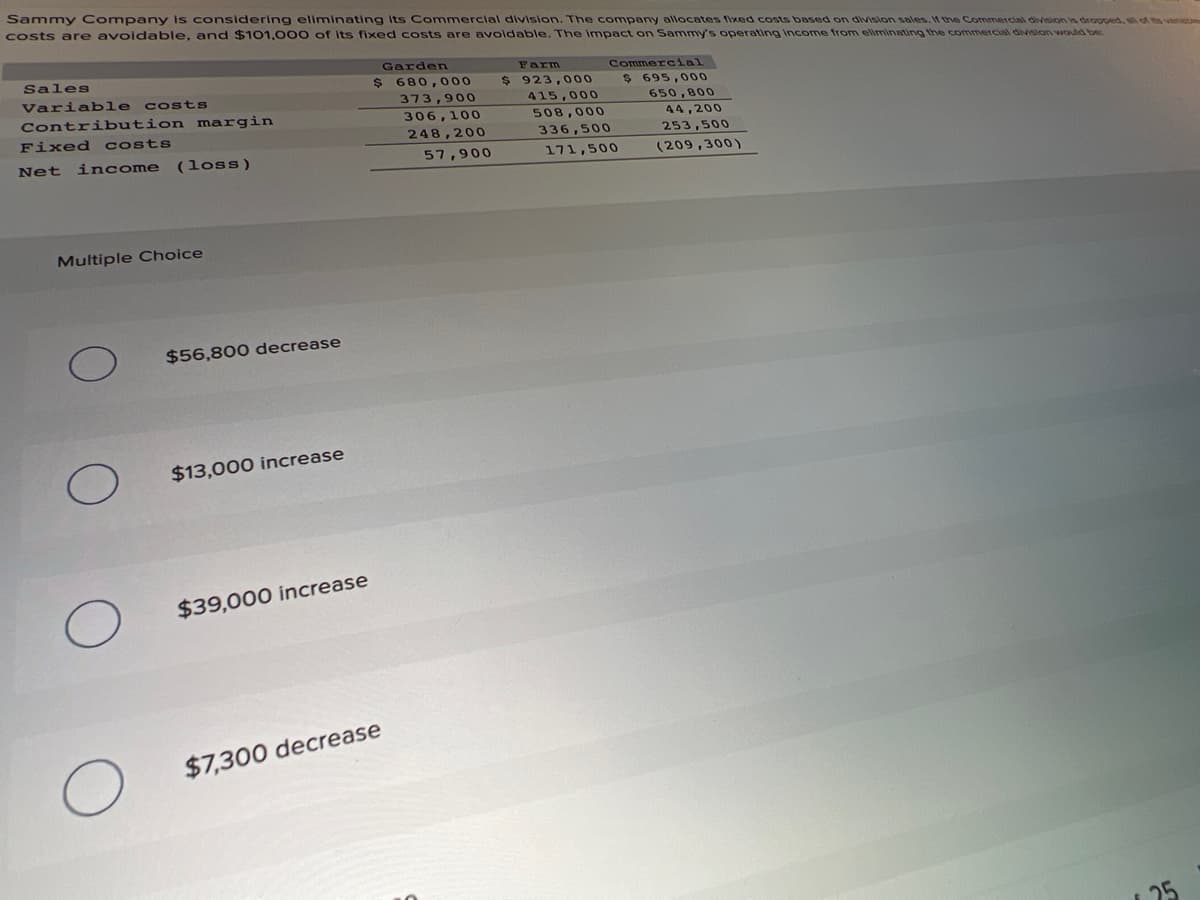

Sammy Company is considering eliminating Its Commercial division. The company allocates fixed costs based on division sales. If the Commercial divsion is dropped, costs are avoidable, and $101,00 0 of its fixed costs are avoidable. The impact on Sammy's operating Income from eliminating the commercial divison would be Sales Garden Farm Commercial $ 680,000 373,900 $ 923,000 $ 695,000 Variable costs 415,000 650,800 Contribution margin Fixed costs 306,100 248,200 508,000 44,200 336,500 253,500 Net income (loss) 57,900 171,500 (209,300) Multiple Choice $56,800 decrease $13,000 increase $39,000 increase $7,300 decrease

Sammy Company is considering eliminating Its Commercial division. The company allocates fixed costs based on division sales. If the Commercial divsion is dropped, costs are avoidable, and $101,00 0 of its fixed costs are avoidable. The impact on Sammy's operating Income from eliminating the commercial divison would be Sales Garden Farm Commercial $ 680,000 373,900 $ 923,000 $ 695,000 Variable costs 415,000 650,800 Contribution margin Fixed costs 306,100 248,200 508,000 44,200 336,500 253,500 Net income (loss) 57,900 171,500 (209,300) Multiple Choice $56,800 decrease $13,000 increase $39,000 increase $7,300 decrease

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 1SEQ: Mario Company is considering discontinuing a product. The costs of the product consist of $20,000...

Related questions

Question

Transcribed Image Text:Sammy Company is considering eliminating its Commerclal division. The company allocates fixed costs based on division sales. If the Commercial diviesion is dropped, of ts vanate

costs are avoidable, and $101,00 0 of its fixed costs are avoldable. The impact on Sammy's operating Income from eliminating the commercial division would be

Garden

Sales

Farm

Commercial

$ 680,000

$ 923,000

$ 695,000

Variable costs

Contribution margin

373,900

415,000

650,800

306,100

508,000

44,200

Fixed costs

248,200

336,500

253,500

Net

income (loss)

57,900

171,500

(209,300)

Multiple Choice

$56,800 decrease

$13,000 increase

$39,000 increase

$7,300 decrease

25

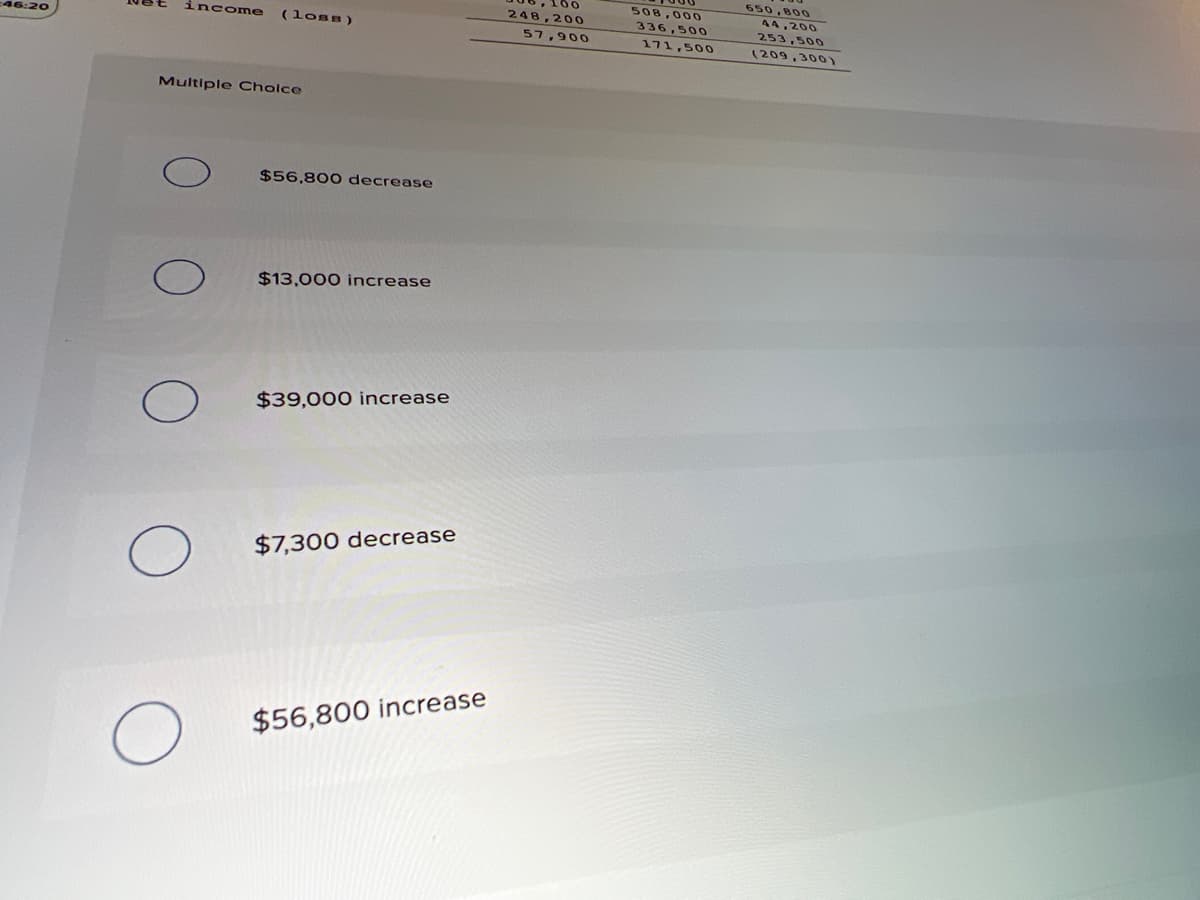

Transcribed Image Text:650,800

100

508,000

44,200

253,500

248,200

income

(loss)

336,500

46:20

57,900

171,500

(209,300)

Multiple Cholce

$56,800 decrease

$13,000 increase

$39,000 increase

$7,300 decrease

$56,800 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College