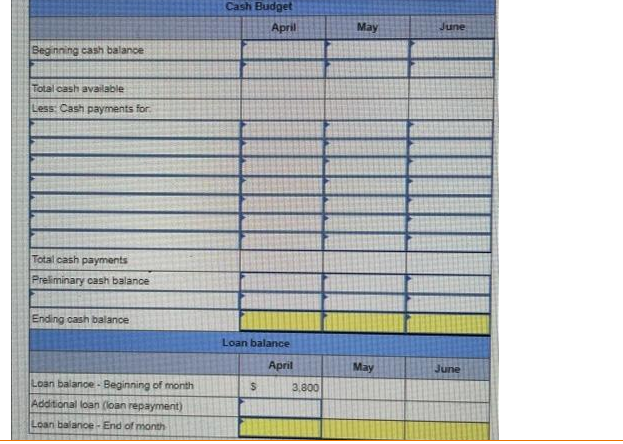

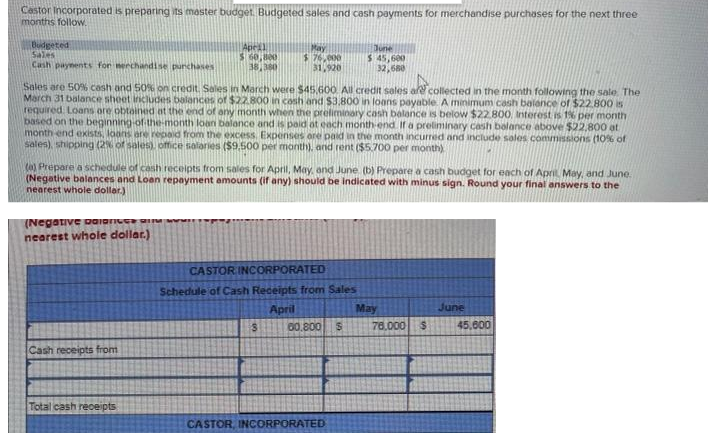

Castor Incorporated is preparing its master budget. Budgeted sales and cash payments for merchandise purchases for the next three months follow. Budgeted Sales Cash payments for merchandise purchases (Negative Dalances ar nearest whole dollar) April $ 60,800 38,380 Sales are 50% cash and 50% on credit. Sales in March were $45.600 All credit sales are collected in the month following the sale. The March 31 balance sheet includes balances of $22.800 in cash and $3,800 in loans payable. A minimum cash balance of $22.800 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $22.800 Interest is 1% per month based on the beginning of the-month loan balance and is paid at each month-end. If a preliminary cash balance above $22,800 at month-end exists, loans are repaid from the excess Expenses are paid in the month incurred and include sales commissions (10% of Sales), shipping (2% of sales), office salaries ($9,500 per month), and rent ($5.700 per month) Cash receipts from (a) Prepare a schedule of cash receipts from sales for April, May, and June (b) Prepare a cash budget for each of April May, and June. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar) Total cash receipts May $ 76,000 31,920 CASTOR INCORPORATED Schedule of Cash Receipts from Sales April S June $ 45,600 32,680 60,800 S CASTOR, INCORPORATED May 78,000 $ June 45,600

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

please answer in detail with all working in required format thanks

Trending now

This is a popular solution!

Step by step

Solved in 3 steps