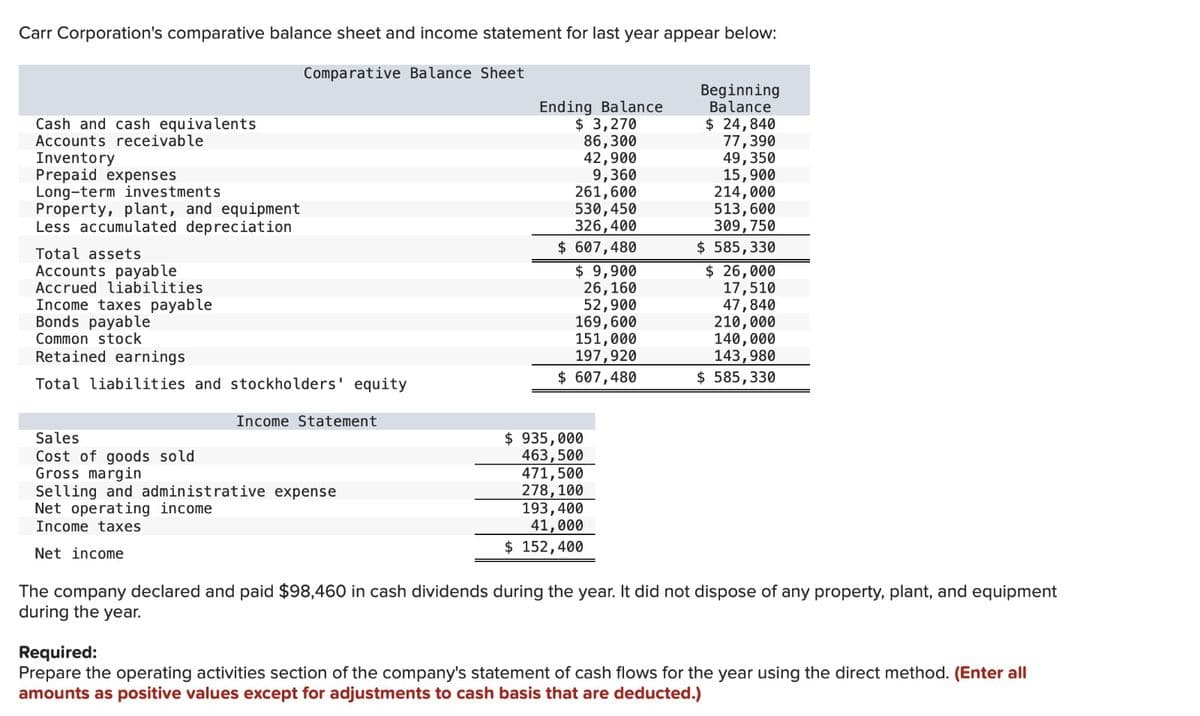

Carr Corporation's comparative balance sheet and income statement for last year appear below: Comparative Balance Sheet Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Less accumulated depreciation Total assets Accounts payable Accrued liabilities Income taxes payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Income Statement Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income Ending Balance $3,270 86,300 42,900 9,360 261,600 530,450 326,400 $607,480 $ 9,900 26,160 52,900 169,600 151,000 197,920 $ 607,480 $ 935,000 463,500 471,500 278,100 193,400 41,000 $ 152,400 Beginning Balance $24,840 77,390 49,350 15,900 214,000 513,600 309,750 $ 585,330 $ 26,000 17,510 47,840 210,000 140,000 143,980 $ 585,330 The company declared and paid $98,460 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. Required: Prepare the operating activities section of the company's statement of cash flows for the year using the direct method. (Enter all amounts as positive values except for adjustments to cash basis that are deducted.)

Carr Corporation's comparative balance sheet and income statement for last year appear below: Comparative Balance Sheet Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Less accumulated depreciation Total assets Accounts payable Accrued liabilities Income taxes payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Income Statement Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income Ending Balance $3,270 86,300 42,900 9,360 261,600 530,450 326,400 $607,480 $ 9,900 26,160 52,900 169,600 151,000 197,920 $ 607,480 $ 935,000 463,500 471,500 278,100 193,400 41,000 $ 152,400 Beginning Balance $24,840 77,390 49,350 15,900 214,000 513,600 309,750 $ 585,330 $ 26,000 17,510 47,840 210,000 140,000 143,980 $ 585,330 The company declared and paid $98,460 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. Required: Prepare the operating activities section of the company's statement of cash flows for the year using the direct method. (Enter all amounts as positive values except for adjustments to cash basis that are deducted.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Acc

Transcribed Image Text:Carr Corporation's comparative balance sheet and income statement for last year appear below:

Comparative Balance Sheet

Cash and cash equivalents

Accounts receivable

Inventory

Prepaid expenses

Long-term investments

Property, plant, and equipment

Less accumulated depreciation

Total assets

Accounts payable

Accrued liabilities

Income taxes payable

Bonds payable

Common stock

Retained earnings

Total liabilities and stockholders' equity

Income Statement

Sales

Cost of goods sold

Gross margin

Selling and administrative expense

Net operating income

Income taxes

Net income

Ending Balance

$ 3,270

86,300

42,900

9,360

261,600

530,450

326,400

$ 607,480

$ 9,900

26,160

52,900

169,600

151,000

197,920

$ 607,480

$ 935,000

463,500

471,500

278,100

193,400

41,000

$ 152,400

Beginning

Balance

$ 24,840

77,390

49,350

15,900

214,000

513,600

309, 750

$ 585,330

$ 26,000

17,510

47,840

210,000

140,000

143,980

$ 585,330

The company declared and paid $98,460 in cash dividends during the year. It did not dispose of any property, plant, and equipment

during the year.

Required:

Prepare the operating activities section of the company's statement of cash flows for the year using the direct method. (Enter all

amounts as positive values except for adjustments to cash basis that are deducted.)

Transcribed Image Text:Required:

Prepare the operating activities section of the company's statement of cash flows for the year using the direct method. (Enter all

amounts as positive values except for adjustments to cash basis that are deducted.)

Adjustments to a cash basis:

Adjustments to a cash basis:

Adjustments to a cash basis:

Adjustments to a cash basis:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning