Calculating tax incidence Suppose that the local government of Ogden decides to institute a tax on seltzer consumers. Before the tax, 20 billion packs of seltzer were sold every year at a price of $9 per pack. After the tax, 13 billion packs of seltzer are sold every year; consumers pay $12 per pack (including the tax), and producers receive $6 per pack. The amount of the tax on a pack of seltzer is $ burden that falls on producers is $ True per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on

Calculating tax incidence Suppose that the local government of Ogden decides to institute a tax on seltzer consumers. Before the tax, 20 billion packs of seltzer were sold every year at a price of $9 per pack. After the tax, 13 billion packs of seltzer are sold every year; consumers pay $12 per pack (including the tax), and producers receive $6 per pack. The amount of the tax on a pack of seltzer is $ burden that falls on producers is $ True per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

. Calculating tax incidence Suppose that the local government of Ogden decides to institute a tax on seltzer consumers. Before the tax, 20 billion packs of seltzer were sold every year at a price of $9 per pack. After the tax, 13 billion packs of seltzer are sold every year; consumers pay $12 per pack (including the tax), and producers receive $6 per pack. The amount of the tax on a pack of seltzer is $ burden that falls on producers is $ True per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on producers. False per pack. Of this amount, the burden that falls on consumers is $. per pack, and the

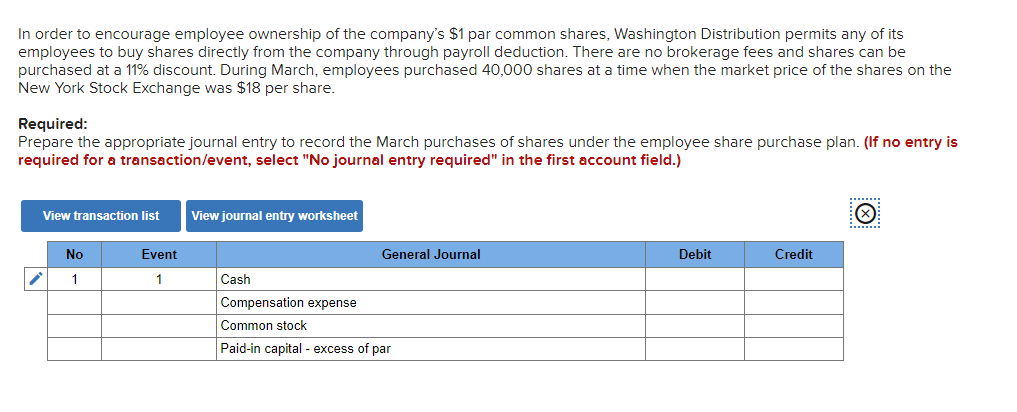

Transcribed Image Text:In order to encourage employee ownership of the company's $1 par common shares, Washington Distribution permits any of its

employees to buy shares directly from the company through payroll deduction. There are no brokerage fees and shares can be

purchased at a 11% discount. During March, employees purchased 40,000 shares at a time when the market price of the shares on the

New York Stock Exchange was $18 per share.

Required:

Prepare the appropriate journal entry to record the March purchases of shares under the employee share purchase plan. (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

✓

No

1

Event

1

View journal entry worksheet

Cash

General Journal

Compensation expense

Common stock

Paid-in capital - excess of par

Debit

Credit

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education