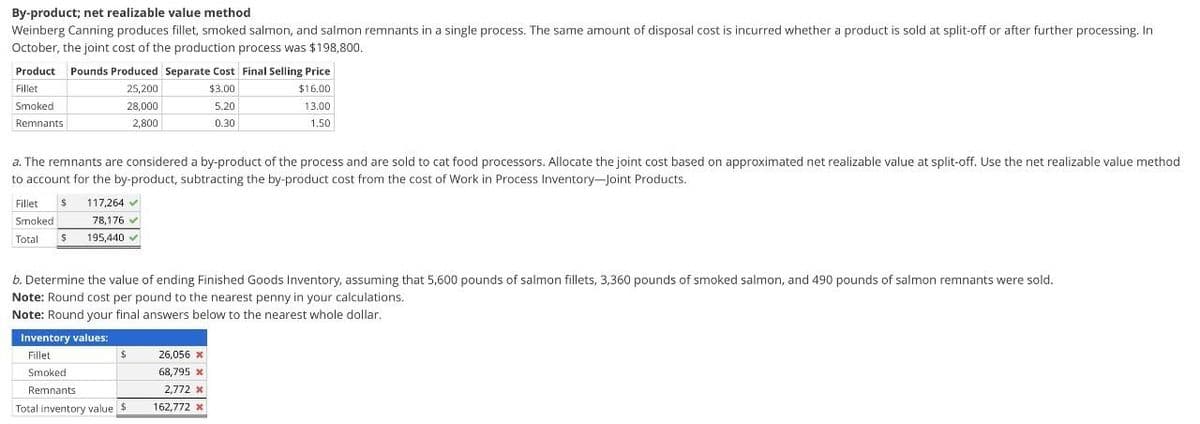

By-product; net realizable value method Weinberg Canning produces fillet, smoked salmon, and salmon remnants in a single process. The same amount of disposal cost is incurred whether a product is sold at split-off or after further processing. In October, the joint cost of the production process was $198,800. Product Pounds Produced Separate Cost Final Selling Price 25,200 28,000 2,800 $3.00 5.20 0.30 $16.00 13.00 1.50 Fillet Smoked Remnants a. The remnants are considered a by-product of the process and are sold to cat food processors. Allocate the joint cost based on approximated net realizable value at split-off. Use the net realizable value method to account for the by-product, subtracting the by-product cost from the cost of Work in Process Inventory-Joint Products. $ Fillet Smoked Total $ 117,264 78,176 195,440 b. Determine the value of ending Finished Goods Inventory, assuming that 5,600 pounds of salmon fillets, 3,360 pounds of smoked salmon, and 490 pounds of salmon remnants were sold. Note: Round cost per pound to the nearest penny in your calculations. Note: Round your final answers below to the nearest whole dollar. Inventory values: Fillet Smoked Remnants Total inventory value $ $ 26,056 x 68,795 x 2,772 x 162,772 x

By-product; net realizable value method Weinberg Canning produces fillet, smoked salmon, and salmon remnants in a single process. The same amount of disposal cost is incurred whether a product is sold at split-off or after further processing. In October, the joint cost of the production process was $198,800. Product Pounds Produced Separate Cost Final Selling Price 25,200 28,000 2,800 $3.00 5.20 0.30 $16.00 13.00 1.50 Fillet Smoked Remnants a. The remnants are considered a by-product of the process and are sold to cat food processors. Allocate the joint cost based on approximated net realizable value at split-off. Use the net realizable value method to account for the by-product, subtracting the by-product cost from the cost of Work in Process Inventory-Joint Products. $ Fillet Smoked Total $ 117,264 78,176 195,440 b. Determine the value of ending Finished Goods Inventory, assuming that 5,600 pounds of salmon fillets, 3,360 pounds of smoked salmon, and 490 pounds of salmon remnants were sold. Note: Round cost per pound to the nearest penny in your calculations. Note: Round your final answers below to the nearest whole dollar. Inventory values: Fillet Smoked Remnants Total inventory value $ $ 26,056 x 68,795 x 2,772 x 162,772 x

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 10CE: A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each...

Related questions

Question

None

Transcribed Image Text:By-product; net realizable value method

Weinberg Canning produces fillet, smoked salmon, and salmon remnants in a single process. The same amount of disposal cost is incurred whether a product is sold at split-off or after further processing. In

October, the joint cost of the production process was $198,800.

Product Pounds Produced Separate Cost Final Selling Price

25,200

28,000

2,800

$3.00

5.20

0.30

$16.00

13.00

1.50

Fillet

Smoked

Remnants

a. The remnants are considered a by-product of the process and are sold to cat food processors. Allocate the joint cost based on approximated net realizable value at split-off. Use the net realizable value method

to account for the by-product, subtracting the by-product cost from the cost of Work in Process Inventory-Joint Products.

$

Fillet

Smoked

Total

$

117,264

78,176

195,440

b. Determine the value of ending Finished Goods Inventory, assuming that 5,600 pounds of salmon fillets, 3,360 pounds of smoked salmon, and 490 pounds of salmon remnants were sold.

Note: Round cost per pound to the nearest penny in your calculations.

Note: Round your final answers below to the nearest whole dollar.

Inventory values:

Fillet

Smoked

Remnants

Total inventory value $

$

26,056 x

68,795 x

2,772 x

162,772 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub